Do you trade in Cryptocurrencies and need to pay taxes? Review and compare the best Crypto Tax Software to select the most suitable tax software:

The number of people investing in cryptocurrencies is overwhelmingly increasing day by day. This is because it can make you a millionaire or even a billionaire within a very short period. History is proof. But when it comes to paying taxes for the trade you have done with crypto exchanges, it can be a troubling process to do.

If you are an investor in cryptocurrencies, most probably you would do several transactions in a year. Keeping a record of these transactions and then calculating net profit and loss is not possible for everyone.

You can get help from crypto tax software, which automatically syncs across crypto exchanges & wallets, calculates your capital gains & losses, and gives you final tax reports, which can then be used for filing your taxes.

Table of Contents:

- Cryptocurrency Tax Filing Software Reviews

- List of the Best Crypto Tax Software Solutions

- Comparing Top Cryptocurrency Tax Software

- History of Crypto Taxes

- How Does Crypto Tax Software Work

- How Cryptocurrency Is Taxed in Different Countries

- Common Types of Tax Software

- Detailed Comparison of the Top Crypto Tax Filing Software

- Frequently Asked Questions

- Conclusion

Cryptocurrency Tax Filing Software Reviews

Through this article, you will learn about the best Crypto tax software, their top features, prices, and other details so that you can decide which one suits you the best.

Expert Advice: You should always look for software that is easy to use. Because, if you find problems while handling the software, then you would ultimately have to find an accountant or tax expert which will cost you double the amount of money. If the software gives you expert help, that can also be very helpful as it can guide you on how to save your taxes.

Terms Apply: Please read all the details and terms carefully on the below Crypto platforms before investing. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

List of the Best Crypto Tax Software Solutions

Here is a list of the top Cryptocurrency Tax Filing Software:

- CoinLedger

- Koinly

- TokenTax

- ZenLedger

- Accointing

- CoinTracking

- Coinpanda

- Awaken Tax

- TaxBit

- BitcoinTaxes

- Bear.Tax

- CryptoTrader.Tax

- CoinTracker

Comparing Top Cryptocurrency Tax Software

| Tool Name | Best for | Price | Number of crypto exchanges supported |

|---|---|---|---|

| CoinLedger | Tracking capital gains and losses | Starts at $49. Free to use with limited features | 20000+ |

| Koinly | Ease of use and automatic data synchronization | Starts with $49 per tax year | 353 |

| TokenTax | Easy integration with all crypto exchanges | Starts with $65 per tax year | All exchanges |

| ZenLedger | Free plan with access to a tax pro | Starts with $49 per tax year. A free plan is also available. | 400+ |

| Accointing | Free version and portfolio analysis tools | Starts with $79 per tax year. A free version is also available. | 300+ |

| CoinTracking | Diversified investors and traders. | Starts at $10.99 per month | 110+ |

| Coinpanda | Accurate and Quick Tax Reporting | Starts at $49 for 100 transactions, forever free plan also available | 800+ |

| Awaken Tax | AI-driven crypto taxing | Starts at $35 for 300 transactions. | 15+ |

| TaxBit | Renders you a unified tax experience. | Starts with $50 per tax year | All exchanges |

Check out the detailed reviews:

#1) CoinLedger

Best for tracking capital gains and losses.

CoinLedger is a platform that automates and simplifies the process associated with filing crypto and NFT taxes. The platform integrates seamlessly with almost all popular crypto wallets and exchanges out there, fetches historical transactions from these platforms, and automatically calculates capital gains.

A final well-drawn tax form is then presented to the user, which can be downloaded in a single click.

Features:

- Crypto Wallets and Exchanges Integration

- Over 20000 Cryptocurrencies supported

- Free portfolio tracking

- Download complete Tax forms

- International Tax Reporting

Verdict: CoinLedger allows you to file your crypto and NFT taxes in 3 easy and quick steps. You’ll be able to generate your gains, losses, and income reports in virtually any currency. The tool itself is easy to use, with a large aspect of the tax filing automated from start to finish.

Pricing: The tool is free to use. For more features, you can opt for any of the following plans:

- Hobbyist: $49

- Investor: $99

Unlimited: $199

#2) Koinly

Best for business and individual local and international filing and tax calculations.

