Here we will review the top Coinbase Alternatives with a comparison and identify the best alternative to Coinbase to save on transaction fees:

Coinbase is one of the most popular trading platforms given it facilitates the trading of multiple digital assets with fiat, is preferred by institutional clients, and offers diversified products. On it, you can stake crypto to earn rewards, get paid in crypto for goods and services, invest, and hold crypto.

However, there are Coinbase alternatives you can use to save on transaction fees, invest in stocks while also investing in crypto, automate orders, and buy or cash out through local payment channels. This tutorial discusses those alternatives to Coinbase to help you decide the best for you.

Table of Contents:

Coinbase Alternatives Review

Terms Apply: Please read all the details and terms carefully on the below Crypto platforms before investing. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

List of Top Coinbase Alternatives

Here you will find a list of remarkable competitors and alternatives to Coinbase:

- Uphold

- Kraken

- Gemini

- Binance

- CoinSmart

- Coinmama

- Swapzone

- Robinhood

- Xcoins

- CEX.IO

- LocalBitcoins.com

- BlockFi

- Bitstamp

- Crypto.com

Comparison of the Best Alternatives to Coinbase

| Name of exchange | Why Better than Coinbase | Fees | Our Rating |

|---|---|---|---|

| Kraken | low-fee trading of cryptocurrencies. | Starting at 0.9% for trading stablecoins either with fiat or other stablecoins | 4.5/5 |

| Binance | Peer-to-peer transactions on blockchain. Developers can develop their products on Binance Chain. | Trading fees of between 0.02% and 0.1% maker and taker fees depending on a 30-day trading volume tier of the user. Instant buy and sell fee is 0.50%. Using BNB saves you more than 25% on spot and margin trading and 10% on futures trading. | 4.5/5 |

| CoinSmart | Disclaimer: 68% of retail investor accounts lose money. Cryptoasset investing is unregulated in some EU countries. No consumer protection. Your capital is at risk. | Up to 6% credit card. 0.20% for single trades and 0.40% for double trades. | 4.5/5 |

| Coinmama | Cheaper bank and wire transactions. | Up to 5% for credit and debit card transactions. Up to 3% for purchases and about 2% to buy. $27 flat fee for SWIFT bank transactions and zero fees for those above $1000. 1.49% for bank account transfers while wire is free for less than $50,000. | 5/5 |

| Swapzone | Auto comparison list of offers. sell, buy, swap crypto for crypto or fiat without custody or registration (crypto) or leaving the platform. | Spreads which vary from crypto to crypto. Mining fees also apply | 4.5/5 |

| Gemini | Debit card and credit card purchases cost lower. | 0.5% – 3.99% depending on payment method and platform. | 4.8/5 |

| Robinhood | Lower trading fees | Free to trade crypto. $5 per month for margin trading of up to $1,000 or pay 5% interest for margins of above that amount. | 4.3/5 |

Review of alternatives:

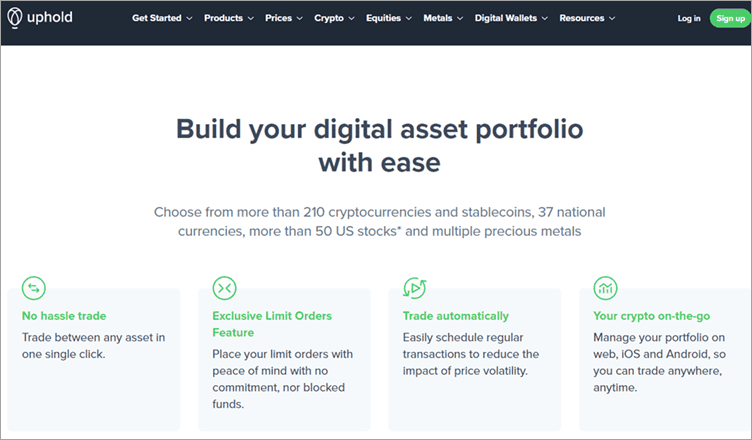

#1) Uphold

Best for cross-asset trading.

Uphold is a great alternative for Coinbase for those businesses and individuals that want to send crypto, receive crypto, earn via cryptocurrency staking, and trade crypto. Except that it does not support advanced trading of cryptocurrencies. It only has limited orders and advanced order trading.

