Explore the multiple tools with features, pricing, and comparison and learn How To Cash Out Bitcoin through this tutorial:

Whether cashing out a small or large amount of Bitcoin, a wrong choice of the cash-out method can affect profitability. The loss is multiplied by a vast amount of Bitcoin.

Most markets also limit the amount to withdraw or trade in a single transaction/day. This is because of security and the fact that moving out of an extensive amount of value can affect their markets sharply negatively. For instance, it can tamper with pricing and liquidity.

Here is a guide for those asking how do you cash out bitcoin to USD. This tutorial provides information about the tools if looking for how to cash out a huge amount of Bitcoin or any amount.

Table of Contents:

Understanding How To Cash Out Bitcoin

Cash Out Bitcoin To USD – Factors

In this section, we will see what are the factors to consider to cash out of Bitcoin and other cryptos to USD?

#1) Transactional costs on peer-to-peer platforms

Peer-to-peer platforms allow you to trade even hundreds and thousands worth of dollars in crypto. However, peer-to-peer platforms also have very low transactional limits. They also have very high transactional fees. This may eat a sizeable chunk when trading millions or a moderate amount of dollar value in Bitcoin.

For instance, you may not trade beyond $1000 per day on most peer-to-peer exchanges. For trading outside of OTC, you can expect to trade and withdraw a limit of between $2000 and $3000 at the maximum end.

#2) Restrictions on trading and withdrawal amounts

Cashing out Bitcoin is best done via a third-party broker, over-the-counter trading, or on a third-party trading platform. You can also trade it peer-to-peer. Cashing out a massive amount of Bitcoin comes with limited restrictions on daily withdrawals. These limits are imposed on many third-party platforms and, of course, the possibility of scrutiny from regulators.

For instance, the trading limits on LocalBitcoins–one of the most popular peer-to-peer platforms is just a maximum of Euros 200,000 per year for tier 2 KYC verified accounts. Tier 3 verified accounts may not have any limits imposed. Practical limits for daily trading exist when trading with the different payment methods supported.

#3) Regulatory scrutiny

Today, it has become clear that Bitcoin can transfer a considerable amount of wealth. Therefore, large transactions almost certainly attract the attention of banks when done via those systems. It is uncommon that it ends with those bank accounts being blocked out of suspicious money laundering activities.

#4) Taxes and tax amounts

In countries where capital gains are taxable, cashing out any size of the transaction to sell means a need for tax reporting. This is not always an issue for traders or holders of negligible sums.

However, large investors and corporate agents face these issues when trading large amounts of cryptocurrencies. They may have to pay enormous sums in taxes where capital gains are taxable. And it may mean guaranteed security procedures for their client holdings.

Cash Out Large Amount of Bitcoin

Here are a few ways to explain how to cash out a vast amount of Bitcoin to USD or for cash.

OTC Brokerage Services

Most centralized cryptocurrency exchanges now support OTC trading for individuals, hedge funds, private wealth managers, and trading groups. Those willing to trade can access large volumes of fiat via liquidity providers organized by these exchanges.

Sometimes, these OTC brokerage exchanges simply facilitate OTC buyers and sellers to transact on a peer-to-peer basis. The brokers specialize in large transactions placed via special platforms. Traders using these services have to adhere to certain verification procedures. There are also transactional limit requirements that vary from one exchange to another.

There are some benefits associated with trading through OTC. One, you avoid large price slippages and fees. Two, most provide different payment methods for which you can get paid when cashing out a huge amount of Bitcoin. These methods include ACH, wire transfers, cash, and online payment methods like PayPal.

Again, the challenge could be banking volume limitations with many legacy payment methods. You can expect considerable limits of way above $100,000 to millions.

Most OTC brokerage platforms also have chat rooms or special communication channels. These allow you to communicate with other peer-to-peer OTC traders or the exchange support team itself. For trusted exchanges, they may consider it to cash out large amounts of Bitcoin on OTC via these exchange platforms.

Most OTC platforms actually do not have any limits regarding the amount of money you can transact. For instance, they do not have a daily limit is pegged to the legacy method of money transfer, like ACH, wire transfers, and online payment platforms.

You can sell to OTC brokers like Coinbase Pro, Gemini, Cumberland Mining, Genesis Trading, Kraken, and Huobi.