Koinly is the best crypto tax software, which connects easily with all your wallets, exchanges, blockchain addresses, and services to give you a clear picture of your invested money across various platforms.

Features:

- Connects with 353 crypto exchanges, 74 wallets, and 14 blockchain addresses.

- Automatically sync your data from all sources.

- Allow us to export your transaction data to other tax software like TurboTax, TaxAct, etc.

- Tracks your portfolio across your wallets & accounts and shows you real-time details of profit & loss and tax liabilities.

Verdict: Koinly simplifies the tax calculation process by calculating the tax liability on your crypto exchanges. You can easily export the results on other tax software. The reviews given by the users of Koinly portray a nice image of the crypto tax software.

Further Reading => A Simple Koinly Review to Manage Crypto Taxes

Pros:

- Affordable on paid plans.

- Integrates too many exchanges and wallets.

- International tax filing supported.

Cons:

- There is no independent tax-loss harvesting tool.

- Tax reports are not included in the free plans.

Pricing:

- Newbie: $49 per tax year

- Hodler: $99 per tax year

- Trader: $179 per tax year

- Pro: $279 per tax year

#3) TokenTax

Best for advanced users and businesses.

TokenTax is a tax software, made for calculating complicated taxes for your crypto exchanges so that you can file your taxes. The automation features offered by the software make tax reporting extremely simple and easy to handle.

Features:

- Gives you audit assistance.

- Supports every exchange.

- Tax loss harvesting.

- Integrates automatically with exchanges to gather your data.

- Get help from a crypto accountant.

- It can calculate as well as file your taxes.

Verdict: TokenTax is an all-in-one crypto filing tax software, which can calculate as well as file your taxes. The tax loss harvesting feature helps you to cut your clients’ tax liabilities. It is a highly recommended crypto accounting software.

Pros:

- International

- Tax-loss harvesting tool available.

- 85+ exchanges.

Cons:

- No free trial.

- The basic plan has few features.

Price: Crypto + full tax filing price plans range from $699 per tax year to $3,000 per tax year.

Plans for crypto tax reporting are as follows:

- Basic: $65 per tax year

- Premium: $199 per tax year

- Pro: $799 per tax year

- VIP: $2,500 per tax year

#4) ZenLedger

Best for business and advanced users.

ZenLedger is a crypto taxation software that supports integration with over 400 exchanges, including more than 30 DeFi Protocols. With more than 15K customers, ZenLedger is providing its crypto tax simplifying services to investors and tax professionals.

Features:

- Calculates your crypto profits and losses with the help of your transaction history.

- Integrate with TurboTax.

- Gives you access to a tax pro with all its plans.

- Tax loss harvesting tools and unified accounting reports

Verdict: ZenLedger even offers a free plan with access to a tax pro. However, you can only track 25 transactions with this plan. It can be a good option for those who hold their assets.

Pros:

- Charges as per the number of transactions made.

- Decentralized applications are supported heavily though on expensive packages (for higher-end users).

- Tax professionals are available.

Cons:

- Pricey for entry-level that have professional assistance. Pricey than competitors.

- Not international.

Pricing:

- Free: $0 per year

- Starter: $49 per year

- Premium: $149 per year

- Executive: $399 per year

#5) Accointing

Best for hobbyists and advanced crypto traders.

Accointing is a crypto tracking as well as tax reporting software that offers you tools to track the market, analyze your portfolio, offer tax loss harvesting, and give you tax reports so that you can file for your taxes easily.

Features:

- Tools to analyze your portfolio so that you can make better moves in the future.

- Allows you to explore the crypto market.

- Calculates your gains and losses.

- Makes tax reports for you, which can be downloaded and used for filing taxes.

- Tax-loss harvesting.

Verdict: The free version offered by Accointing can be very beneficial for beginners in trading because it supports tax reporting of 25 transactions only.

Pros:

- Easy to set up. Desktop and mobile supported.

- Integrates with 300+ different exchanges and wallets. 7500+ currencies supported. Portfolio tracking.

- Crypto tax expert support.

Cons:

- Priority support on Pro plans only.

Pricing:

- Trader: $199

- Hobbyist: $79

- Free Tax: $0

- Pro: $299

#6) CoinTracking

Best for diversified investors and traders.

