Review and compare the top Payment Gateway providers and select the best payment gateway for hassle-free payments for your business:

A few questions that come to mind when we talk about payment gateways are: What is a payment gateway? How does a payment gateway work? How to build a payment gateway?

If you have bought any product through any e-commerce site, you must have paid the money online. Plus, the site must have provided you with multiple options to pay through, for example, GPay, MasterCard, etc. A payment gateway is an online payments services provider, which lets you pay or accept payments online, from global buyers or sellers, in several currencies.

Table of Contents:

Review Of Payment Gateway Providers

The one you opt for gives you access to popular payment methods that get integrated into your eCommerce site, thus giving your buyers a smooth check-out experience.

For getting a payment gateway for your online business or your retail store, you should first look around and check which service provider offers the most suitable features for you and at what prices. Then contact the one you think is suitable for you, talk about their plans, features, subscription charges, learning curve, etc.

[image source]

In this article, we will talk about the top best payment gateway providers. Go through their top features to check which one offers the features that are best suitable for your business needs.

List of Top Payment Gateways

Here is the list of popular payment gateway providers:

- Helcim

- PayPal

- Authorize.Net

- Stripe

- 2Checkout

- Adyen

- Payline

- Braintree

- WePay

- AmazonPay

- Skrill

- Fondy

- Tap2Pay

- EasyPayDirect

- Akurateco

- ECOMMPAY

- Passimpay.io

- Jotform

- Merchant One

Comparison of the Best Payment Gateway Providers

| Tool Name | Best for | Price | No of Currencies supported |

|---|---|---|---|

| Helcim | Fast and easy set-up | Pay a mark-up above the interchange rate | — |

| PayPal | A trustable and easy payment solution. | Starts at 2.7% + $0.30 per transaction | 25 |

| Authorize.Net | Protection from frauds. | Monthly Gateway: $25 Per transaction: 2.9% + 30¢ | 11 |

| Stripe | Advanced features for receiving payments. | Starts at 2.9% + 30¢ per successful card charge | 135 |

| 2Checkout | Eases up the checkout process | Starts at 3.5% + $0.35 per successful sale | 103 |

| Adyen | Helps in building customer relationships, along with accepting instant payments. | Starts at 3% (payment method fee) + $0.12 processing fee | 37 |

| Merchant One | Robust Security Features | Contact for quote | — |

Let us review the above-listed providers:

#1) Helcim

Best for Fast and easy set-up.

Helcim is a payment processing tool that allows you to customize and launch hosted payment pages. The payment functionality integrates seamlessly with any website and can help you with customer registration, invoice payments, adding QR codes, and recurring payments. The API integrates seamlessly with billing systems, shopping carts, and other compatible third-party software.

Features:

- Customizable design

- Custom data fields

- QR Code Payments

- Create Shopping Card with ‘Buy Now’ Button.

Verdict: Quick, easy to set up, customizable, and seamless integration with billing systems, shopping carts, and other applications, Helcim offers a payment gateway solution that can streamline the entire process of collecting payments online.

Price: Helcim adheres to an interchange-plus pricing structure. This means you’ll have to pay a mark-up above the interchange rate.

#2) PayPal

Best for being a trustable and easy payment solution.

PayPal is an online payment gateway provider, which offers you a feature for easily paying or receiving money in exchange for the goods or services you buy or sell.

Top Features:

- You can pay to millions of online stores.

- Pay using cryptocurrency.

- Send money to your dear ones and make it more expressive with the help of animation tools.

- Pay by scanning the QR code of the seller.

- ‘Pay in 4’ feature lets your customers buy anything they want and then pay for it later, in 4 installments.

- Beneficial for the sellers, as it eases up the selling process.

Verdict: PayPal is a popular and extremely easy-to-use payment gateway. It offers you a tool for receiving payments in hundreds of currencies. You can even have your transactions done in cryptocurrencies with PayPal.

Price: You do not have to pay any fees when paying through PayPal (if you are a buyer) unless some kind of currency conversion is involved.

Standard rates for receiving domestic transactions (when you are a merchant) are as follows:

You need to pay an additional percentage-based fee for international commercial transactions.

