Switch over to automated, optimized, and standardized account reconciliations to save your valuable time. Pick the best Account Reconciliation Software for perfect balance sheet reconciliations at a rapid speed:

This digital age has made many complex tasks easy. In addition, AI-based software enables organizations to get quick, accurate, and more efficient results at lower costs.

Account Reconciliation software is one of the best examples of modern-day applications that benefit organizations in many ways.

Table of Contents:

Bank Account Reconciliation Software: Top Automated Tools

What is Account Reconciliation

Account Reconciliation refers to the process of matching internal accounts with the external financial records of an organization. This process is done to make sure that there is a balance in the company’s accounts and to keep an accurate record of each transaction.

Watch this YouTube video to learn more about account reconciliation and why it is important.

Benefits of Account Reconciliation

There are several benefits of account reconciliation software. For example,

- It helps in detecting errors and anomalies in the company’s financial records.

- It helps in detecting fraud.

- It is done to ensure accuracy in the company’s accounting records.

- It helps in the auditing process.

- It helps in maintaining compliance with regulations.

Suggested Read => BEST Financial Consolidation Software

The whole process of account reconciliation can be tiresome if done manually. But if you use software for reconciliation, you will get the following benefits:

- The process can be done a lot more quickly, as compared to doing it manually, and at a lower cost.

- There are fewer chances of errors.

- There will be more transparency in the financial records.

- You can access the records anytime, from anywhere.

Account Reconciliation can be done for different types of accounts, for example,

- Bank account reconciliation

- Accounts receivable reconciliation

- Accounts payable reconciliation

- Inventory reconciliation

- Payroll reconciliation

- Credit card reconciliation

- Fixed asset reconciliation

- Expense reconciliation

Via Collidu

What is Account Reconciliation Software?

Account reconciliation software simply refers to an application used to automate the account reconciliation process. Account reconciliation software offers tools for

- Automated reconciliations

- Journal entry

- Compliance management

- Keeping records of the reconciliations

- Workflow management

In this article, we have collated a well-researched list of the top 10 account reconciliation software available today. You will find detailed reviews about each one of the software programs on our list. So, read the article to pick a suitable software for your organisation.

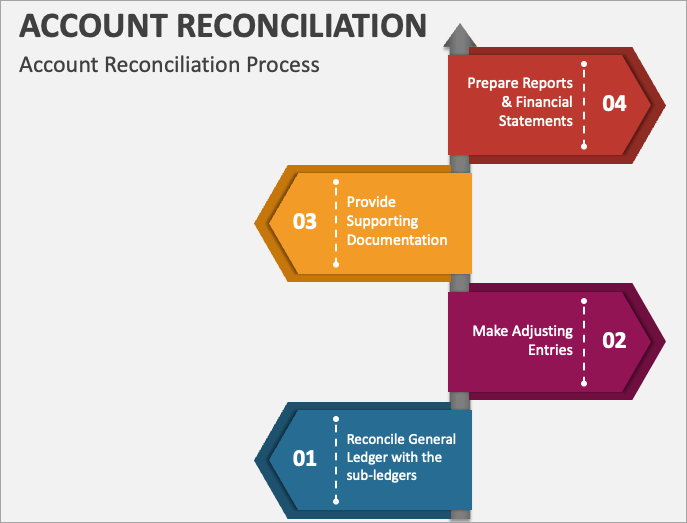

Account Reconciliation Best Practices

These are the best steps to be taken when deploying for account reconciliation:

- First of all, identify the accounts that need to be reconciled.

- All information regarding the account data should be gathered.

- Now, the internal financial accounts will be balanced with the external statements.

- Find and correct errors, for example, some discrepancies can occur due to delayed payments or bounced checks, etc.

- There should be a record of the whole reconciliation process, which will then help in the audits.

- The relevant stakeholders should approve the account reconciliation data.

- The account reconciliation process should be performed regularly, at least once every month.

How to choose the right Account Reconciliation Platform

When you select an account reconciliation software for your organisation, you should consider these steps:

- Firstly, note down all the inefficiencies and bottlenecks your organisation currently faces.

- Your business operations must be digital. For example, the invoices, accounting, and other data should be electronic, to be able to use an account reconciliation software.

- Note down the goals you want to achieve. For example, how much time do you want to save? What error rates do you want to reduce? etc.

- Now, investigate all the capabilities offered by trusted account reconciliation software solutions in the industry, talk to their team regarding your goals and the expected returns and benefits, look for the security features they are offering, and ask for a personalized demo if possible.