CoinTracking is a popular cryptocurrency tracking and tax reporting software having 930K+ active users. It provides you with details of market trends for 12,033 coins and automation features for importing your crypto transactions.

Features:

- Provides you a tool to study the trends in coins for trading.

- Gives you the report of profits and losses.

- Supports importing data from 110+ exchanges

- Lets you export the tax reports to CPSs or tax offices.

- Gives you tutorials through FAQs and videos.

- Tax reporting for crypto traders and crypto companies

Verdict: CoinTracking is a highly recommended crypto tax software that is loaded with some nice features for tax reporting and market analysis. There is a free version too that allows tracking of 200 transactions.

Pros:

- Support for 5,000+ different coins. Multiple exchanges support.

- API-based crypto trading is supported. Detailed charting and portfolio tracking.

- Android and iOS apps.

Cons:

- The free mode supports imports for just 2 wallets.

- ICOs are not supported.

Pricing:

- Free

- Pro: $10.99 per month

- Expert: $16.99 per month

- Unlimited: $54.99 per month

- Corporate: Contact them for prices.

#7) Coinpanda

Best for Accurate and Quick Tax Reporting.

Coinpanda is a platform you can use to create crypto tax reports in less than 20 minutes. You get a single report that gives you a comprehensive overview of all your cryptocurrency, transactions, and taxable gains.

In the reports, you get a detailed breakdown of your acquisition costs, proceeds, and long-term and short-term gains for every NFT and crypto asset you own. What we admire about Coinpanda is the fact that it can generate tax reports specific to the laws of over 65 countries in the world.

Features:

- Capital Gains Report

- DeFi support on all blockchains

- Automatic profit-loss calculation for all futures and margin trading.

- Generate reports for income, staking, and mining.

Verdict: Coinpanda is a platform that facilitates tax reporting in a quick, easy, and accurate manner. All tax reports this platform helps you generate comply with local tax laws and authoritative bodies like the IRS, CRA, and more. Coinpanda is one of the finest crypto tax service providers in the country today.

Pros:

- Quick and Accurate Tax Reporting.

- All donations and lost coins are supported.

- Country-specific tax reporting.

- Import from over 800 exchanges and wallets.

Cons:

- Customer support needs to be more responsive.

Price:

- Forever Free Plan for 25 transactions

- Hodler: $49 for 100 transactions

- Trader: $99 for 1000 transactions

- Pro: $189 for 3000+ transactions

#8) Awaken Tax

Best for AI-driven crypto taxing.

Awaken Tax is a software that’ll help you file and process taxes related to crypto transactions. Awaken gained prominence lately because of its support of industry-leading NFTs and DeFi protocols. The platform supports over 10000 such protocols. Awaken also stands out for its support of various crypto exchanges like Coinbase, Kraken, Binance, Solana, and more.

Features:

- Automated support for exchanges

- Sort transactions by capital gains and losses

- Real-time portfolio

- Edit cost basis

- AI that supports over 10000 dapps.

Verdict: Awaken is an easy-to-use platform that automates and streamlines the tax filing process related to cryptocurrencies. You can use Awaken to track your transactions and view your filings at no cost. You only pay to download the reports. You are offered real-time updates on news related to taxes. As such, the tool does a great job of helping you comply with applicable tax regulations.

Price: Awaken Tax charges start at $35 for 300 transactions.

#9) TaxBit

Best for beginner users with its unlimited free tier.

TaxBit is a crypto tax solution, founded by CPAs and tax attorneys, for consumers who want to transform their 1099s and other data into crypto tax reports, as well as enterprises who need to issue 1099s.

TaxBit offers you automation technology that syncs your data and gives you final tax reports, while you do not need to do anything.

Features:

- Supports more than 150 exchanges and 2000+ currencies.

- Let’s you to export your transaction reports.

- A powerful dashboard that shows you your tax position, asset balances, and unrealized profits/losses.

- Tax loss harvesting and portfolio performance analysis features.

Verdict: TaxBit is reported to be an easy-to-use crypto tax tool, and its customer service is also appreciated by its users. The automation feature, which syncs your transactions from across different exchanges and gives you tax reports while you do not need to do anything, is also a plus point.

Pros:

- Customer service agents.