Terms Apply: Please read all the details and terms carefully on the below Crypto platforms before investing. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

List of Tools to Cash Out Bitcoin

Here is the list of tools to cash out of Bitcoin:

- eToro

- Coinmama

- Swapzone

- Nuri

- CashApp

- Coinbase

- PayPal

- LocalBitcoins

- CoinSmart

- Crypto.com

- Bitstamp

- Spend it

Comparing the Top Tools to Cash Out Bitcoin

| Cash out Platform | Top features | Payment methods | Fees | Our rating |

|---|---|---|---|---|

| Coinmama | Buy crypto with fiat via credit card and electronic payments and cash out Bitcoin via bank account. | Bank transfers, VISA, SEPA, MasterCard, Apple Pay, Google Pay, and Skrill. | From 3.90% to 2.93% depending on loyalty level. | |

| Swapzone | sell, buy, swap crypto for crypto or fiat without custody or registration (crypto). Auto comparison list of offers | Crypto, 20+ national currencies (SEPA, VISA, Mastercard, UnionPay, SWIFT and bank) | Spreads which vary from crypto to crypto. Mining fees also apply. | |

| Nuri | Euro and German bank account. Bitcoin and Ethereum supported. | Bank | 1% | |

| CashApp | For U.S. and United Kingdom residents. Bitcoin only. | Bank, credit card, debit card. | 1.5% | |

| Coinbase | Convert to fiat and withdraw. $50,000/day. Multiple crypto supported. | Bank and debit cards. | 2.49% | |

| PayPal | Can’t deposit or transfer crypto out. Multiple crypto supported. Bank transfers supported. | Bank and credit card transfers. | $0 or up to 1% | |

| Spend it | No KYC Needed, Built-in Metamask Integration | Visa card, Apple Pay and Google Pay | Free to use card. Depositing funds incurs a fee of 8%. |

Tools review:

#1) eToro

Best for social investing and copy trading.

eToro lets you send 7 cryptocurrencies to the etoro wallet, the cryptocurrencies that are available to transfer are Bitcoin, Bitcoin Cash, Ethereum, Litecoin, XRP, Stellar, and TRON. You can read more about this here.

However, you can also request to withdraw your crypto assets in a fiat currency like USD. The third cash-out option is to directly sell crypto for fiat and withdraw via bank or on ATMs through the eToro Money Visa debit card.

Features:

- Buy crypto with debit, credit card, bank account, PayPal, Sofort, Rapid Transfer, Skrill, Wire Transfer, Neteller, WebMoney, etc.

- Trade raw Bitcoin and other cryptos.

- Copy popular crypto investors.

- Join millions of investors on the world’s largest social investing platform.

- 100k virtual portfolio when you sign up.

- “Limited time offer: Deposit $100 and get a $10 bonus”

Note: PayPal and CC are not available for the UK and FCA users.

How to cash out Bitcoin on eToro

- Log in, close trading positions, if need be, or transfer amounts from the trading account to your eToro Money account. Visit the Withdraw Funds tab, enter the amount (at least $30), select the payment method (including bank or custom), and wait for processing. The fee is $5 per withdrawal.

- Track the status of the transaction from the History page’s “Under Review” section or revert the transaction.

- Alternatively, click on the Crypto tab, select Crypto, then tap Convert, enter the amount, and proceed to convert to fiat currency. Go to the Withdraw Tab and withdraw.

Fees: $5 per transaction.

Terms Apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

#2) Coinmama

Best for crypto to fiat or fiat to crypto conversions.

Coinmama is also efficient for bank cash outs but not with other methods. It also only supports Bitcoin cash-outs. It lets you cash out up to $50,000 per order and up to 10 orders per day through your bank account. The same limit applies for monthly cash outs but the maximum order amount is 50. If you want to cash out other cryptos through this exchange, then a middleman exchange is needed to first convert them to Bitcoin.

You also pay cash out fees depending on your loyalty level, which gives you the chance to reduce fees by trading more. The Curious level is charged 3.90%, Enthusiast 3.41%, and Believer 2.93%.

Features:

- Cash outs through IBAN account for Europe and SWIFT for U.S.

- Cash outs for most except a few restricted countries (11 countries, 15 states, and 6 U.S. territories are exempted).

Fees: From 3.90% to 2.93% depending on loyalty level.

#3) Swapzone

Best for comparing best cash-out rates across multiple exchanges.

Swapzone facilitates easier and quicker Bitcoin cash out by helping users to find the best crypto-to-fiat trading and swapping rates across multiple exchanges.