- After going through all the steps, choose the platform most suitable for your organisation.

List of the Best Account Reconciliation Software

Here is the popular list:

- Record to Report Automation by Redwood

- Trintech

- FloQast

- Blackline

- Oracle Cloud EPM

- Oracle NetSuite

- Onestream

- High Radius

- Cadency

- Numeric

Comparing the Top Account Reconciliation Tools

| Platform | Best for | Top benefits | Clients |

|---|---|---|---|

| Record to Report Automation by Redwood | Large sized businesses | • Flexible deployment options • Offers a wide range of features • Seamless ERP integration • Visibility tools | Exxonmobil, ArcelorMittal, Siemens, Energy Transfer, Forvia, Jumbo, Arla and more |

| Trintech | Mid to large sized businesses. | • Exceptional customer service • Visibility tools • Delivers significant ROI | Ralph Lauren, Kroger, Albertsons, HP, Kellogg's and many more. |

| FloQast | Businesses of all sizes | • Security features • A good range of workflow automation tools • Looks after and gives visibility into the end-to-end of the reconciliation process | Fanatics, Toll Brothers, SoFi, Twilio, and more. |

| Blackline | Mid to large sized businesses. | • Scalability • Data security features • Delivers immediate ROI | eBay, Philips, Hershey, GoodRx and many more |

| Oracle Cloud EPM | Large businesses | • Automated intercompany reconciliations • Security features • An integrated, complete platform for all EPM processes. | American Airlines, FedEx, Vodafone, Marriott International and many more |

Detailed reviews:

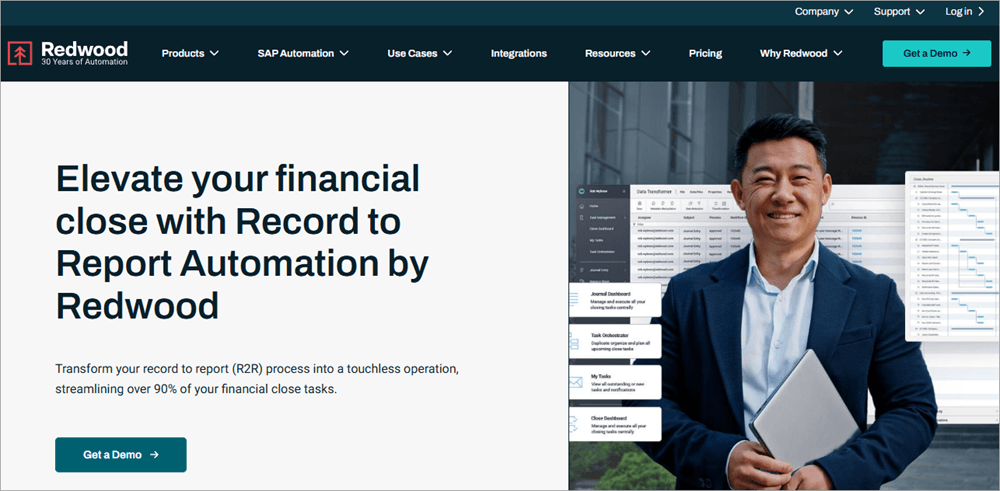

#1) Record to Report Automation by Redwood

Best for large-sized businesses that want to simplify their complex R2R process.

Record to Report Automation by Redwood is a highly recommended platform for account reconciliation. It is trusted by some of the most renowned global companies, including ArcelorMittal, Siemens, and more. Most of their clients have given awesome reviews about the platform.

Redwood’s Record to Report Automation platform offers touchless close with up to 90% automation levels, deep SAP integration, flexible deployment options, and comprehensive coverage across all areas of Record to Report, which all together transform the financial close process and make the platform the best choice for global businesses.

Watch this YouTube webinar to learn how Redwood streamlines your R2R process with a touchless close.

Also Read => Review of Record to Report by Redwood

Features offered:

- Close management: The platform lets you create, automate, and orchestrate month-end close tasks like reconciliations, accruals, provisions and reclassifications, journals, intercompany, and more.

- Reconciliation and compliance: The platform offers tools for automating about 90% of the reconciliations and eliminates the risk of errors, and is seamlessly integrated within SAP.

- Journal entry: Redwood’s journal entry automation tools, including approvals management, validations, and more, are praiseworthy.