- Immutable audit trail. Issuance of 1099s for exchanges.

Cons:

- Manual formatting for CSV files.

- Limited auto-sync reporting.

Pricing:

- Basic: $50 per year

- Prus: $175 per year

- Pro: $500 per year

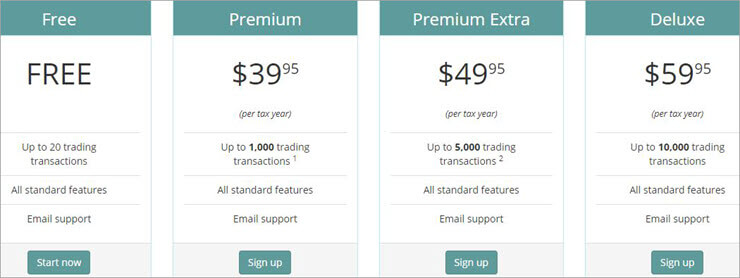

#10) BitcoinTaxes

Best for comprehensive tax reports and filing.

BitcoinTaxes lets you know about your capital gains and losses so that you can file your taxes.

It also offers you assistance through an experienced crypto tax professional who can guide you on how to enter crypto trades in Bitcoin.tax

Features:

- Calculate your capital gains and losses.

- They also offer full tax preparation services, with prices starting at $600.

- Take advice from tax professionals for tax planning.

- Tax loss harvesting.

Verdict: BitcoinTaxes is a recommendable crypto tax software, which offers a wide range of price plans so that you do not pay more for using less of it. Plus, the range of features offered is nice.

Pros:

- Import CSV files and upload transaction histories from exchanges and wallets to ease tax filing.

- Generate reports for capital gains, incomes, donations, and closing.

- Form 8949, TaxACT, and TurboTax TXF formats.

Cons:

- Limited features for non-premium accounts.

- The free version allows just 100 transactions.

Pricing:

There is a free plan and paid plans are as follows:

- Premium: $39.95 per tax year

- Premium Extra: $49.95 per tax year

- Deluxe: $59.95 per tax year

- Trader (50k): $129 per tax year

- Trader (100k): $189 per tax year

- Trader (250k): $249 per tax year

- Trader (500k): $379 per tax year

- Trader (1M): $499 per tax year

- Trader (unlimited): Contact them for pricing.

[image source]

#11) Bear.Tax

Best for beginners.

Bear.Tax is a cryptocurrency tax software that can automatically import your transactions, calculate your taxes, make tax reports, and send them to your CPA or the tax software you use.

Features:

- Allows you to import your trades from any crypto exchange you are using.

- Automation feature to process your tax documents and send them to your CPA or the tax software you use.

- Calculate your crypto gains and losses

- Gives you sales reports, audit trail reports, and much more.

Verdict: Bear.Tax is an affordable and recommended tax software. The automation features offered by this crypto tax software are appreciable.

Pros:

- Support traditional tax software.

- Get support from tax professionals

Cons:

- Support for lesser markets. About 50 exchanges.

- Not available for tax reporting in some countries.

Pricing:

- Basic: $10 per tax year

- Intermediate: $45 per tax year

- Expert: $85 per tax year

- Professional: $200 per tax year

#12) CryptoTrader.Tax

Best for tax-loss harvesting.

CryptoTrader.Tax is a popular tax software that is trusted by more than 100k customers.

It supports more than 10,000 cryptocurrencies, syncs through unlimited exchanges, gives you current profit and loss reports, and much more.

Features:

- Allows you to import your transaction data easily, from different crypto platforms.

- Let you download the completed tax forms, which can then be sent to your tax software or your CPA.

- Supports many currencies from around the world.

- Gives you resources to increase your knowledge about the crypto world.

- Complete audit support.

- Tax loss harvesting tools.

Verdict: CryptoTrader.Tax is a highly recommended crypto tax software. It offers reasonable pricing plans and a very nice range of features.

Pros:

- Tax-loss harvesting opportunities.

- TurboTax integration.

- Competitive with multiple tiers.

Cons:

- No direct filing of tax returns.

- Limited customer support for lower-priced tiers.