Uphold also lets users cross-trade crypto for stocks, precious metals, and fiat. It also supports buying crypto instantly with credit and debit card as well as Apple Pay and Google Pay. Compared to Coinbase, you may not get the most diverse crypto selection on Uphold because it supports 210+ cryptos. Uphold, however, charges lower trading fees, especially for Bitcoin, Ethereum, and mainstream coins.

Coinbase will also have an upper hand when it comes to the diversity of products offered, although both platforms support staking. Uphold gives up to 24% in staking APYs while Coinbase affords 100%+ for newer tokens. You will also get more tokens to stake on Coinbase than on Uphold.

Features:

- Uphold Mastercard that gives crypto purchase rewards when you spend crypto on buying goods and services. It offers up to 2%.

- Business services. It also provides APIs.

Trading Fees: Trading spreads vary between 0.9% and 1.2% for BTC and ETH. 1.4% to 1.9% for XRP and other cryptos.

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong – Uphold Card is Issued by Optimus Cards UK Limited, a principal member of Mastercard and authorized by the FCA.

#2) Kraken

Best for low fee trading of cryptocurrencies.

Kraken is one of the oldest and best cryptocurrency exchanges with over 60 crypto tokens listed. Unlike Coinbase, it also boasts of top-notch security, having never been hacked.

On a cryptocurrency exchange, you can trade, stake, or loan out your coins and earn rewards for them. The exchange also provides margined futures trading for qualified investors (high-net worth individuals). Those who lock their tokens for staking get biweekly rewards.

Kraken crypto exchange is also a cheaper alternative to Coinbase and also provides advanced investment options.

Features:

- 95% of deposits are held offline in cold storage units.

- Instant buying and selling through supported payment methods. Does not support debit or credit card payments.

- Encrypted information and data systems for improved crypto security.

- Easy to use automatic verification, although the Pro account can take days to be verified manually. There are four registration tiers.

Fees: Fees range between 0.0% and 0.26% for both takers and makers, which is below the industry average. It also depends on a 30-day trading volume. Instant buys are charged a 1.5% fee for buying, selling, or converting any order. Debit and credit card transactions attract a 3.75% + €0.25 each. ACH bank transfer processing is 0.5%.

Margin trading fees range from 0.01% to 0.02%. Rollover margin fees are of 0.01% to 0.02, depending on the base currency.

#3) Gemini

Best for casual and institutional investors.

With a listing of 40 cryptocurrencies, Gemini is one of the most popular crypto-to-crypto exchange alternatives to Coinbase. That does not mean it does not support cashing out of crypto to fiat.

You cannot currently cash out to debit cards, although Gemini is working on introducing a credit card to allow ATM withdrawals and cash back on crypto purchases. Users can also purchase crypto by fiat through depositing money freely from US bank accounts, wire, and debit cards.

The exchange provides a welcome bonus of $20 for any user who trades $100 or more within 30 days. The best thing about it is that it provides insurance for all crypto holdings, against hacking incidences. Gemini also supports peer-to-peer trading among its users. The exchange allows users to trade a minimum of 0.00001 bitcoin or 0.001 ether.

Features:

- Available in over 50 countries besides all states in the U.S.

- Integrated ActiveTrader platform for advanced users, although also work great for newbies.

- iOS and Android apps besides web trading platforms.

Fees: It is 0.5% – 3.99% depending on payment method and platform. 0.5% above the market rate is called the convenience fees. $0.99 for trades of $10 or less, up to 1.49% for trades over $200 in value. 3.49% for debit card purchases, free to deposit through wire or US bank account.

#4) Binance

Best for diversified crypto users.

Binance is a dedicated cryptocurrency exchange given the number of products it has so far and the vast number of users – over 13 million. It is almost equal to Coinbase with the number of users and popularity. The exchange lists over 150 cryptocurrencies each, or we can pair most of them with over 50 fiat currencies for trading.

Binance has many firsts, including a dedicated platform token BNB and a blockchain known as Binance Chain. Binance Chain facilitates peer-to-peer exchange of crypto value at low fees compared to the regular Binance centralized platform.

Blockchain already supports trading and lists several cryptos and digital tokens for trading. BNB is used as a platform token for both regular exchanges and the Binance Chain. Those using it can pay less gas fees. In that regard, it is a much better alternative to Coinbase. Unlike with Coinbase, you can even build your crypto products on the Binance Chain.

