This tutorial explains Cryptocurrency IRAs. Explore the top Cryptocurrency IRAs along with features and comparison:

Individual Retirement Accounts are savings accounts with tax advantages, used by individuals to save and invest either Bitcoin, cryptocurrencies, cash, bonds, stocks, or any other asset for a long-term retirement.

Cryptocurrency IRAs (Individual Retirement Accounts) help you find a custodian for a self-directed IRA in which you can invest in cryptocurrencies. The custodian has to be approved by the Internal Revenue Service, which treats Bitcoin and other cryptocurrencies as property for purposes of an IRA.

The custodian will hold your digital assets as an investment. For instance, hold other property like real estate with an approved investment plan.

Table of Contents:

Understanding Cryptocurrency IRAs

They are great if you want to diversify your retirement savings and investments from other assets to crypto. This tutorial looks at the top crypto and Bitcoin IRAs to invest in or through, as well as the benefits, and frequently asked questions.

Expert Advice:

- Self-directed IRAs are most suitable when you already have crypto investment and trading advice. Otherwise, it is recommended to look for those with IRA investment and crypto trading consultancy, guides, and advisors.

- Putting Bitcoin in Individual Retirement Accounts is more preferable for those with low risk-averse, although volatility is not a huge problem nowadays, so long you can take necessary precautions.

- Best crypto IRAs support trading, a rollover from other 401(k) and other investment plans into a Bitcoin 401k, diversification to investing in cash, bonds, stocks, and other assets. This is in addition to investing in cryptos.

Market Trends:

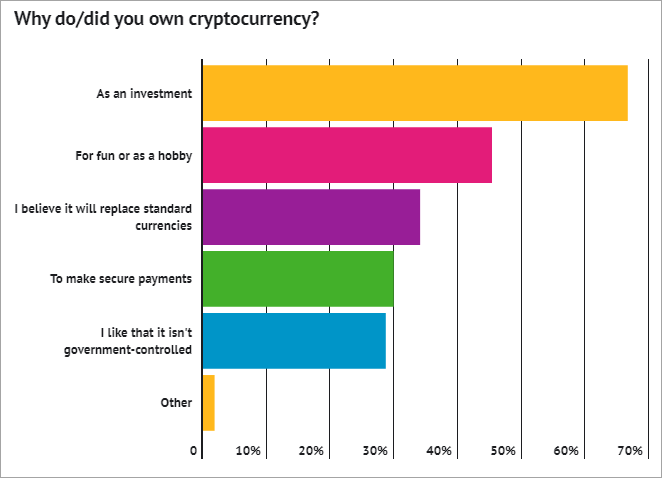

- With 66% of Americans owning crypto for investment according to a 2021 survey by Ascent survey, now is the time to include crypto in your Individual Retirement Accounts plans since there is growing confidence in crypto investments.

- As per the above survey, 50 million Americans are likely to buy crypto in the next year. Thus many more people are looking into Bitcoin 401k and will put Bitcoin in IRA in the coming years.

Crypto Or Bitcoin IRA

When termed as Bitcoin IRA or crypto IRA, they allow users to hold, trade, save, or invest Bitcoin and other cryptos in their portfolios.

All Individual Retirement Accounts require you to find a custodian who can accept the asset you want to invest through them. For cryptocurrency IRAs or Bitcoin IRAs, therefore, it will be harder to find those that allow you to invest cryptocurrencies through them.

Otherwise, Bitcoin 401k is similar to 401(k) retirement accounts, but unlike 401(k) plans that are obtained only through employees, they are self-directed. For taxation, the IRS taxes crypto the same way as bonds, stocks, and other property assets.

Frequently Asked Questions

Q #1) Is there an IRA for Bitcoin?

Answer: Yes, today, there are multiple IRA Bitcoin or Individual Retirement Accounts that allow you to include Bitcoin and other cryptos as investment portfolios. Scroll through our list to find the best one you can use for this purpose.

Q #2) Can I buy Bitcoin in a Roth IRA?

Answer: Yes, multiple IRA custodians also accept Bitcoin and other cryptos as assets in addition to bonds, stocks, real estate, and other properties. But there are also exclusively crypto IRAs.

Bitcoin is now allowed by many IRA custodians because the IRS treats it as taxable property. Therefore, investing in Bitcoin and/or other cryptos via Individual Retirement Accounts is legal.

Q #3) What coins does Bitcoin IRA offer?

Answer: Bitcoin IRA is one of the many cryptocurrency IRAs that support Bitcoin, Ethereum, Litecoin, and many other cryptocurrencies. In fact, with IRA Bitcoin, you can invest, hold, and trade Bitcoin and other eight cryptocurrencies, namely Ethereum, Litecoin, Stellar Lumens, Zcash, Bitcoin Cash, Ethereum Classic, and digital gold.