Pricing:

They offer a 14-day money-back guarantee. Pricing plans are as follows:

- Hobbyist: $49

- Day Trader: $99

- High Volume: $199

- Unlimited: $299

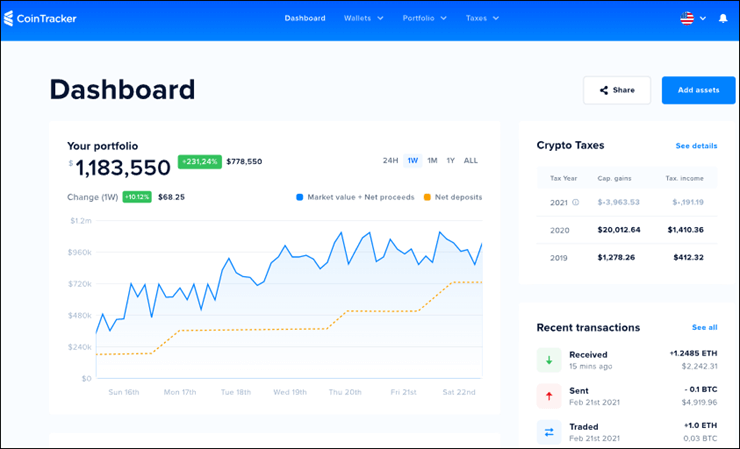

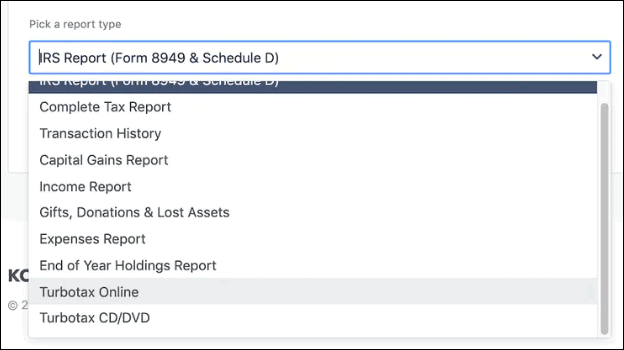

#13) CoinTracker

Best for comprehensive tax reports and mobile users.

CoinTracker is a trusted crypto tax software with more than 500,000 users. It automatically tracks your portfolio and saves your money through tax-loss harvesting tools.

Features:

- Automation features to sync your transaction data from unlimited crypto exchanges.

- Calculate capital gains.

- Allow you to export your tax reports to TurboTax or TaxAct.

- You can consult a personalized CPA with the unlimited plan.

- Supports more than 2500 cryptocurrencies.

Verdict: CoinTracker is a good crypto tax filing software. The features offered are applaudable. One main drawback is that it tracks only 2500 cryptocurrencies, which is less than many of its counterparts.

Pros:

- Android and iOS apps are available.

- 12 different methods for generating tax reports.

- Over 7,000 cryptocurrencies are supported.

Cons:

- Limited transactions (25) and no chat support for the free plan. Unlimited transactions only on the unlimited paid plan.

Price:

There is a 30-day money-back guarantee. The other pricing plans are as follows:

- Free

- Hobbyist: Starts at $59

- Premium: Starts at $199

- Unlimited: Priced individually

History of Crypto Taxes

- In the United States, crypto taxation regulation is based on a 2014 IRS ruling that crypto should be treated as stocks or bonds and not as dollars or euros.

- No taxation on crypto existed before 2014.

- Thus, like other assets, it attracts capital gain taxes and other forms of business taxes.

- In 2019, it was established that new cryptocurrencies received from airdrops and hard forks attract income tax.

- Infrastructure Bill 2022 requires crypto exchanges as brokers to submit transaction records for customers to the IRS, while persons are required to file returns on income and capital gains. Decentralized exchanges are also affected.

Businesses that receive over $10,000 in crypto should file records about the sender.

How Does Crypto Tax Software Work

Crypto tax filing software works by simplifying the process of calculating and filing crypto tax returns.

It will calculate crypto gains and losses and then either provide that information or fill up the tax documents automatically with it for purposes of filing tax returns. They reduce the labor requirements and time consumption, but also confusion in the process of filing.

- Choose your e-file software: The IRS allows you to do exactly that on the website following this official process. If you do not know how or which software, use the IRS wizard to choose one. Proceed as below when using the software.

- Connect the computer to the Internet. Sign up using the software.

