This is a comprehensive review of Coinbase – one of the most trusted, safe, and legit cryptocurrency exchanges:

Coinbase is a safe and secure cryptocurrency exchange based in the U.S. founded in 2012. The company stocks are now listed on the Nasdaq stock market under the ticker COIN. With over 56 million users across over 100 countries globally, it is a yes for those asking is Coinbase a safe crypto exchange to trade with.

This applies to both beginners and pro traders, although some traders have reported difficulties with customer support issues.

The crypto exchange has traded over $150 billion of digital assets so far and is now a publicly-traded company on the Nasdaq stock exchange, which tells of its safety and trust among users.

Table of Contents:

Coinbase Review

This tutorial looks at a variety of issues around Coinbase, like whether it is legit, safe, how simple it is to use, and other factors. The tutorial directly addresses questions like is Coinbase safe or is Coinbase legal?

Is Coinbase Safe?

Coinbase says that all of its customer deposits are insured, although they are not protected by the Federal Deposit Insurance Corporation or the SIPC. Compared to most crypto exchanges, it is relatively safe. Hence, it is recommended even for people asking if it is safe?

Security Measures

Coinbase uses several security measures meant to secure user funds from theft and hacking or in case of eventualities. Despite being more costly to use compared to other exchanges, it is preferred as a cryptocurrency exchange due to higher security for funds. Even most institutions are interested in such services.

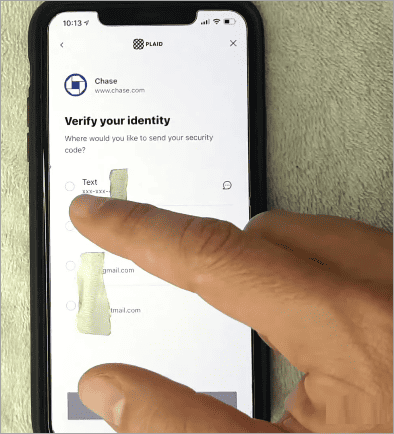

The methods used to secure crypto funds and accounts include 2-factor authentication using phone and email, biometric and fingerprint logins, and of course, passwords to secure the accounts. Besides, users can connect to hardware storage for better control of funds.

It also stores 98% of user funds on cold storage. However, Coinbase is categorical that SIPC or FDIC does not secure the funds. However, the exchange pools the exchange balance and stores it in USD custodial accounts, USD denominated money market funds or liquid U.S. Treasuries.

Is Coinbase a trusted cryptocurrency exchange?

We know for sure that Coinbase is a trusted exchange for both individual and institutional crypto holders, investors, and traders.

First, it operates in San Francisco, which is a highly regulated location in terms of personal and business assets. Second, hundreds of thousands prefer it as a go-to crypto exchange, especially in the United States. This is because of its safety, popularity, ease-of-use, and the fact that it has a wide range of products.

It is a widely reviewed cryptocurrency on the Internet. Although its products are not regulated by the Security Exchange Commission as a part of the stock, Coinbase stores assets safely on cold storage, as claimed by them. Besides, it halts dubious or suspicious transactions.

The exchange also regularly stops transactions involved in hacking practices and at one time stopped the transfer of more than $280,000 worth of Bitcoin transactions to hackers who cracked twitter in mid-2020.

In addition to that, it is backed by trusted investors and has raised $547 million from multiple investors.

The exchange has adequate resources on how to secure your wallet and trade safely on it.

Cash held in Coinbase wallets is FDIC-insured up to $250,000, although the crypto is not.

Trust Score And Reviews

Then Coinbase scores 8.9/10 on third-party review and independent review sites like Trustradius.com, which is a very high trust score as a trusted crypto exchange. It is also rated 9.8/10 from 729 reviews on the BitDegree.org website.

The Better Business Bureau gives Coinbase a D- rating because it did not respond to more than 1,100 complaints. The evaluation is based on time in business, type of business, and customer complaint history. It also considers licensing status, actions by governments, and other factors.

In July 2021, Coinbase faced a class action lawsuit for violating securities laws. BBB also lists customers who had Coinbase accounts that were closed, but the people are unable to reach the customer service. The company has closed many complaints from customers.