Website: https://www.paypal.com/us/home

#3) Authorize.Net

Best for protection from fraud.

Authorize.Net is a Visa solution that aims to simplify the payment process by allowing you to accept online payments through credit or debit cards, e-checks, and more.

Top Features:

- Accept payments online, at your retail store, or at your online store.

- Accept payments using a card reader.

- Send transaction receipts to your customers through emails.

- An Advanced Fraud Detection Suite that identifies, manages, and prevents suspicious fraudulent transactions.

- Automatically pay or accept recurring payments

Verdict: Authorize.Net is a highly recommendable online payment gateway. It offers a wide range of features. The Advanced Fraud Detection Suite is a great plus point.

Price: Prices are as follows:

- Monthly Gateway: $25

- Per transaction: 2.9% + 30¢

Website: https://www.authorize.net/

#4) Stripe

Best for advanced features for receiving payments.

Stripe is a popular and trusted payment solution. It offers you powerful APIs, 99.9% uptime, and much more, for businesses of every size.

Top Features:

- Get advanced fraud detection tools.

- Create and send invoices.

- Supports 135+ currencies and several local payment methods.

- Keeps the data secure and encrypted.

- Financial reporting tools.

- Integrates with 450+ platforms and gives you access to 24/7 customer support.

Verdict: Stripe is one of the best payment gateway providers. The features offered by Stripe help you increase your global sales by letting you accept payments in over 135 global currencies.

Price: Prices are as follows:

- Integrated: 2.9% + 30¢ per successful card charge.

- Customized: Contact the sales team directly.

Website: https://stripe.com/

#5) 2Checkout

Best for easing up the checkout process.

2Checkout is a monetization platform, founded in 2006, which serves in over 180 countries all over the world. It helps you to increase your sales by making the checkout process easy for your buyers.

Top Features:

- Make or accept global payments instantly.

- Recurring billing.

- Gives you access to 45+ payment methods.

- Global tax and regulatory compliance.

Verdict: 2Checkout allows you to accept payments for your products from more than 180 countries instantly while giving you access to 45+ payment methods. This can be a highly beneficial method of increasing your sales.

Price: Price plans are as follows:

- 2SELL: 3.5% + $0.35 per successful sale

- 2SUBSCRIBE: 4.5% + $0.45 per successful sale

- 2MONETIZE: 6.0% + $0.60 per successful sale

- Enterprise: Custom Pricing

Website: https://www.2checkout.com/

Further Reading => Most Popular Buy Now Pay Later Apps

#6) Adyen

Best for building customer relationships, along with accepting instant payments.

Adyen is a payment platform that lets you accept payments for the goods or services you sell to your global customers. Founded in 2006, this popular payment gateway has offices in 24 locations around the globe.

Top Features:

- Get any payment method added at the checkout.

- The tokenization feature lets you recognize a customer with his card number, which is saved as a token.

- Artificial Intelligence-based fraud protection tools

- You can build good relationships with your customers by giving rewards and discounts to loyal customers.

- Recurring payment solutions.

Verdict: Adyen is a recommended payment solution, which has almost all the explanations that you would look for in a payments platform. The system makes transaction processes extremely easy and thus leads to an increase in sales.

Price:

*Visit the website for transaction fees of other payment methods.

Website: https://www.adyen.com/

#7) Payline

Best for affordable pricing.

Payline provides you with payment processing solutions based on your individual needs. They offer you a feature for easing up the checkout process.

Top Features:

- Tools for easy checkout, refunds, sending transaction receipts, and more.

- Send invoices.

- Easy integration with online payment tools.

- A mobile credit card reader for Android and iOS phones.

- Mobile application for taking payments, instantly calculating taxes, and more.

Verdict: Payline aims to provide an online payment gateway at a low price. The features offered are nice. The platform is recommendable.

Price: There is a free trial for one month. Price plans are as follows:

Website: https://paylinedata.com/

#8) Braintree

Best for giving access to plenty of popular payment methods.

Braintree is a company of PayPal, which lets you accept global payments instantly, through various popular payment methods. This 20+ years old company aims to increase your sales by delivering modernized payment experiences to your customers.

Top Features:

- Gives you access to popular payment methods.