Crypto tax software calculates tax:

- Most software works by letting you integrate your crypto exchanges and wallets and you can pull transaction data and history from there. It does so automatically and even fills some fields on tax documents automatically. You may need to fill in other info manually.

Integrate wallet exchanges:

- Fill in the required information on the software – names, emails, adjusted gross income for last year, and your or your dependents’ IRS electronic filing PIN (you can get one on the IRS website). It will require your social security number, W-2 forms from employers, and any 1099-INT forms showing interest paid from the past year.

- You can preview capital gains, calculate taxes automatically, and auto-generate and download tax documents.

Auto-generated tax reports:

- Some let you trade from within the app. For instance, you can integrate exchanges using the software’s API and place trades on the exchanges. These may have advanced charting for traders.

Other information includes the 1099-G forms that show refunds, credits, or offsets of state and local taxes; and receipts from your business and/or additional income documentation. It may also require filling out any unemployment compensation and Social Security benefits where they apply.

- The software may also provide access to professional tax assistance who can ask questions relating to taxation. Besides, these companies provide customer support via email, chats, phones, and other methods.

- Sign your returns electronically and get a printout. Follow the directions to submit the returns.

Features to look for in crypto accounting software:

- Should give you audit assistance. This includes help from a crypto accountant.

- Support all or as many exchanges as possible. It should automatically sync or integrate with the exchanges you use to gather your data. It should advisably use that data to calculate taxes and file your taxes automatically.

- It should calculate crypto profits and losses and help track transaction history.

- Affordable, if not free to use – Most paid ones have the best features for advanced users.

- Should advisably allow importing and exporting transaction reports.

- Has tax-loss harvesting opportunities. It will suggest tax credits and tax deductions you may qualify for. You will still need to decide which to take.

- Should advisably provide tools for studying crypto coins and trading tools like charting.

- Is easy to use.

- Should suit needs – as a trader or institutional needs.

- Helps with complete audit support.

- Long-term storage is supported by some software so you can access records for many years.

- Most software also offers the option to file state returns in addition to federal taxes.

- Most software checks the entered information and will signal you if it is incorrect.

How Cryptocurrency Is Taxed in Different Countries

#1) United States

[image source]

- Crypto income, lending, staking, mining businesses, selling, and buying crypto attract taxes. This falls into income and capital gains. Other taxes apply to crypto companies, corporates, and funds.

- Buying crypto in the US dollar does not need you to file returns. Trading does, including for Defi and NFT assets and investments. Hobbyists cannot deduct business expenses or claim deductibles. Businesses, trusts, and corporations can.

- Types of taxes include income, sales, capital gains, alternative minimum tax if income exceeds a certain exclusion amount, and additional Medicare tax for high-income earners. There also is the net investment income tax.

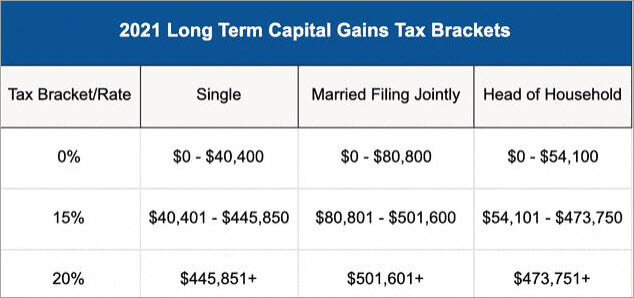

- Capital gains are 37% on short-term (held within one year) capital gains and crypto income. Between 0% to 20% tax on long-term capital gains.

- Federal and state tax returns on income are filed before April 15 of every year, by any person earning over $6,750.

Types of income include and are not limited to salaries, wages, tips, pensions, and fees generated from service provision. It includes rents received, property gains, business income, sales, interests, dividends received, and proceeds from selling crops. All that does not meet the taxable threshold is not taxed.

- Tax deductions include losses, business deductions, personal deductions, and standard deductions for certain personal expenses, e.g. marriage. Others are itemized deductions on specific items like medication, tax credits, and capital depreciation. Crypto trading losses may not be tax deductibles.

- Sales tax and business taxes are charged on purchases and corporations respectively. The percentage varies from state to state, as do the goods to be taxed or not. The corporate tax also applies to trusts and estates.