They can find and compare exchanges based on expected transaction times, exchange rates or selling prices, and user ratings. It also helps users to purchase Bitcoin and other cryptos with fiat by first finding the best rates from across multiple exchanges.

Those needing to cash out Bitcoin with Swapzone simply visit the home page, choose the crypto such as Bitcoin which they need to cash out, enter the amount, and choose the fiat or national currency that they wish to receive.

Features:

- 1000+ cryptos can be cashed out or traded against 20+ fiat and cashed out to the bank.

- Trading or swapping crypto for others or stablecoins.

- Chat support.

- 15+ exchanges and crypto networks from which orders and offers are drawn.

How to cash out Bitcoin to USD with Swapzone:

Step 1: Visit the home page. Click or tap Exchange crypto to do crypto-to-crypto or crypto-to-stablecoins transactions. Click the Buy/Sell by fiat button to cash out Bitcoin or other cryptos.

Choose BTC or crypto to cash out from the drop-down menu on the right. Enter amount. You will be presented with the wallet address where to send this crypto, later on in the cash-out steps.

In the other entry, choose the fiat or national currency to receive in the bank or through other payment methods. The interface will calculate and show you the amount of fiat you will receive after sending the crypto specified in the aforementioned sub-step.

Step 2: It presents you with a list of offers from different exchanges, through which to cash out. Click or tap Sell against your choice offer. Of course, you can shuffle offers based on expected transaction time (fastest), customer rating, and exchange rate.

Step 3: Enter the wallet address to which the crypto can be refunded if the transaction fails. There is the option to enter an email.

Proceed with the transaction and enter your details and IBAN where the money will be sent. Fill in all the required details and proceed with the transaction, and send the crypto to the given wallet address. The fiat money will then be sent to your bank.

Fees: Free crypto swap/exchange. There will be price differences or spreads.

#4) Nuri

Best for beginner crypto users who want to convert their Bitcoin and Ethereum to cash.

Formerly Bitwala, Nuri is a European blockchain bank that seeks to bridge the gap between crypto and legacy money. It was founded in 2013 and it continues to grow, especially in the European region.

It helps users save or store their cryptocurrencies in a non-custodian way. It also has a debit card that lets users spend money and crypto daily as far as they are based in Europe. Users can also get a EUR bank account in addition to the crypto wallet with this service. Hence, it is a popular option for those requesting how to cash out of Bitcoin to USD or other fiat currency.

For instance, those who receive their salaries and payments in crypto can spend or convert them instantly for sending to the bank and withdrawing. However, the service has support for a few coins and some people have reported freezing of their accounts.

The service comes with a $100,000 deposit guarantee users will get their Euros back if anything goes wrong. However, for the sake of those asking how do you cash Bitcoin, this does not apply to BTC holdings.

Features:

- Android and iOS apps are available besides the desktop version.

- Save and earn interest on your cryptocurrencies. This feature is provided in partnership with the Celsius Network.

- Free worldwide and debit card payments and cash withdrawals. This helps those asking to cash out of Bitcoin to USD.

- Euro IBAN bank account, ATM withdrawals and merchant payments worldwide, annual tax reports, SEPA transactions, etc. Full German bank account.

- Free MasterCard debit card.

- The limit is EUR 3,000 for offline card disposal and EUR 5,000 for online card disposal.

- The minimum trade is EUR 30, and the max is EUR 15,000.

- The trading limit is EUR 30,000 per rolling 7 days.

How to cash out Bitcoin to USD on Nuri:

- Open BTC wallet and visit the wealth section. Select Bitcoin wallet.

- Enter amount to withdraw.

- Confirm the transaction using biometrics.

- Continue to withdraw for the fiat to appear in your bank account.

Fees: 1% trading fees, buying crypto is 1% (+ EUR 1 network fee), selling crypto is 1% (+ current network fees).

Website: https://bitwala.com/

#5) CashApp

Best for beginner and diversified investors or traders who also trade stocks and legacy fiat products.

CashApp was created in 2013 and it let users send and receive, as well as trade Bitcoin from a bank-linked wallet account. Hence, you can trade it for cash that is then deposited into your bank account and withdrawn via ATM, for instance.

The bank linkage allows users to use a credit card – Visa, MasterCard, American Express, and Discover – to buy and sell Bitcoin. CashApp also lets users pay for goods and services using Bitcoin, and to invest money through methods like dollar-cost leveraging, etc. All a person needs is an email address, phone number, or $Cashtag to send cash to a recipient.