Suggested Read => Pionex Vs. Binance Vs. Matrixport

Features:

- You can trade margined futures, NFTs, and derivatives.

- Desktop, iOS, and Android apps are available.

- BNB value increases with regular re-purchases and burning of repurchased tokens from time to time to boost demand.

- Other products: Binance Earn and Binance smart mining pool both allow mining and staking, which earns income for users on supported cryptocurrencies. Binance Pay is for merchants to receive crypto payments. There is also an NFT listing, Binance Labs that invests in blockchain startups, research tools, tutorials, and trading signals.

- Highly liquid. Has multiple order options or types.

- Token listing services. It supports Initial Coin Offering projects. The service is known as LaunchPad.

- Verification needed to trade.

- Binance Visa Card credit card to withdraw and spend crypto on purchases.

Fees: It has trading fees of between 0.02% and 0.1% maker and taker fees depending on the 30-day trading volume tier of the user. Instant buy and sell fees are 0.50%. For trades not done with BNB, there is a standard fee of 0.1% per trade. Using BNB saves you over 25% on spot and margin trading and 10% on futures trading.

#5) CoinSmart

Best for same-day crypto to fiat conversions.

CoinSmart is a crypto exchange that lets people trade about a dozen cryptos against each other instantly. It can be regarded as the best crypto exchange in this list because it lets anyone trade Bitcoin for fiat through a bank account with a guarantee that the money arrives in the account on the same day.

Additionally, if you want to trade other crypto for fiat, you can do so instantly by first swapping them for BTC on the spot exchange, then exchanging the BTC for fiat.

Features:

- Portfolio tracking features. Track trading histories and other transactions.

- Send, receive, and hold cryptos on the exchange.

Trading fees: 0.20% for single trades and 0.40% for double trades. Single trades involve a crypto being exchanged for Canadian dollars or Bitcoin. Up to 6% for credit card deposits, 1.5% e-Transfer, and 0% for bank wire and draft.

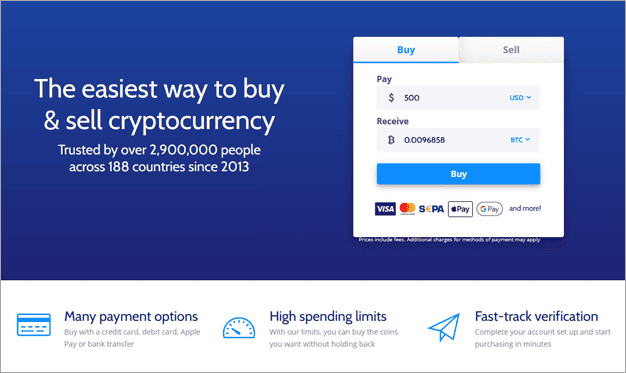

#6) Coinmama

Best for crypto to fiat purchases.

Coinmama is a great option for Coinbase users when you want to buy crypto with fiat locally and for less. It offers free crypto purchases via bank accounts, while Coinbase charges 1.49% per trade. Wire transfer is free for orders of less than $50,000.

However, unlike LocalBitcoins or LocalCryptos.com, Coinmama does not facilitate the trading of crypto between its users. Instead, the transactions are between the exchange and its users only.

Unfortunately, it only supports purchasing Bitcoin, Ethereum, and Cardano and no other cryptos. In the exchange, you can buy these cryptos with U.S. dollars, UK pounds, and Euros. It lets customers use a variety of payment methods including Visa, Apple Pay, PayPal, SEPA, Google Pay, Wire Transfer, Bank, and MasterCard credit cards.

The crypto exchange has eight years of experience providing crypto buying and selling services since its founding in 2013 in Tel Aviv, Israel. The exchange now has offices in Dublin and serves over 2.6 million users in 188 countries.

Features:

- Simple design and use.

- Loyalty program with reduced fees by up to 25% depending on the transaction volume.

Fees: The cryptocurrency exchange charges up to 5% for credit and debit card transactions and up to 3% for purchases and 2% to sell crypto. Other fees may also apply. $27 flat fee for SWIFT bank transactions and zero fees for those above $1000.