- The IRS is the taxation authority. Filing tax returns allows taxpayers to self-access their income and capital gain tax obligations. The tax law comes from different sources, including the Constitution, Internal Revenue Code, Treasury regulations, Federal court opinions, and treaties. Tax penalties apply for late or failed payments and filings.

#2) United Kingdom

[image source]

- Buying, selling, receiving crypto as payment, crypto mining and validation businesses inherited crypto, lending, and staking qualify for taxation depending on if it is income or capital gain. Other taxes may apply to crypto companies, employees, etc.

- The HM Revenue and Customs administer and collect taxes. Federal, state, and local government taxes apply. Can get tax advice from TaxAid.

- Tax returns are filed until October 30 for paper returns and January 31st for online returns. The tax year is from April 6 of the present year to April 5 of the preceding year. Returns can be online or offline via post. A unique tax reference or UTR number is required for filing for taxation.

- Penalties start at Euros 100 for up to three months of delayed filing, and a Euros 10 per day penalty may apply afterward. It may go up to 200%.

- Basic types of tax include income tax (for those earning Euros 12,570 and above), property tax, capital gains, inheritance tax, value-added tax, etc. The local government implements council tax and charges fees like street parking fees, etc.

- Tax bands include personal allowance (0%), a basic rate (20%) for people earning 12,570 to 50,270 Euros, a higher rate (40%) for those earning 50,270 to 150,000 Euros, and an additional rate (45%) for those earning above 150,000 Euros. Rates and tax bands are different in Scotland.

- Crypto capital gains tax is 10% for earnings less than Euro 50,279 and 20% on capital gains if you earn more than Euro 50,279.

- Savings interest, dividends, first Euros 1,000 property rental income, and first Euro 1,000 income from self-employment are tax-free.

- A national insurance number is needed to pay taxes. A skilled Worker visa may be needed.

- Non-residents pay only income tax. Short-term business or corporate taxes may apply. Non-domiciled residency may require tax return filing for income above Euros 2,000.

- Social Security taxes apply to both employees and employers.

- Normal corporate tax is 19%.

#3) Crypto taxation in Canada

[image source]

- The Canadian Revenue Revenue Agency or CRA is the taxation authority in the country.

- Tax returns for crypto earnings and capital gains are filed by April 30 of every year.

- Individual taxable events include paying for goods and services using crypto, selling cryptos, trading crypto on centralized and decentralized exchanges, and cashing out into fiat. Crypto gifting is also covered as a taxable event.

- Business taxable events are product and service promotions, commercial activities like selling and buying, profit-making intents, business plans, and inventory acquires. Mining, staking, getting paid in crypto, referral bonuses, and NFT sales are also applicable, but these are mainly effective in the business settings like regular trading.

- Capital gain taxes are determined by inclusion rate IR which is calculated as taxable capital gains less allowable capital losses. The current rate is 50% of your inclusion rate.

- Crypto business income is taxable, but the rate varies from one province to another (the lowest in Manitoba and Yukon with 0% on the low end to 12% on the higher side). The federal tax band determines the rate of income tax.

- Capital loss on crypto is tax-deductible up to 50%. Crypto loss is also a deductible.

Common Types of Tax Software

- Interview-based tax software: This is the most common type. It collects information in a question-and-answer format to have the necessary information filled in the relevant sections. It will provide the correct information for the places to be filled.

- Form-based tax software: Mimics tax document layout and requires a customer to fill in the correct information in the corresponding places according to your tax document.

- Electronic filing software: All these types are also called e-filing software and are most preferred by the IRS because they are more secure and reduce filing errors and time.

E-filing lets you transfer tax information from your computer to the IRS. It works instantly. If there are tax refunds, they can take up to three weeks to be deposited into your account. Ordinarily, it would take four to eight weeks.

E-filing is available from the IRS by simply filling out the required forms either online and submitting or downloading them to fill and submit them. E-filing software, however, guides you through the steps to have you fill these documents correctly. It then calculates expenses and deductions using that information.

One good thing about this software is it updates with the recent documents from the IRS. So you do not have to worry about pulling the latest documents from their database or website. You do not have to worry about uploading and downloading forms.

- Most are paid to access advanced features.