Features

- iOS and Android version with no desktop version available.

- Only for U.S. and United Kingdom residents,

- Tax forms for reporting Bitcoin gains.

- Only supports Bitcoin and no other crypto.

How to cash out Bitcoin to USD with CashApp:

- Assuming you have signed up for an account and have Bitcoins on your wallet.

- Click the Bitcoin icon on the bottom of the taskbar and select the sell button.

- Enter the amount to sell and you will see the rates and any fee that applies. Confirm the sale. Conversion is instant.

- You will find the amount of sell as $ or other supported local fiat currency in your CashApp. This can be withdrawn to a bank or credit card supported for spending. It will reflect in 1-3 days to the bank or card supported for free, although you can pay a 1.5% (or a minimum $0.25) fee to have it reflect instantly.

Fees: 1.5% fee (with a minimum fee of $0.25) to instantly send converted Bitcoin to a bank or credit card. Otherwise, it is free for 1-3 days of delays.

Website: https://cash.app/

#6) Coinbase

Best for multi-crypto holders and traders.

Coinbase lets you cash out Bitcoin and multiple other cryptocurrencies by first converting them to fiat on the platform and then withdrawing the fiat to a bank account. The process is done through selling crypto, either on the web or via Android or iOS apps.

The good thing about using this platform is that it allows people to do many other things with their crypto. You can stake and earn returns depending on the amount staked, convert one crypto to another, and invest crypto. It is a custodian platform.

Features:

- Sell an unlimited amount of crypto to fiat on the app at the market rate.

- Withdraw to multiple supported banks, wire transfer, credit, and debit card, and SEPA, and PayPal.

- Withdraw or cash out up to $50,000/day on the Coinbase Pro after converting to cash. No limits to withdrawal on Coinbase Commerce.

How to cash out Bitcoin to USD on Coinbase:

- On the platform, tap on or select/click Buy/Sell and choose to sell.

- Choose the crypto you want to sell.

- Enter amount to sell, preview the sell order and click/tap on the Sell now button. The withdrawals related to sales are held for some time, as shown on the transaction before reflecting the bank account or credit card balance. It takes 1-5 business days depending on the withdrawal method used. US, Europe, UK, Canadian PayPal transactions are instant.

Fees: Flat fee of 2.49% is charged when selling BTC in the United States and withdrawing via Coinbase Card. 1% fee to convert and withdraw your crypto to fiat besides standard network fees.

Website: https://coinbase.com

#7) PayPal

Best for instant and multi-crypto holders.

PayPal does not currently allow users to send crypto to the platform through wallet addresses and such but lets users buy it using their balances on PayPal. You can use the platform to buy and then speculate prices to sell later. Selling lets you convert crypto to fiat automatically, and the balance reflects on your account.

The money can then be withdrawn to any bank, or credit card supported. However, the service is only available for U.S. residents, although there was a planned expansion this year. PayPal may also revert to a digital wallet app being worked on currently and could launch this year.

Features:

- It supports Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

How to cash out Bitcoin to USD via PayPal:

- From the home screen button on the PayPal app, while logged in, find Crypto.

- Select the crypto to sell.

- Confirm Tax Information, enter the amount to sell and continue to sell. The amount will reflect on the PayPal app balance and can be withdrawn into a bank account or supported credit card. Of course, the transfers take 1-2 business days depending on bank and card mechanisms.

Fees: Fee is disclosed at the selling point but PayPal says it charges spread (or margin). For withdrawal to the bank, it is $0 or up to 1% depending on location and currency.

For credit cards or debit cards, there is an additional fee to transfer to the bank after exchanging. In that case, you pay between 5.00 USD for manual transfer to a credit card, 10.00 USD in the U.S., or other amounts depending on the card type used.