- Makes the checkout process easy and quick, involving fewer clicks.

- Protection against fraudulent transactions.

- Get your data encrypted via Braintree Vault.

Verdict: Braintree offers you to get payments through popular methods like PayPal, GPay, etc. They also offer advanced fraud protection tools. The customer care services, though, are reported to be not up to the mark.

Price:

- Cards and digital wallets: $2.59% + $0.49 per transaction

- Venmo: 3.50% + $0.49 per transaction

- ACH Direct Debit: 0.75% per transaction

Website: https://www.braintreepayments.com/

#9) WePay

Best for powerful APIs.

WePay is a company of Chase Bank. It offers one platform that is capable of payment processing, payouts, and cash management, all in a single place.

Top Features:

- If you have an account with Chase Bank, you can receive same-day deposits at no additional cost.

- Offers multiple methods of receiving payments.

- Card Tokenization feature lets you save the sensitive data of card numbers as tokens.

- Earnings & performance reporting features.

Verdict: The main plus point of WePay is that it is an all-in-platform. It is easy to use and offers easy integration with other platforms. The customer service is reported to be not good.

Price: Contact directly for pricing.

Website: https://go.wepay.com/

#10) AmazonPay

Best for easy checkout.

With AmazonPay, you open the doors for hundreds of millions of Amazon customers to shop with you. The smooth shopping experience rendered by AmazonPay will surely be beneficial in increasing your sales.

Top Features:

- Your customers can pay without having to create a new account or without giving their card details.

- Faster checkout process.

- Check out with Alexa.

- Easy integration with many e-commerce platforms.

Verdict: AmazonPay can be a good option for sellers, because the large number of users of Amazon, who already use AmazonPay, will be able to easily shop with you.

Price: 2.9% + $0.30 (For domestic U.S. transactions.)

Website: https://pay.amazon.com/

#11) Skrill

Best for free global money transfer.

Skrill is one of the best payment gateway providers, which is available for free. It lets you transfer money to your friends, see currency conversion rates, trade in cryptocurrencies, and earn by referring a friend to Skrill.

Top Features:

- Transfer money to a bank account, with no fees.

- Refer a friend to Skrill and both of you will get $10 off on your next payment.

- Monitor the exchange rate so that you can transfer money abroad when the exchange rate is profitable.

- Buy and sell cryptocurrencies.

- Get live updates on the prices of Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

Verdict: Skrill offers you a free global payment transfer method. You can even trade in cryptocurrencies for free and observe the live prices of your favorite cryptocurrencies.

Price: Free

Website: https://www.skrill.com/en-us/

#12) Fondy

Best for UK & EU-based businesses.

Fondy is a one-stop payment solution for businesses of all sizes. Choose from flexible payment options, including payouts, splits, and subscription payments. Benefit from a multi-currency IBAN account to store and move funds from one place.

Features:

- Supports over 300 payment methods inc. local payment schemes

- Reach of 200 countries and territories

- Processes payments in 150 currencies

- One-click payment methods

- Enables crypto payments

Verdict: Every business owner needs Fondy on their toolbelt. Their global reach and flexibility with currencies and payment methods make Fondy a must for businesses large and small.

Price: Simply pay a low set fee for each transaction. Even better, the more you process, the lower the cost.

#13) Tap2Pay

Best for Easy Integration.

With Tap2Pay, you get a payment gateway that easily integrates with websites, social networks, and messenger apps so you can start selling subscriptions and products without any code. Payments through Tap2Pay can be activated using selling links, express checkout widget, and plugins.

Plus, you also get a live chat feature with the help of which you can directly respond to your customers from the app itself.

Features:

- Digital Wallet

- Customer Management

- Recurring Payments

- One-click shipping notification alert

Verdict: Tap2Pay allows you to sell subscriptions and products without using any code on platforms like Facebook, Telegram, Viber, WhatsApp, etc. It accepts payments on almost all digital channels, and as such, earns a place on this list.

Price: There’s the pay-as-you-go model wherein you are charged 2% per transaction. Alternatively, you can go with the premium plan that will cost you $49/month.

#14) EasyPayDirect

Best for Safe and Fast Payment Gateway.