- They rarely integrate with all cryptocurrency exchanges. You might struggle to find appropriate taxation software if you use a new crypto exchange.

- Most do not incorporate additional investment opportunities like staking, mining, etc.

Detailed Comparison of the Top Crypto Tax Filing Software

| Crypto Tax Software | Trial Available | Free Version Available | Countries Supported | Exchanges Supported | Transactions | Trading Supported |

|---|---|---|---|---|---|---|

| Koinly | Yes | Yes (up to 10,000 transactions) | US, UK and other over 20 countries. | Unlimited | 10,000+ on the Trader Pro plan. | Margin trading |

| Accointing | Yes | Yes (up to 25 transactions) | US, UK, Australian, Swiss, German, and Austrian versions | 300 | Pro up to 50,000 transactions | No |

| TokenTax | No | No | All countries. | 85+ exchanges on pro plan. | VIP up to 30,000 transactions | Margin trading |

| ZenLedger | Yes | Yes (up to 25 transactions.) | All countries | 500+ | Up to unlimited for Platinum plan. | General trading. |

| TaxBit | Yes | Yes (unlimited transaction.) | US, plus other over 15 countries and similar tax regimes. | 500+ | Unlimited on Pro plan. | No |

Frequently Asked Questions

1. Is cryptocurrency a good investment?

Yes, investing in cryptocurrencies can prove to be highly profitable, if you do good market research and study the trends of the coin you are going to invest in.

Taking advice from a friend who is already trading in cryptocurrencies would also be a good idea as the crypto market is a highly volatile market, which can make you or even break you.

2. Has anyone become rich from Bitcoin?

Yes, many people have become rich from Bitcoin.

According to a website named Data Driven Investor, if you had invested merely $1,000 in 2010 in Bitcoin, you would be a millionaire by now. The value would have become more than $287 million today.

3. Should I report cryptocurrency on taxes?

Yes. Since cryptocurrency can yield income for you, it is a taxable asset.

If you trade in cryptocurrencies and do not know how to calculate crypto taxes, look for crypto tax software that can sync your transactions from across different crypto exchanges & wallets and give you a detailed profit and loss report, and ease up the tax filing process for you.

4. How do I convert Bitcoins to cash without paying taxes?

If you are a crypto investor and want to save money from taxes, you can consider the following options:

You can invest in an IRA (Individual Retirement Account)

Since tax rates on long-term gains are lower than those on short-term gains, keep your holdings for a longer period.

You can gift your assets to a friend whose income is low and non-taxable.

You can donate your capital gains to charity and get a significant deduction in your taxes.

You can move to a state that does not charge any taxes on your income.

Recommended Reading => Most Popular Bitcoin Mining Software

5. What is the best software for crypto taxes?

CoinLedger, Accointing, Koinly, TaxBit, TokenTax, ZenLedger, and Bear.Tax are some of the best software for crypto taxes. Any software that can sync your transaction data with the highest number of exchanges and can easily give you profit and loss reports & tax reports, can be termed as the best software for crypto taxes.

6. How is Crypto taxed in the US?

In the United States of America, crypto is being taxed as per the tax rate on capital gains.

There are different tax rates for short-term as well as long-term capital holdings. If you hold an asset for less than or equal to 365 days, it is termed as a short-term holding and otherwise, it is called a long-term holding.

The short-term tax rates set by the IRS for the year 2021 are as follows:

The long-term tax rates are as follows:

Conclusion

Cryptocurrencies have become very popular within a very short period. The reason for this is the high chances of getting huge profits from it. But, if you trade in cryptocurrencies, you will need to pay taxes and for that purpose, you need to accurately calculate your capital gains and losses.

Now, this is a tricky task to do. Thus, we have crypto tax software out there that makes this task extremely easy by automatically syncing with crypto exchanges and all your wallets. You can get tax reports within minutes with the help of crypto tax software.

Koinly is the best crypto tax software, which offers you some very nice automation & integration features and supports more than 300 crypto exchanges. This software even offers you portfolio analysis tools so that you can make better investments.

Further reading =>> Complete guide to Bitcoin IRA

Research Process:

- Time Taken To Research And Write This Article: 12 hours

- Total Tools Researched Online: 16

- Top Tools Shortlisted for Review: 10