The platform requires a minimum investment amount of $3,000, although you can also transfer funds from an existing IRA account.

Q #4) Is Bitcoin IRA legitimate?

Answer: It is a legitimate platform for Individual Retirement Accounts. It lets you invest a portion of your portfolio in crypto assets and physical gold. With it, you can roll over existing retirement savings into the IRA Bitcoin account and trade digital assets supported, however, you want.

Q #5) How do I invest in Bitcoin with IRA?

Answer: You first need to research a custodian that allows putting Bitcoin in an IRA or crypto as a portfolio inside Individual Retirement Accounts. Research their Bitcoin IRA fees, limits, features, and other things. From here, you can open an account with that custodian.

Most of these allow for online account opening. The next step is depositing Bitcoin or crypto into your IRA account. You can also roll over your Bitcoin or investment in an already existing IRA account. From there, and depending on the custodian, you can trade crypto, invest in different crypto products, and do other things with the account.

Q #6) Can I buy Bitcoin with a self-directed IRA?

Answer: Yes, a self-directed IRA account that supports a crypto or BTC portfolio lets you invest Bitcoin in IRA and other cryptocurrencies using either a traditional or Roth IRA. With a traditional IRA, you use pre-tax funds where the tax is deferred until the amount is withdrawn during retirement. The amount is taxed at the IRA owner’s current income tax rate.

In a Roth, you benefit from tax-free growth or tax-free withdrawals in retirement. According to the IRS, you can withdraw the amount without being charged any federal taxes as long as the account is owned for 5 years or more and is 59½ years or older.

Benefits And Challenges

Benefits:

- You can get tax-deferred or tax-free benefits as you grow these accounts. This depends on the type of IRA account.

- In a traditional IRA, the taxes are made before and therefore you get tax deductions before contributing to the crypto IRA. There are no taxes paid until you withdraw the funds. In a Roth IRA, however, you get no tax deductions, but never pay taxes when you withdraw the value from the IRA.

- Short-term and long-term gains tax on purchases and sales the same way with stocks, bonds, and mutual funds. You will not need to report any individual purchases or sales to the IRS for taxation purposes. Being treated as a property for purposes of taxation means it accrues short and long-term capital gains.

- Portfolio diversification. Cryptocurrency IRAs allow you to diversify your investment portfolios, which exposes you to more profits and lessens hefty losses in case the value of a single asset increases or drops significantly, suddenly, and unexpectedly.

Challenges:

- Bitcoin in Individual Retirement Accounts is exposed to the volatility of cryptocurrencies. Volatility can lead to either hefty losses or profits. Hence, they are not preferred for those with a higher risk aversion.

- Some of these have high and multiple types of Bitcoin ira fees. Depending on the provider, the setup fees could be way up to $6,000 during an initial setup.

Add this to the recurrent custody, trading, custodian commission, which can be around 3.5% per transaction, and maintenance fees. Otherwise, the minimum amounts needed to open these accounts are also high way up to $50,000.

Terms Apply: Please read all the details and terms carefully on the below Crypto platforms before investing. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

List of the Best Bitcoin IRAs

Here is the list of the Best Bitcoin IRA Companies:

- Bitcoin IRA

- iTrustCapital

- CoinIRA

- Alto

- BitIRA

Comparing The Best Cryptocurrency Individual Retirement Accounts

| Crypto IRA name | Top features | Fees | Minimum investment | Our rating |

|---|---|---|---|---|

| Bitcoin IRA | Crypto investing in addition to stocks, bonds, and cash. Rollovers. | • Deposit fee: 0.99%-4.99% • Transaction fee: 2% • Security fee: 0.08% per month | $3,000 | 5/5 |

| ITrustCapital | Cheapest for trading and investing. Precious metals supported. | •$29.95 per month. •1% per transaction for crypto. •$50 over spot for gold. •$2.50 over spot for silver. | $2,500 minimum plus $1,000 in a subsequent deposit. | 4.4/5 |

| Coin IRA | Saver IRA lets you earn on your crypto deposits and holdings. | •$195 annual maintenance fee. • $50 setup fee. •0.05% per month for storage. | $20,000 | 4.7/5 |

| Alto IRA | Unlike others provides SEP IRA accounts. | •$2/month for starter or $25/month for Pro accounts. •1.5% per transaction. •$10-50 fee per partner investment •$75 for each private investment. •$25 wire transfers. •$50 account closures. •1.5% trade fees. | $2,500 | 4.5/5 |

| BitIRA | Digital Currency Specialists and Dedicated IRA Specialists to assist investors in addition to customer support staff. | •$50 account setup. •$195 annual maintenance. •0.05%/month offline storage. | $5,000 | 4.4/5 |

Detailed Review:

#1) Bitcoin IRA

Best for advanced crypto Individual Retirement account investors, those looking to earn interest on their crypto savings.