Recommended Coinbase Alternative

eToro

Best for social and copy trading.

eToro is a competing platform for Coinbase. It has features unavailable on Coinbase like copy trading and social trading. With the copy trading feature, you leverage other people’s expertise to trade 20 + crypto. eToro also has extra payment methods for buying crypto than Coinbase.

Features:

- 20+ million users including popular investors, from whom you can copy trades.

- Learn crypto from scratch.

- 100k virtual portfolio when you sign up.

- “Limited time offer: Deposit $100 and get a $10 bonus”

Fees: 1 % spreads when trading Ethereum.. $5 withdrawal. Buying fees with payment methods apply.

Disclaimer – eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

Common Scams To Avoid When Using Coinbase

The first issue with cryptocurrency exchanges, whether done on Coinbase or other exchanges, is they are irreversible. In addition to this, here are some more common scams to avoid while using.

#1) Impersonation scams: Different cases of fraudsters impersonating Coinbase have been reported. The fraudsters can set up scams and fake phone lines and numbers to dupe customers seeking assistance about the exchange.

They then ask for personal information promising to offer asked assistance. They can also collect other information necessary for hacking accounts through social engineering tactics and manipulation.

Most advanced scammers are skilled and part of a network carrying out fraudulent activities against Coinbase or other exchanges. Users should confirm that they are using the legal Coinbase site and never give even support staff any personal information.

Whether seeking to have the account locked or funds reversed or other services, never give out your 2FA authentication codes or passwords to any staff, including real ones.

When contacting Coinbase, only use legal phone numbers and the help website or through this form. Do not send any cryptocurrency to any addresses belonging to anyone claiming to be the staff.

#2) Giveaway scams: These are very common and many. In most cases, fraudsters promote giveaways with scam hyperlinks that lead to fraudulent websites. The scammers may then respond to the postings to affirm them as legit. They may ask you to verify your address by sending cryptocurrencies or ask to log in into your account through the links.

Coinbase does not ask anyone to send crypto to an address in order to receive more. Never send crypto to an address if and when anyone purports you will receive back more.

Always be skeptical of any promotions unless they are on Coinbase’s official sites and social media. Before participating in any promotion, always confirm that it is legit by checking from the official pages and media sites. To confirm that the social media pages are legal, check the official Coinbase website.

By checking the giveaway URL, you can confirm whether or not it is from coinbase.com. You can also respond by reporting all phishing attempts or scams.

#3) Investment scams: Investment scams involve people promising to help you earn or offer higher returns against your investment and requesting you to bring more people into the same. What they are most characteristic of is very high and unexplained returns, as is with many Ponzi and pyramid schemes.

To avoid these scams, be skeptical of any websites or services promising high returns and unrealistic investment opportunities. If you are sending cryptocurrencies to participate in an investment scheme, confirm and send to trusted third-party sites. Do research to determine if these are verifiable publicly.

#4) Extortion schemes: Always report the email involved, contact local authorities, change passwords, and scan your computer for malware.

#5) Loader or load-up scams: Loaders claim to need Coinbase accounts with top limits to give a portion of proceeds to the owners. They perpetuate the payment fraud using stolen credit cards on compromised accounts. They steal cryptocurrencies and submit unauthorized charges on verified payment methods.

Never provide passwords or security codes to any person under any circumstance. Ensure to report all loaders to Coinbase and to the platform on which they are advertising their fraud.

#6) Telegram scams: These are propagated on Telegram. Coinbase does not have any Telegram account or group.

#7) Phishing: These sites mimic or resemble a legit Coinbase website to trick you into visiting and logging into your account with them. You end up submitting login information to scammers who then use it to log in to your legit account and steal crypto. Always confirm that the article is coinbase.com.

Coinbase stock COIN is regulated by SEC and is safe for stock traders

Coinbase is now listed on the Nasdaq stock exchange for trading after the IPO. The trading launched on April 14, 2021 at a price of $250 per share. It shot 72% after opening for trading and closed the first day at 31.3%, for a valuation of $87.3 billion. Coinbase announced Q1 results that shareholders would earn $6.42 a share of sales of $2.22 billion.