- Intercompany transactions: Their intercompany automations help in simplifying complexities. Features include automated intercompany reconciliations, invoice matching, and more. You can request a demo from them.

- Accruals, provisions, and reclassifications: Redwood offers tools for transforming the traditional manual processes, including accrual calculations, journal entries, provisions management, and more.

Pros:

- Can be deployed on the cloud and on-premises

- Covers a good range of financial tasks, including accruals and intercompany reconciliations

- Gives real-time visibility into the financial activities

- Helps teams in maintaining compliance

- Seamless ERP integration

Why we like Record to Report Automation by Redwood: Redwood’s Record to Report Automation claims to streamline over 90% of the financial close tasks. The platform offers an incredible range of automations for even the traditionally overlooked areas of the financial close.

With Record to Report Automation by Redwood, you can accelerate the close process, simplify complexities, manage compliance, and much more.

Price: Contact them for pricing and other information.

#2) Trintech

Best for mid to large-sized businesses that want to reduce the time spent on the close process.

Trintech is an AI-based Financial Close and Account Reconciliation Software, which is trusted by global companies like Ralph Lauren, Kroger, Albertsons, HP, Kellogg’s, and many more. The platform is a partner with Workday, Planful, PWC, KPMG, SAP, Oracle, Microsoft, Servicenow, Accenture, and Capgemini, which makes it possible for Trintech to provide its customers with a smooth, simplified R2R process.

Further Reading => Best Balance Sheet Software to Look For

The company claims that it helped the mid-sized organizations in reducing the time to perform balance sheet reconciliation by 99%, to match transactions by 70%, and to close the books by 6.

And for the large enterprises, Trintech has reduced their number of accounts to be reconciled by 90%, time spent to match transactions by 80%, and time spent to prepare and review journal entries by 75%. You can book a personalized demo of Trintech from them.

Features offered:

- Financial close management: Trintech provides a centralized place for managing the entire financial close cycle at one place. The platform helps its customers in attaining operational efficiencies, gaining visibility into close tasks, and much more.

- Automated reconciliations: Trintech’s automated balance sheet account reconciliation tools deliver efficiency and effectiveness and help businesses ensure compliance.

- Transaction matching: Trintech automates the transaction reconciliation process, thus saving a lot of time. It improves data quality and enhances visibility into cash.

- Journal entry: The platform automates the journal entry process and reduces the chances of mistakes of omission and duplication in account coding. It also increases transparency in the process, thus reducing the risks of fraud.

- Intercompany accounting: Trintech deploys preventative & detective controls along with automation, for simplifying processes like mismatched identification and elimination, transactions posting, and more; thus transforming the intercompany accounting process.

- Reporting and analytics: The platform offers meaningful insights and visibility into the financial close process, thus helping to identify bottlenecks and increasing productivity.

Pros:

- Exceptional customer service

- Simplifies reconciliation and closing processes

- Gives visibility into closed tasks

- Helps in maintaining compliance

Why we like Trintech: Trintech is an award-winning automated reconciliation software and has a good history in serving businesses from industries like Retail, Banking & Financial services, Healthcare and Human services, Power and Utilities, Industrial Manufacturing, and Insurance.

They claim to render their clients with increased operational efficiencies and risk mitigation, thus delivering significant returns on investment. You can even get an estimate of your returns on investment with Trintech.

Price: Contact them for pricing and other information.

Website: https://www.trintech.com/

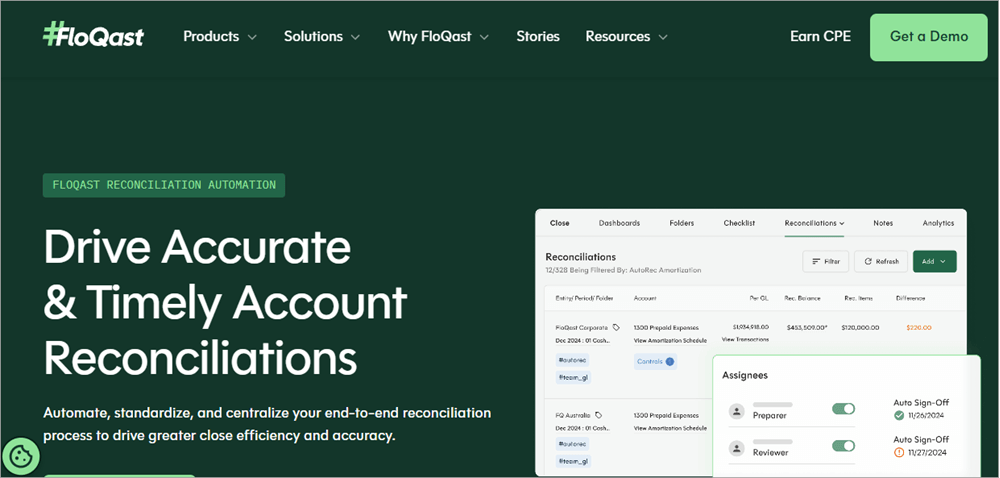

#3) FloQast

Best for businesses of all sizes who want to centralise the whole reconciliation process.