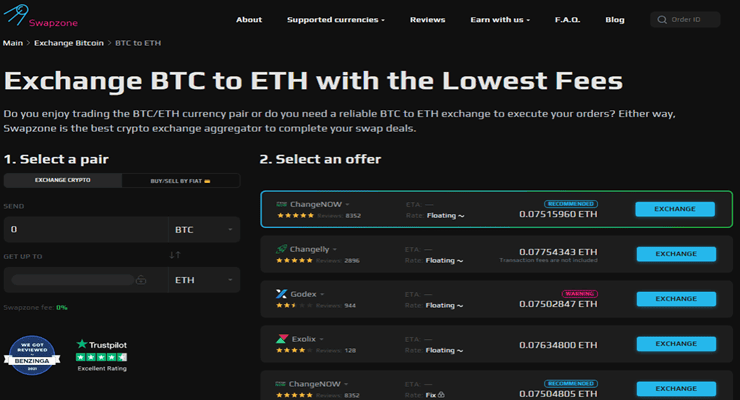

#7) Swapzone

Best for exchange rate comparisons across different exchanges and trading platforms.

Swapzone is one of the best Coinbase alternatives in the United States and almost any other country because it enables you to compare crypto swap rates or exchange rates for over 1000 cryptos that you can then trade for fiat or national currencies.

You can compare offers from different exchanges depending on your selected crypto and fiats and you can sort the offers based on the exchange rate, customer rating, and expected transaction time.

Swapzone currently partners with 15+ exchanges and trading platforms and when I checked, it rates these partners based on customer feedback on Trustpilot and the feedback on the Swapzone platform. Customers can see these ratings for each offer provided when the customer enters crypto trading queries on the home page.

To swap or trade crypto, simply visit the homepage and choose the Exchange crypto button for crypto-to-crypto exchanging/swapping or the Buy/Sell by fiat option to sell crypto for fiat or buy crypto using fiat. Choose the crypto and fiat to pay and proceed to fill in the required details on the next screens.

When buying crypto with fiat, you will be presented with the option to pay from the exchange from which the order emanates. If selling crypto, you will need to send the crypto and enter the bank details to receive fiat.

Features:

- In comparison to Coinbase, the exchange is non-custodial and a customer does not need to register to trade. Only registration with a third party may be necessary to make or receive fiat payments.

- 1000+ Crypto supported. Coinbase, in comparison, supports 200+ cryptocurrencies.

- It supports 20+ stablecoins and 20+ fiats. In comparison, Coinbase supports mainly three fiats though available in 200+ countries.

- No FDIC insurance on deposits because the exchange is not custodial. Coinbase offers FDIC insurance up to $25,000 on deposits. Coinbase also stores crypto in cold storage and offers multi-sig wallets.

Fees: Free crypto swaps and exchanges.

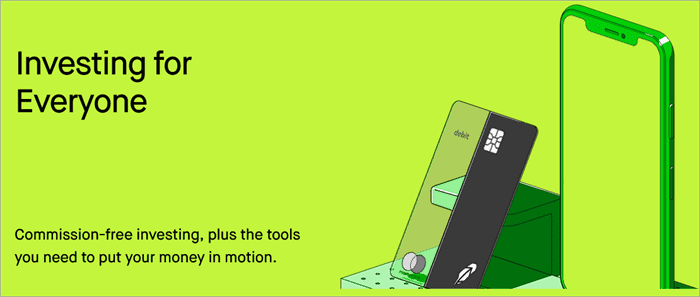

#8) Robinhood

Best for crypto trading newbies.

Robinhood is U.S.-based, although it has expanded services to Europe. Unlike Coinbase, it is a popular crypto, ETFs, and stock trading platform for young people new to investing. Some benefits of using this platform are that it charges no commissions. It now hosts over 10 million accounts held by an unknown number of customers.

Although it does not charge commissions, spreads are not tight. Regarding cryptocurrencies, it supports trading of Litecoin, BTC, Bitcoin Cash, Doge, Bitcoin BSV, Ethereum, and Ethereum Classic.

Features:

- Zero balance requirements. Small quantity trading allowed. However, there is a limited set of order types. Trade prices also lag a bit.

- $5 subscription on Robinhood Gold lets users trade on margin, get market depth data, access research, and access morning star reports. Can be tried for free for 30 days.