You can buy the stock by opening an account with any regulated brokerage that facilitates buying stocks on the Nasdaq stock exchange. You simply deposit money into the brokerage account and then buy the number of stocks desired.

Securing Cryptocurrency Wallets On Coinbase

Coinbase offers hosted wallets in that they are a third-party that keeps the customer’s crypto for them. It is similar to how a bank keeps money in your checking or saving account.

With a hosted wallet, a customer does not need to worry about losing their keys to their wallets or losing their USB-connected wallets. However, lack of control over private keys means a lack of retrieval if anything worse, like company closure happens unexpectedly. You also are more likely to lose in case of a hack.

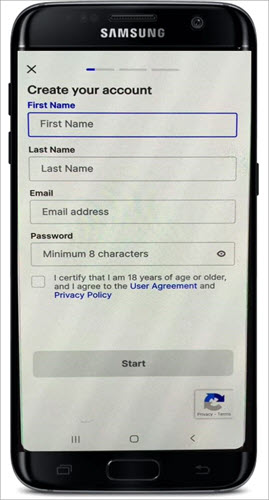

#1) Sign up: All you need to do is sign up with account details like name, email, and password.

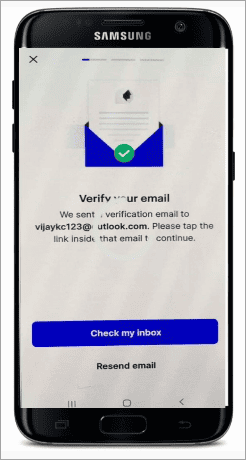

#2) Verify account: Coinbase requests you to verify the account by adding and verifying a phone number. Select the country and add the number. It sends a seven-code which you must input back to the web platform for verification.

From that point, proceed to add profile information, answer a few questions on the use of the account, and finish up.

You also need to verify the account by uploading a government-issued ID or passport. You also require an Internet-connected computer or device, a phone number to connect to the account, and, of course, a browser.

During the creation of the account, you are encouraged to secure it with 2-factor authentication. In that case, click to enable 2-FA authentication from the profile.

Install a third-party 2FA app like Authy and then add an account to Authy by scanning a code or inputting the account key manually. The last step in this is to confirm setting the 2-FA by entering one code from the installed app to the web platform as required.

#3) Link a payment method: You should then link a payment method by selecting your country first because different procedures apply differently for different countries. Some methods are available for some countries while missing for others.

Adding Bank Account:

Payment methods available for customers include ACH, bank account deposits and withdrawals, debit cards, wire transfer, Apple Pay, and PayPal. You can use these to deposit and withdraw cryptocurrencies.

On the app, go to settings and choose Payment Methods to add your desired method. Select account type to link and follow instructions to verify the method depending on the method. For instance, adding a bank account requires entering bank account details and login credentials to connect to the bank.

You can also use the don’t see your bank option after clicking on the bank account payment method. This option allows you to enter your routing number, bank account number, bank name, and account. Click verify account.

If the bank details are correct and match those of your account, the process initiates two test bank deposits to help verify the bank payment method. Deposit cash and wait until the deposit arrives in the bank for about two to three days.

After this, print a statement – and check for the two transactions. Come back to the website and add the “cent” portion of the shown transaction amounts as required. Click verify. You can now initiate deposits from your Coinbase account to the bank using this method.

Adding other payment methods is clearly explained for each method here on the Coinbase website.

How To Buy, Sell And Send Crypto Safely

Coinbase allows you to exchange crypto for another crypto or to sell your crypto for fiat.

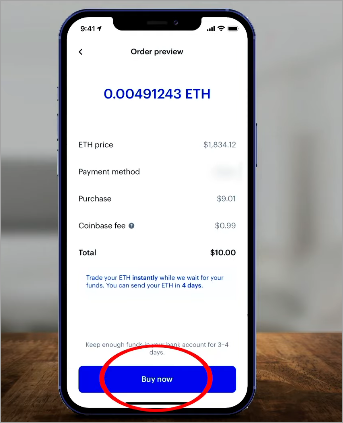

Buying:

- Make sure you have a verified account or follow the above procedure to create one.