EasyPayDirect allows you to process payments, electronic checks, credit cards, and ACH transactions without a hassle. It also lets you leverage online payment forms, email invoicing, recurring billing, and batch uploading to easily collect payments. It also integrates seamlessly with tons of other applications like Bigcommerce, PrestaShop, Shopify, etc.

Features:

- Seamless Integrations

- Chargeback Management

- High-Risk Merchant Accounts

- Integrated Payments API

Verdict: EasyPayDirect essentially optimizes the way one collects payments. It can integrate seamlessly with more than 250 shopping carts and benefits from an intuitive interface. It is one of the finest payment gateway solutions you can check out today.

Price: One-time set-up fee is $99. Swiped Card Rate will have a transaction fee of 1.59% and Online Card Rate will have a transaction fee of 2.44%

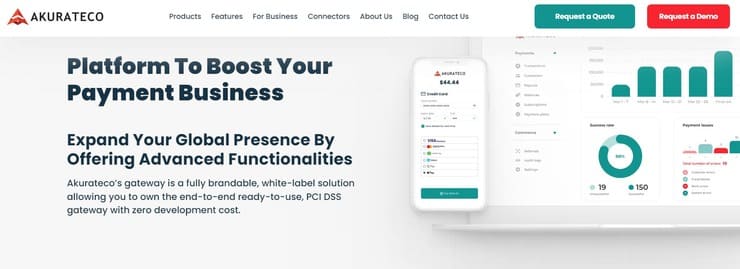

#15) Akurateco

Best for White Label Payment Gateway Solution.

With Akurateco, you get a fully brandable white label payment gateway solution. The payment solution comes fully optimized. As such, you’ll be able to manage multi-channel transactional flow, improve your transaction approval rate, and make decisions driven by data… all from a single platform.

Features:

- Back Office Admin Panel

- Smart Invoicing

- Risk Management

- Smart Routing and Cascading

- Payment Calendar

Verdict: Akurateco is one of those rare vendors that offer you a robust white-label payment gateway solution. This means you can set up a payment gateway in accordance with your brand guidelines at zero development cost. Add to that, you get a fully customizable payment page.

Price: Contact for a quote

#16) ECOMMPAY

Best for global and local online businesses wishing to cover all of their payment needs via a single platform.

ECOMMPAY is an entire fintech ecosystem allowing you to make online payments and payouts globally. The platform includes access to direct acquiring, top local payment methods and currencies, a B2B bank, and much more, plus consulting services for businesses entering new markets. Enjoy all the benefits of an in-house, bespoke payment infrastructure tailored to your specific needs.

Top Features:

- Conversion growth strategies, based on historical and real-time data, accompanied by research on end-consumer payment behavior.

- Built-in risk control system. One of the unique aspects of ECOMMPAY is that it has a bespoke risk control management system with a 97% fraud detection and prevention rate.

- Let your business work without interruptions – ECOMMPAY’s payment infrastructure uptime is 99.99%.

- Intelligent payment routing and cascading for higher acceptance rates and lower fees.

- Business intelligence solutions. The platform offers analytics and reporting features to help merchants learn more about their business operations, customer payments, and cash flow.

- All-in-one payment solutions are tailored to exact business verticals, including, but not limited to eCommerce, travel and hospitality, e-learning, transportation & mobility.

- Payment and expansion consultations to support your business growth.

Verdict: ECOMMPAY is one of the leading payment providers, with an in-house infrastructure that allows their service to be easily tailored to a client’s needs while offering exceptional expert and technical support. The company constantly develops new products and payment solutions, helping businesses keep up with end-consumer expectations and needs.

Price: Free Version available

#17) Passimpay.io

Best for providing payment alternatives for ALL types of online businesses.

PassimPay is a versatile crypto payment platform specializing in processing payments for a wide range of online businesses. What sets PassimPay apart is its seamless integration with various e-commerce platforms and payment processors, ensuring a flexible and convenient solution for businesses of all sizes.

Top features:

- Static payment addresses

- Customizable fees from 0.5%

- Instant payment processing

- Advanced payment analytics

- Easy API integration

- Flexible personalized settings and features

- Robust Security Features

- Possibility of registration without documents

Price: Contact for quote. PassimPay offers a flexible personalized system of rates and fees depending on the volume of payments, personal wishes, flexible settings and features provided at the request of clients.