Website: https://paypal.com

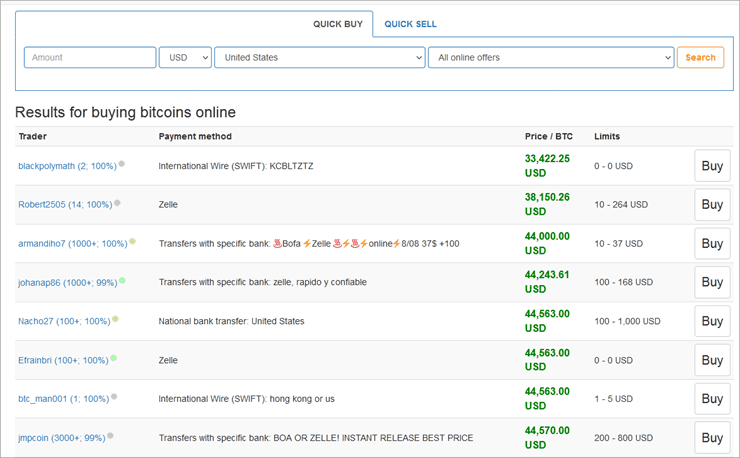

#8) LocalBitcoins

Best for peer-to-peer trading.

LocalBitcoins.com and LocalCryptos are popular options for peer-to-peer traders. They allow them to trade Bitcoin and other cryptos with any local national currency beyond USD, Euro, Yen, GBP, and others. Anyone in almost any country can transact BTC only for LocalBitcoins and BTC, ETH, LTC, and Dash, for LocalCryptos.com.

To cash out of Bitcoins and other cryptos on this platform, one only needs to deposit the cryptocurrency. They can then find a peer willing to buy the crypto for local national currency. They can exchange using any preferred payment method.

These platforms use escrow services where the BTC is first sent to a wallet address inaccessible to a seller or buy until they complete the transaction offline. By offline payment, it means the buyer is paid outside of the service. For instance, via PayPal, credit card, or bank transfer. The seller will confirm having been paid before releasing the amount from escrow to the buyer.

Features:

- LocalBitcoins and LocalCryptos support popular money transfer methods like ACH, bank wire, Credit Card, PayPal, Western Union, etc.

- Most suitable for traders willing to cash out small amounts not over $1000 at once.

- High fees.

- Instant cash out depending on the payment method chosen by peers.

- Easy to use–register and verify.

How to cash out Bitcoins from LocalBitcoins.com:

- Register on the platform and deposit your BTC.

- Click Sell Bitcoins and from the list of shown orders. Select the person with your most favorable trading terms, like rate, payment method, and trading limits. You can sort the list as per payment method and country.

- Click on the selected person order, input the amount of BTC to trade, and sell. The BTC is put into escrow where you cannot take it back if paid for by the buyer and where the buyer cannot access it unless you release it after they pay you. The buyer will be notified to make a payment to your preferred method. You can then release the BTC from the escrow to their wallet after confirming the money has been paid.

Fees: 1% for every completed trade for anyone who creates a sell or buys order on the platform. Network confirmation fee is charged, if sending to other wallets directly.

Website: https://localbitcoins.com/

#9) Crypto.com

Best for companies, merchants, and individual crypto holders.

Crypto.com is probably the best app on the list for cashing out Bitcoins. It lets you cash out any crypto via ATMs or spend it on Visa payment points globally. You do not have to worry about in-exchange crypto to Bitcoin conversions with the Crypto.com Visa card. The crypto will also attract rewards of up to 14.5% if you stake in platform tokens CRO.

Furthermore, users can leverage in-app trading features with advanced charting and portfolio monitoring tools. It also supports margined spots and derivative trading.

Features:

- Over 250+ cryptos supported.

- Swap crypto with each other or instantly convert it to fiat and withdraw from ATM.

- Rewards when you spend crypto.

- Stake and earn up to 14.5% in rewards.

Fees: Free for up to $200 and $1,000 depending on card tier, then 2.00% later.

#10) CoinSmart

Best for same-day crypto to fiat conversions.

CoinSmart is also effective at exchanging Bitcoin for fiat and withdrawing via a bank account. The good thing about this exchange is that it guarantees same day fiat deposit to your bank account once you initiate a fiat cash-out transaction.

The other thing is that you can’t cash out other cryptos apart from Bitcoin. However, this is easier done than said since the exchange has a spot exchange. Simply swap the other cryptos instantly and cash out in Bitcoins.

Suggested Read => Buy Bitcoin in Canada

Features:

- Sell Bitcoin for fiat with same day deposit guarantee to bank.

#11) Bitstamp

Best for beginner and advanced regular trading with low fees; crypto/bitcoin cashout to bank.

Bitstamp provides a cashout method for fiat/legacy/real-world currencies like USD through the bank. With web and mobile (Android and iOS) apps, people can withdraw over 50 crypto assets supported for trading.