- Simple and easy to use.

- iOS and Android apps are available in addition to the web app.

- Immediate deposits via banks.

Fees: It is free to trade crypto. $5 per month for margin trading of up to $1,000 or pay 5% interest for margins of above that amount. Wire transactions up to $50 for international, $20 for overnight checks, an account transfer fee is $75, and $10 per transaction on live broker fee.

Website: https://robinhood.com/us/en/

#9) Xcoins

Best for cryptocurrency buying and selling with fiat.

Xcoins peer-to-peer crypto exchange supports Bitcoin, Ethereum, Litecoin, XRP, and Bitcoin Cash cryptocurrencies and is a popular Coinbase alternative for those wanting to buy using credit cards, PayPal, and debit cards.

It processes transactions within 15 minutes, supports instant account verifications (mobile, email, passport, national ID, selfie, and driver’s license), and is famous for top-notch customer service.

The exchange allows up to 1000 BTC trading volumes daily. The exchange is being used by people from over 167 countries around the world. Those willing to sell deposit their BTC on the XCoins wallets. The exchange uses a lending model where a person in need of buying BTC will take an order from the exchange and pay cash via the method desired.

The Malta-based exchange is regulated and customers must adhere to KYC regulations. Data is secured as per the European Union Data Protection standards.

Features:

- Does not offer any digital wallet services. You place a trade, buy, and receive your crypto in a few minutes.

- Accounts secured with 2-Factor authentication.

- From the account, you can track your order completion or status, view transaction histories, etc.

Fees: About 5.00%.

Website: https://xcoins.io/

#10) CEX.io

Best for individuals looking for diversified crypto investment options.

CEX.io offers spot trading, margin trading, staking rewards, holding or savings, and crypto-backed loans for users. Besides, there are products (for instance, the CEX.IO Prime) specifically tailored and suited to institutions, businesses, and advanced traders.

Started in 2013, it also allows users to buy crypto with fiat through bank wire and credit or debit card transactions.

A key benefit for Kraken users over Coinbase users is the supported instant withdrawals on crypto assets, a feature not available on other exchanges. Through this feature, a user can sell crypto and the money will reflect immediately on their bank card. It is a great option for those looking for apps better than Coinbase or better Coinbase competitors, although liquidity is lower.

Features:

- Android and iOS apps are available in addition to the web platform.

- Supports automated trading, order execution, payment services and more, through APIs.

- CEX.IO Aggregator and CEX.IO Direct are also institutional and business-focused products. Aggregator is a liquidity-providing protocol while the Direct service lets you embed crypto access, user verification, procurement, and delivery on your website.

Fees: 0.10-0.25% is the maker fee; 0-0.16% is the taker transaction fee (2.99% deposit). The fee is based on a 30-day trading volume tier rankings. You pay 0.10% if you place over 6,000 both as maker and taker.

Website: https://cex.io

#11) LocalBitcoins.com

Best for peer-to-peer trading with local payment channels and fiat.

LocalBitcoins.com is a well-renowned peer-to-peer crypto trading platform and Coinbase alternative, safe because it supports only Bitcoin trading with fiat. It may not be one of the best sites like Coinbase given that it is non-custodian and peer-to-peer. The exchange is available in almost every country.

It is better than Coinbase only for Bitcoin trading, but that applies to a small amount of Bitcoin and daily trading volumes. Through it, you can trade Bitcoin with fiat instantly, using multiple local currencies and payment methods. You simply open an account and place trades for other users to take and pay.

When a user is placing a trade, they put their BTC into an escrow where it cannot be reversed by them or withdrawn by the buyer unless after a dispute if the buyer does not pay. If the buyer pays, the seller will click or tap to release the BTC to the buyer’s wallet. Anyone can open a dispute if anything goes wrong.

Features:

- Tiered account verification levels with different trading limits.

- Sellers and buyers can pay to promote their ads and orders.

- Sellers and buyers rate each other for reputation purposes.

- Trading is done as per local agreements and terms between buyer and seller – including amounts, payment methods, and verification needs.

- Provides two-factor authentication, offline codes, HTTPS encryption, and Login Guard to protect accounts.

Fees: 1 percent fee applies to all trades, paid by the seller.