FloQast is an AI-powered accounting transformation platform built by accountants themselves. It is trusted by more than 3,000 organizations, including Fanatics, Toll Brothers, SoFi, Twilio, The Humane Society of the United States, Shopify, and many more.

FloQast helps businesses achieve accurate and timely account reconciliations. It offers tools for automating, standardizing, and centralizing the end-to-end reconciliation process. You can request a demo from them.

Features offered:

- Account Reconciliation: FloQast’s account reconciliation tool automates manual reconciliations and centralizes documentation, thus enhancing data integrity.

- Visibility: The software gives visibility into the reconciliation process and addresses issues proactively, thus enabling accounting agility.

- Workflow optimization: FloQast helps in standardizing the workflows by assigning the right people for tasks, ensuring proper execution, and an auditable process.

- Integrations: The software integrates with Box, Dropbox, Google Drive, SharePoint, Slack, Microsoft Teams, and more platforms to streamline automations.

Pros:

- Highly useful integrations

- Offers a good range of tools for automating accounting workflows

- The platform guarantees the confidentiality of your data

Why we like Floqast: FloQast is an ISO 27001, ISO 27701, ISO 42001, and AICPA SOC 2 Type II certified platform, known for delivering material impact. The platform claims to reduce the reconciliation time by 38%, time for the audit process by 23%, time to close the books monthly by 20%, and discrepancies found by auditors by 20%.

FloQast helped PageGroup achieve faster and easier account reconciliations, and Rehmann could optimise their month-end close for 1,000+ CAS Clients with FloQast. You can read more of their astonishing customer success stories from their site.

Price: Contact them to request a quote.

Website: https://www.floqast.com/automate-the-close/products/automated-reconciliations

Also Read => Top FloQast Alternatives in the market

#4) Blackline

Best for mid to large-sized businesses that want immediate returns on investment.

Blackline is an award-winning platform. For 5 years in a row, it has been named on G2’s Top 50 list of the ‘Best Products for Accounting and Finance’. Blackline has over 4,400 customers coming from 130+ countries. Their clients include eBay, Philips, Hershey, GoodRx, and many more.

Blackline ensures its customers deliver a more accurate and less stressful account reconciliation process. You can request a demo from them.

Features offered:

- Streamlines your reconciliation processes: Blackline automates the account reconciliation process. Plus, it offers tools for resource optimization, internal control, and audit requirements.

- Improves reporting and accounting integrity: The software helps organizations in increasing data accuracy, ensuring compliance, and reducing risk. Based on some pre-defined criteria, it certifies the low-risk account reconciliations, generates audit trails, and gives you visibility into the whole reconciliation process.

- Increases visibility and agility: You can get a record of all the reconciliation activities and check the real-time status of activities across departments.

Pros:

- Provides dedicated support

- Seamless integration with most of the ERP systems

- Helps in achieving immediate returns on investment

- Scalable platform

- Ensures the security of data

Why we like Blackline: Blackline claims to automate 98% of the reconciliations, save reconciliations time by 50%, and deliver a 70% faster close. Their visibility tools help businesses in removing bottlenecks and making better, data-driven decisions.

68% of the Fortune 50 companies are their customers. Understand how Blackline is helping Domino’s, Zurich, and other organisations with their account reconciliation tools from their site.

Price: Contact them for pricing information.

Website: https://www.blackline.com/products/financial-close/account-reconciliations/

#5) Oracle Cloud EPM

Best for large businesses that want to automate the complex reconciliation process while getting full control and visibility over the process.

Oracle Cloud EPM is a frequent winner of many prestigious awards. It automates complex, high-volume account reconciliations while giving you full control and visibility over the process. The pre-built reconciliation formats they offer are their most liked feature.