Bitcoin IRA was established in 2016 and hence is the first and now the largest cryptocurrency Individual Retirement Accounts there is. Through it, individuals can invest in crypto with a portion of money from their retirement accounts. You simply open an IRA account and digital wallet, then trade within three to five days of transferring the money.

With Bitcoin Individual Retirement Accounts, users can trade digital assets in addition to securing up to 9 cryptocurrencies in cold storage. This includes Bitcoin, Ethereum, Ripple, and Litecoin. With more than $100 million of insurance protection for digital assets, it is the best Bitcoin IRA available for crypto users currently. This is despite the high setup and maintenance fees.

It is a self-directed IRA whose assets are insured by Lloyd’s of London. Bitcoin IRA is based in Sherman Oaks, California. With over 100,000 users currently, the company has handled over $1.5 billion in transactions.

Features:

- Aside from the $3,000, opt for the Saver IRA in which you deposit $100 with a recurring investment of $100 per month.

- Can also invest in gold and save cash through IRA Bitcoin.

- You can roll assets (IRA, Roth IRA, SEP-IRA, SIMPLE IRA, 401(k), or 403(b) from an existing retirement account into the IRA. Roll a portion or all assets from these accounts.

- Invest in Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), Digital Gold (DG), Ripple (XRP), Litecoin (LTC), Stellar Lumens (XLM), and Zcash (ZEC) for retirement.

- Accounts type supported — both as a Roth or traditional IRA.

- In addition to a basic IRA, earn up to 6.00% APY from your cash on the IRA. Crypto earnings differ from one crypto to another.

- Crypto assets are secured through BitGo Trust.

Minimum to open an account: $3,000

Fees: Deposit fee: 0.99%-4.99%, Transaction fee: 2%, Security fee: 0.08% per month.

#2) iTrustCapital

Best for beginners in IRA.

ITrustCapital is a legit cryptocurrency IRA approved by the IRS and SEC, with a high rating of 4.5 on TrustPilot and an AAA rating on Business Consumer Alliance. The self-directed cryptocurrency IRA also allows investing in precious metals for those who are saving for a long-term retirement.

On the platform, you can buy and sell Bitcoin and Ethereum, as well as gold and silver, with the tax advantages of retirement investing. The IRA allows you to open a traditional or Roth IRA account, which you can fund with pre-tax dollars and post-tax dollars, respectively.

As per Bitcoin IRA reviews, it is one of the best IRAs in terms of pricing, minimum investment amount, and investment diversity as it supports more cryptos than other IRAs. The crypto transactions are dealt directly from account to account, unlike silver and gold which are dealt via Kitco metal dealers.

Features:

- Supports Bitcoin, Ethereum, Litecoin, Bitcoin Cash and 21 other cryptos and crypto tokens.

- The monthly fee covers IRA set-up, transfer/rollover facilitation, IRA fund contribution facilitation, reporting on taxes, no limit on storage of crypto with institutional custodial services, and maintenance and support.

- Trading orders were completed in 5 minutes.

- Good customer support.

- Educational resources are provided through a dedicated Knowledge Center. However, no investor’s advice is provided.

Minimum investment amount: $2,500 minimum plus $1,000 in a subsequent deposit.

Fees: $29.95 per month, 1% per transaction for crypto, $50 over spot for gold, and $2.50 over spot for silver.

#3) Coin IRA

Best for those needing crypto consultancy and advice alongside IRAs.

Coin IRA is advantageous to Bitcoin IRA because it charges lower Bitcoin IRA fees. Besides, it offers multiple storage options for those investing in crypto for retirement purposes. Through Coin IRA, you do not have to walk alone investing in crypto for retirement because there are cryptocurrency consultants available.

It was founded in 2017 and has a free “Ultimate Guide to Cryptocurrency Investing” to furnish newbie investors with information about crypto and crypto IRA investment options. It provides insurance of up to $100 million for crypto assets kept there.

The cryptocurrency Individual Retirement Accounts supports six of the most popular cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, XRP, and Litecoin.

With this IRA, it takes 1-3 days to set up an account. However, it can take up to three weeks to roll over funds from a separate IRA. Although you can manage your account and place trades online, you must confirm trades over the phone to complete trading. This helps prevent fraud.

Features:

- Keep crypto offline, to a hardware wallet (KeepKey, Ledger, or Trezor), exchange wallets, or any other wallet you want.

- Open the IRA account with a minimum of 20,000 or transfer $3,500 from a non-IRA account.

- Rollover a portion of 401(k) or IRA to the IRA.

- Non-IRA accounts with higher trading limits for experienced investors.

- Invest in a traditional IRA or post-tax dollars in a Roth IRA.

Minimum to open an account is $20,000.