Website: https://localbitcoins.com/

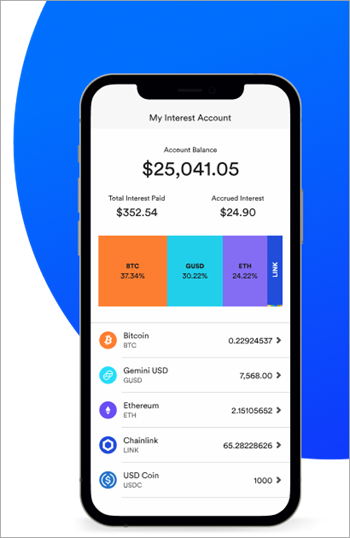

#12) BlockFi

Best for earning interest in crypto savings.

BlockFi, unlike Coinbase, lets users earn interest on their crypto deposits. The platform was founded in 2017.

Features:

- It lists cryptocurrencies like BTC, ETH, LTC, USDC, USDT, GUSD, and PAXG.

Fees: Withdrawal fees vary depending on the crypto in question: BTC is 0.00075 BTC for 100 BTC transacted in 7 days, ETH is 0.02 ETH for 5,000 ETH per 7 days, and LTC is 0.0025 LTC per 10,000 LTC volume transacted in 7 days.

Website: https://blockfi.com/

#13) Bitstamp

Best for beginners and advanced regular trading with low fees; crypto/bitcoin cashout to the bank.

Bitstamp is a major competitor to Coinbase in the trading of cryptocurrencies, mainly because of its low pricing and the fact that it is older, tried, and tested than Coinbase. It supports multiple cryptocurrencies but not as many as Coinbase (50+).

The exchange has institutional trading and investment features suitable for both beginner and institutional traders. The funds are secured when offline or while in transit when being traded, sent, or received. However, there is a more limited range of products when compared to Coinbase. For instance, staking only supports Ethereum and Algorand crypto.

Features:

- Trading fees drop by up to 25% depending on 30-day transactional volume.

- You can buy crypto using multiple payment methods – Apple Pay, SEPA, PayPal, Google Pay, Wire Transfer, Mastercard, and credit card.

Fees: Trading fees – 0.50% for <$10,000 of trading volume to 0.0% for > $20 million of trading volume. Staking fees — 15% on staking rewards. Deposits are free of charge for SEPA, ACH, Faster Payments, and crypto. International wire deposit – 0.05%, and 5% with card purchases. Withdrawal is 3 Euro for SEPA, free for ACH, 2 GBP for Faster Payment, 0.1% for International wire. Crypto withdrawal fees vary.

#14) Crypto.com

Best for merchants to be paid in crypto for their goods and services.

Crypto.com is a renowned platform for merchants who want to accept crypto payments. It performs better than Coinbase in that regard, with thousands of merchants already using it.

Features:

- Crypto.com supports 91 cryptocurrencies and digital assets with which merchants can get paid when selling goods and services online.

- Merchants benefit from low transaction fees, quick conversion to USD and other supported fiat, bank transfers after being paid, website payment button integrations, and other things.

Fees: 0.04% to 0.4% maker fees, 0.1% to 0.4% taker fees, plus 2.99% for credit card purchases.

Conclusion

This tutorial dwelt on platforms similar to Coinbase. Coinbase is the preferred alternative for many in the United States and even has a stock listed on the Nasdaq stock exchange.

We discussed some platforms and apps like Coinbase including Kraken, Bitstamp, CEX.io, Binance, Gemini, and eToro. Coinbase is very much comparable to Binance, for those looking for sites like Coinbase. However, it has lower fees than Coinbase.

Platforms like eToro and Robinhood are best if you want to trade stocks as a diversification from or to crypto, all on the same platform. eToro stands out from all other platforms with its established copy trading feature, and is hence recommended for beginners looking for apps and websites better than Coinbase.

With Coinbase being an institutional platform, some alternatives to Coinbase in that regard are Bitstamp, Kraken, eToro, Gemini, and Binance. Kraken charges much lower fees than Coinbase and is more secure, hence much better than Coinbase. If you are based in the US and looking for a Coinbase alternative, that would be Gemini or Coinmama.

Researched Process:

Time taken to research and write this article: 18 Hours

Total tools initially shortlisted for review: 20

Total tools reviewed: 12