- Connect a bank account or other payment methods. Please see the above section to learn how to add any method.

- Select the Buy/Sell from the upper right hand. After clicking on the Buy option, choose the crypto and amount needed, then the payment method. Continue to purchase the crypto.

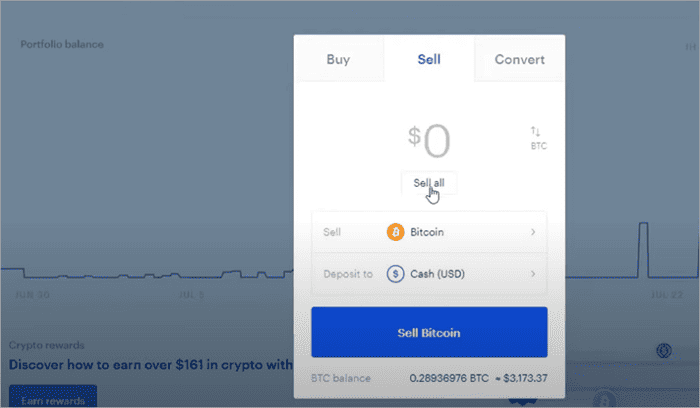

Selling or cashing out:

There is no direct method of cashing out Bitcoin except selling your crypto for USD and then withdrawing to a bank or other payment method.

- Select Buy/Sell on the browser.

- Select Sell. Choose the crypto you want to sell for USD, enter the amount desired to cash out, preview sell, and continue to sell.

- After selling crypto to USD, the amount will reflect on the wallet immediately. To withdraw from Coinbase, please follow the below procedure:

Withdrawing USD:

- Ensure you have linked a bank account, debit card, or PayPal or other supported payment methods on Coinbase. Click on the Withdrawal option next to the Balances section.

- A window pops up in which you should enter the amount to withdraw. Continue to withdraw. It will take a few days to reflect on your bank account.

Sending cryptocurrency to other people is easier done than said. All a user needs to do is select the crypto they want to send, input an address, and boom! For those asking whether Coinbase is legal, it is one of the best methods of trading crypto.

Cashing out crypto to USD or fiat on Coinbase requires you to first convert the said crypto into USD. This is instant. After this, you can withdraw to a connected bank or debit card, which takes up to three days. You can also withdraw instantly to PayPal.

Coinbase vs Other Exchanges

| Coinbase | Kraken | Binance | |

|---|---|---|---|

| Minimum investment | $2 | varies per cryptocurrency. | $10 |

| Fees | Transaction fees: $0.99 to $2.99. 0.50% for Coinbase Pro. Spreads: 0.50% for both buy and sell. | Fees: 0-0.26% | Transaction fees – spot trading fee: 0.1%. Instant buy/sell fee: 0.5%. US debit card deposits: 4.5%. |

| Investment choices | Cryptocurrencies, tokens | Cryptocurrencies, tokens, futures | Cryptocurrencies |

Coinbase Fees

Fiat deposit and withdrawal fees are as follows:

| Deposit (Add Cash) Fee | Withdrawal (Cash Out) Fee | |

|---|---|---|

| ACH | Free | Free |

| Wire (USD) | $10 USD | $25 USD |

| SEPA (EUR) | €0.15 EUR | €0.15 EUR |

| Swift (GBP | Free | £1 GBP |

Coinbase charges a flat 2.49% on all purchases with a Coinbase debit card.