Fees: $195 annual maintenance fee, $50 setup fee, 0.05% per month for storage.

Website: https://coinira.com/

Further Reading => Most Popular Precious Metals IRA Companies

#4) Alto IRA

Best for SEP-IRA users, and Coinbase customers.

Alto IRA self-directed investment account allows anyone to invest almost anything into the retirement account. You can invest with angel funds, real estate companies, crypto exchanges, online investment funds, and accredited private investors.

With Alto IRA, you are free to invest directly in private deals. You can use it to fund a loan for starting a business, buy duplexes, or other motives. This IRA provides traditional IRAs, Roth IRAs, and SEP-IRAs.

When deciding between the Pro and basic account, the Pro suits those with private investments or those assets re-registered with Alto. If you exclusively invest through the company’s investment partners, you are better with the Starter plan. It is, however, possible to upgrade.

Features:

- Does not support inherited IRAs or individual 401(k)s for anyone looking for a Bitcoin 401 k plan.

- Supports direct investments or those that you make without engaging any of the Alto IRA partners. These include extending a small business loan or buying residential real estate. The investment must, however, be legal.

- Allows buying, flipping, and selling of property using retirement funds as long as you follow the rules.

- Trade via Coinbase with minimums as low as $10. There are no set-up charges.

- You pay $10 per investment when investing with preferred investors, otherwise; you pay $50.

- Can fund accounts with major credit and debit cards.

Minimum investment amount: $2,500.

Fees: $2/month for starter or $25/month for Pro accounts, 1.5% per transaction, $10-50 fee per partner investment, $75 for each private investment, $25 wire transfers, $50 account closures, and 1.5% trade fees.

Website: https://c212.net/c/link/?t=0&l=en&o=3135155-1&h=608948731&u=http%3A%2F%2Fwww.altoira.com%2F&a=www.altoira.com

#5) BitIRA

Best for those needing assistance from crypto specialists

BitIRA combines both traditional and IRA Bitcoin investments. It is used by both institutions and individuals wanting to diversify their investments into crypto. The platform offers a fully assisted setup, account rollover, and funding process. The IRA was founded by the Birch Gold Group.

Besides, the platform uses strategies like reducing the risk of devaluation and debasement to protect crypto assets from inflation risks. This is despite BitIRA’s high minimum investment and long waiting periods before the account is set up.

The accounts are handled by licensed and trusted custodians – BitRA works with the Equity Trust IRA investment platform especially if you are a beginner feeling uneasy investing in digital assets.

The company also has Digital Currency Specialists and Dedicated IRA Specialists to assist investors, as well as dedicated customer support staff. As per Bitcoin IRA reviews, this plan allows rolling over investments to Roth IRAs, SEPs, and SIMPLE IRAs, but penalties may apply when rolling over to all 401(k) accounts, including Bitcoin 401 k.

Features:

- Offers both traditional or Roth IRA accounts.

- Supports Bitcoin, Bitcoin Cash, Ethereum, Zcash, Ethereum Classic, Litecoin, Stellar Lumens, and Bitcoin SV. Besides crypto, invest also in traditional assets like stocks and bonds or other assets inside an IRA.

- $100 million custody insurance.

- Secured against hacking and other forms of account violations. This is done through multi-encryption, multifactor authentication, and end-to-end insurance coverage.

- Allows buying and selling of crypto.

- You can speak with experts to advise on choosing an investment using this IRA.

- You can also manage your crypto and IRA portfolio online 24/7.

Minimum investment: $5,000.

Fees $50 account setup, $195 annual maintenance; 0.05%/month offline storage.

Website: https://www.bitira.com/

Conclusion

This crypto or Bitcoin IRA review/tutorial discussed in depth the idea of cryptocurrency IRAs, their benefits, challenges, and the top crypto or Bitcoin IRAs you can invest with.

All of these crypto IRAs in the list allow you to diversify your investment portfolio with multiple cryptos, including Bitcoin and Ethereum. They all support traditional and Roth IRA accounts, although Alto IRA adds on SEP accounts.

In this Bitcoin IRA review, we suggested these types of investments to experienced IRA investors looking for trusted IRA platforms that have been around for a while. It is the best option if you want to deal in crypto IRAs in addition to cash, bonds, and stocks IRAs. However, beginner investors looking for cheaper options can opt for iTrustCapital IRAs.

Most would look for a crypto IRA that allows them to transfer their funds from existing IRAs and these 5 options are suitable for that.

If you are an investor in metals and precious metals already and looking for diversification, we suggest iTrustCapital. Otherwise, you are better off with Coin IRA and BitIRA if looking for additional crypto IRA investment consultancy or advice.

Research Process:

- Time Taken to Research and Write This Article: 10 Hours

- Total tools shortlisted for research: 10

- Total tools reviewed: 5