Verdict: PassimPay is a comprehensive crypto payment gateway that is well-suited for both businesses and individual users.

#18) Jotform

Best for: Integration with multiple payment gateways

Jotform allows you to gather credit and debit card payments, and make ACH and e-check payments with seamless payment processor integrations. You first choose the payment gateway of your preference, add it to the form of your choosing, and embed that form in your website. Plus, you aren’t charged additional transaction fees from the platform.

Features:

- Accept Donations via Stripe

- Collect electronic payments online

- Accept global payments

- Collect payments through online forms

Verdict: With Jotform, you get software that facilitates numerous payment process integrations. With the help of these integrations, you’ll be able to collect payments both locally and globally without a hassle via the forms on your website.

Price:

- Forever Free Plan available

- Bronze: $39/month

- Silver: $49/month

- Gold: $129/month

#19) Merchant One

Best for Robust Security Features

Merchant One offers a payment gateway service that was tailor-made to make the lives of eCommerce entrepreneurs simple. It is easy to set up and use. Plus, it features some of the most robust security features we’ve ever witnessed in order to prevent fraud and protect data. The service also gives merchants access to more than 15 shopping cart integrations.

Features:

- Virtual Terminal

- Comprehensive Reporting features

- Invoice Generator

- Advanced Fraud Detection

- Payer Authentication

- Recurring Payments

Verdict: Easy to use, brimming with advanced security features, and offering over 175 shopping cart integrations, Merchant One is hands-down one of the best payment gateway services available for merchants.

Price: Contact for quote

Website: https://www.merchantone.com/

Frequently Asked Questions

1. What is a payment gateway? Explain with example.

It is an online service that allows you to accept payments from all over the world.

For example, if you book a hotel online, through a website named, say, XYZ, then the XYZ website will give you some options to pay for the booking. The website XYZ has bought a payment gateway service that allows you to pay through the options offered to you.

2. How does payment gateway work technically?

It acts as a ‘Cashier’ and collects money from your customers on your behalf and then deposits it directly to your bank account. Your eCommerce site has to be integrated with a payment gateway system through APIs so that you can start getting your payments online.

3. How do I choose a payment gateway?

Keep the following points in your mind:

– It should offer multiple payment methods.

– The checkout process should not be too long.

– Fraud detection tools should be provided.

– Accepts payments in multiple currencies.

– Understand per transaction charges.

4. How do I secure my payment gateway?

Many payment gateway providers offer features for the security of the sensitive information collected about the card details of your customers. This information is saved as codes and is usually encrypted and can not be accessed by any third party.

You should always look for a payment gateway that provides the best features in data security.

5. What is a stripe payment gateway?

Stripe is a popular payment gateway provider, which was founded in 2011. Stripe offers you integration with over 450 platforms, lets you accept payments in 135 currencies, and guarantees you 99.9% uptime.

6. Which is the best online payment gateway?

Fondy, PayPal, Authorize.Net, Stripe, 2Checkout, and Adyen are the top 5 best online payment gateway providers.

They offer numerous beneficial features that can help in increasing sales by easing up the checkout process and offering your customers several payment options, in various currencies.

Conclusion

If you have an online store, or if you take payments digitally at your physical store, you must give your customers multiple options to pay through. This way, you can minimize the chances of cart abandonment and maximize sales.

There are several online payment gateway providers out there, which offer you features for accepting global payments while supporting several currencies from all over the world.

If you want a payment gateway for your receiving online payments, then Fondy, PayPal, Authorize.Net, Stripe, 2Checkout, and Adyen are the best options, go through their features and prices to choose the best one for your business.

Apart from these, Braintree, WePay, Skrill, AmazonPay, and Payline are also highly recommended payment gateway providers.

Skrill is available for free. We can use it for transferring money globally and trading in cryptocurrencies.

Research Process:

- Time taken to research this article: We spent 07 hours researching and writing this article so you can get a useful summarized list of tools with a comparison of each for your quick review.

- Total tools researched online: 15

- Top tools shortlisted for review: 10