This means that after depositing via bank, wire, SEPA, crypto, and credit/debit card, you can trade crypto using advanced charting and speculation, earn profit and withdraw as fiat currency via bank. Start by downloading from the app store, installing, and setting up the account. You must activate the device and set up a PIN, fingerprint, or face ID.

To withdraw, simply head over to the Wallet of the app in the bottom bar, select the currency to withdraw, input an amount, and click next. Review the information and confirm the transaction. The exchange does not state the amount of time it will take to process the withdrawal but says the shortest time possible. Another withdrawal option is to send crypto from your Bitstamp wallet to an external wallet.

Features:

- Cashouts and deposits are also suitable for pro traders and OTC institutional trading for crypto against fiat.

- Bitstamp supports passive income by staking Ethereum and Algorand cryptocurrencies.

Trading Fees: 0.50% for <$10,000 trading volume to 0.0% for > $20 million trading volume. Staking fees — 15% on staking rewards. Deposits are free of charge for SEPA, ACH, Faster Payments, and crypto. International wire deposit – 0.05%, and 5% with card purchases. Withdrawal is 3 Euro for SEPA, free for ACH, 2 GBP for Faster Payment, 0.1% for International wire. Crypto withdrawal fee varies.

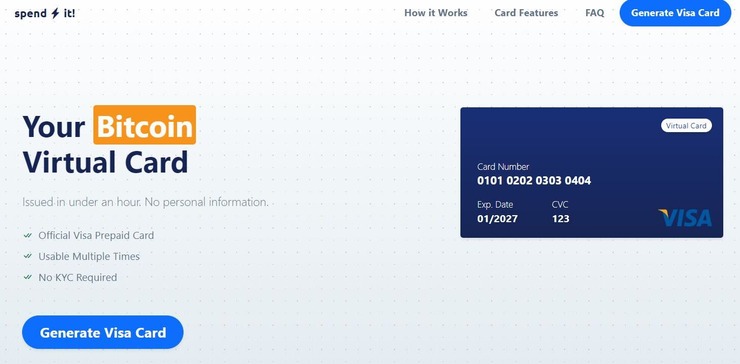

#12) Spend it

Best for Official prepaid visa card.

Spend it is different from all the other cards on this list. However, it still warrants a mention because of its ability to facilitate transactions with the help of Bitcoin. Spend it offers you an official prepaid Visa card that you can fill with Bitcoin for transaction with any merchant that accepts a Visa card.

You don’t need to provide any personal information or register to get the card issued. The card can also be added to Apple pay and Google pay for hassle-free transactions. As of today, you can use this card to conduct business at over 40 million + merchants. Although the card is generally funded by US dollars, you can make purchase in other currencies as well at a fee of 2% + 2 USD.

Features:

- Use with Bitcoin deposit

- No KYC Needed

- Add to Apple pay and Google pay

- Built-in Metamask Integration

How Spend it’s card works?

- Top up the card with amount ranging from $20 to $750

- Make a crypto deposit using Bitcoin

- Get the card issue via email within minutes of making the deposit.

Fees: Depositing funds incurs a fee of 8%. Using the card, however, is absolutely free.

Conclusion

This tutorial discussed options to cash out of Bitcoins and other cryptocurrencies to a bank account, debit card, credit card, or other fiat accounts. After exchanging, the amount can then be withdrawn via ATM, bank counter, or spent on merchant stores that don’t accept crypto directly. All the options require you to exchange BTC for fiat and then withdraw with your preferred method.

CashApp only supports Bitcoin but allows you to cash out Bitcoin instantly to a US bank account. A major drawback is that it is only for the US, Europe selected other countries. For international or other countries, we suggest using Nuri. This option allows you to have an IBAN bank account for crypto withdrawals and other transactions. This is for the case of SMEs.

Also read =>> Best Exchanges to buy Bitcoin in Germany

Coinbase and Bistamp are excellent if you have other coins or tokens to cash out other than Bitcoin and Ethereum. These two are also great choices when cashing out numerous Bitcoins because they also support over-the-counter trading.

LocalBitcoins.com, like LocalCryptos, is a fantastic choice if you want to cash out small amounts in your local payment methods. Some local payment methods that allow you to cash out of Bitcoins to are not be supported on Coinbase, Bitstamp, or perhaps Nuri. LocalBitcoins supports only Bitcoin but LocalCryptos are for BTC, Litecoin, Dash, and Ethereum.