Trading fees are as follows:

| Pricing Tier | Taker Fee | Maker Fee |

|---|---|---|

| $0 – 10K | 0.50% | 0.50% |

| $10K – 50K | 0.35% | 0.35% |

| $50K – 100K | 0.25% | 0.15% |

| $100K – 1M | 0.20% | 0.10% |

| $1M – 10M | 0.18% | 0.08% |

| $10M – 20M | 0.18% | 0.08% |

| $20M – 50M | 0.15% | 0.05% |

| $50M – 100M | 0.15% | 0.05% |

| $100M – 300M | 0.10% | 0.02% |

| $300M – 500M | 0.08% | 0.00% |

| $500M – 750M | 0.06% | 0.00% |

| $750M – 1B | 0.05% | 0.00% |

| $1B – 2B | 0.04% | 0.00% |

| $2B + | 0.04% | 0.00% |

| Stable Pairs | Taker Fee | Maker Fee |

|---|---|---|

| DAI – USDC | 0.0001 | 0 |

| DAI – USD | ||

| PAX – USD | ||

| PAX – USDT | ||

| USDC – EUR | ||

| USDC – GBP | ||

| USDT – EUR | ||

| USDT – GBP | ||

| USDT – USDC | ||

| USDT – USD | ||

| WBTC – BTC |

With Coinbase Pro, the maker fee varies between 0.50% for transactions <$10,000 and 0.00% for transactions whose value is between $50 and 100 million. And taker fee of between 0.50% is charged for <$10,000 worth of transactions and 0.04% for over $1 billion worth of transactions.

The Pro app charges a lower fee with crypto and ACH transfers being free to deposit and withdraw. You also pay $10 to deposit and $25 to withdraw through the wire.

A flat fee of 2% of the total transaction applies to all collateralized crypto transactions on Coinbase.

There are no sign-up fees, and the mining fee varies from one blockchain to another.

Frequently Asked Questions

1. Is coinbase safe and legit?

Yes, it is a legitimate cryptocurrency exchange due to the high-profile investors and companies behind it. Located in San Francisco, a highly regulated location, it is highly positively reviewed online. It scores a high trust rating on TrustRadius and BitDegree.

2. Can you get scammed on Coinbase?

It is hard to get scammed on the legit Coinbase website although users must be very careful to not send any crypto or log-in details to anyone, including support staff. Do not share the 2-FA security codes or private keys with anyone. Verify the website you are login in to is legit and coinbase.com.

3. Is it safe to add a bank account to Coinbase?

Yes, for as long as the website on which you add the bank account after logging in is legit. Coinbase stipulates methods of adding a bank account into your account to transact safely. Make sure you add the right account and routing numbers. The information is also protected through encryption and hence prevented from eavesdropping and hacking.

4. Is my money safe on Coinbase?

Coinbase has once been hacked but makes a significant effort to secure user accounts. First, the cash on the accounts is secured on FDIC-approved accounts, though the crypto is not. It also deactivates or suspends suspicious accounts and is monitoring for suspicious activity on its platform.

With over 56 million users trading and transacting on it successfully with minimal complaints, it appears as a safe option.

5. Can Coinbase freeze your account?

Yes, but extremely rare and only when it is required by law, for instance, if the account is involved in hacking. It complies with court orders or authorities that have jurisdiction over Coinbase. This means they can deactivate an account or restrict access to funds.

6. Is it safe to give Coinbase my SSN?

It is easy to set up an account although you will need some information. Some information needed includes legal name, address, date of birth, SSN last digits, and plan for using Coinbase. This means you will be complying with federal regulations when adding the SSN accounts on Coinbase.

Conclusion

Yes. Coinbase is one of the most trusted cryptocurrency exchanges today. It secures cash on FDIC-secured accounts, lets you securely connect and trade crypto via your bank account, and blocks suspicious accounts to ensure user safety.

It provides a host of services, which centers on crypto-to-crypto trading and crypto-to-fiat trading. The exchange serves 56 million verified users globally and 8,000 institutions. These are distributed in over 100 countries around the world.

There are more reasons to support Coinbase’s trustworthy nature than not. It is widely reviewed and the trust score is high on many third-party review sites like TrustRadius and BitDegree.org. Although there are low ratings on some websites, like TrustPilot, it appears to be due to poor customer care.

Nevertheless, users are required to take responsibility when trading crypto on Coinbase. Always ensure the site and social media accounts to which you log in is legit. Do not click on promotional emails or participate in reward programs before confirming the legality of the links.

Research Process:

Time taken to research and write this article: 15 Hours

All the directors are crooks an take an hidalgo people money an pretend they don’t have any