The platform claims that their customers have been able to automate 90% of their account reconciliations, and one of their customers has saved about 40,000 hours of manual efforts in a year.

62% of their customers have stated that they realized efficiency in transaction matching, and 39% of them stated that they saved time and attained agility on the close with the help of the pre-built functionality of the software.

Features offered:

- Transaction matching: Oracle Cloud EPM offers automations for high-volume transactional automations. It can match millions of transactions in just minutes. It allows you to choose to confirm or discard the matches suggested by the software.

- Journal entries: The journal entry automation feature creates journal entries to resolve variances found in the matching process.

- Provides flexible reconciliation formats: Based on your company goals, you can choose from their pre-built reconciliation formats, which are created while considering the best practices. You can even choose to build your own custom format.

- Visibility: You can view the status of all reconciliations and control the whole process.

- Reconciliation compliance: The software keeps a record of all reconciliations that help in audits and maintaining compliance.

Pros:

- Automated intercompany reconciliations

- Security features

- Integrates all EPM processes into one unified platform.

Why we like Oracle Cloud EPM: Trusted by many of the leading companies worldwide, including American Airlines, FedEx, Vodafone, Marriott International, and many more, Oracle Cloud EPM is one of the most recommended account reconciliation software.

The software helps businesses automate complex reconciliations, close faster, increase accuracy, meet compliance requirements, and more.

Price: Contact their sales team for pricing information.

Website: https://www.oracle.com/performance-management/account-reconciliation/

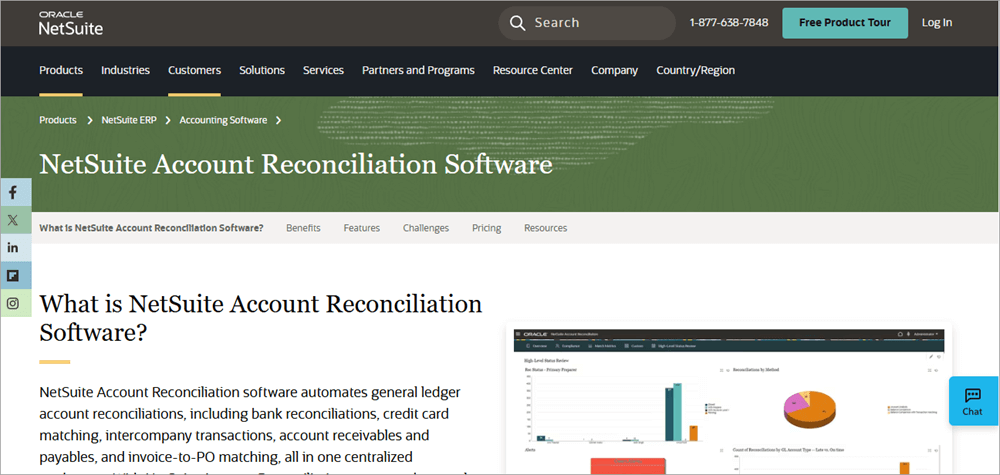

#6) Oracle NetSuite

Best for their pre-built formats and templates for account reconciliation. The platform is suitable for startups and businesses of all sizes.

Oracle NetSuite is trusted by businesses of all sizes and pre-revenue startups. It helps businesses solve account reconciliation challenges, such as manual processes, matching large numbers of transactions, a lack of control and compliance, and poor visibility.

Watch this YouTube video for an overview of Oracle NetSuite account reconciliation:

Features offered:

- Automate reconciliations: With Oracle NetSuite, you can automate reconciliations for bank accounts, credit card transactions, intercompany transactions, and more.

- Transaction matching: Their automations can match millions of transactions in minutes. The software auto-suggests matches; you can accept them or decline.

- Task management: You can assign tasks, monitor the status of each task, and choose the pre-built customizable workflows for automating tasks like data validation, approval routing, and more.

- Visibility: Oracle NetSuite gives you complete visibility into the process. You can see all reconciliations in one place.

Pros:

- Pre-built formats and templates for account reconciliation

- Audit support and compliance

Why we like Oracle NetSuite: Oracle NetSuite is a highly recommended platform with over 41K global customers. It helps businesses close faster, speed transaction matching, strengthen internal controls, maintain compliance, reduce the risks of financial errors, and gives complete visibility into the account reconciliation process.

Read how Rayburn Electric Cooperative is benefiting from Oracle NetSuite account reconciliation software from their site.

Price: Contact them for a price quote.

Website: https://www.netsuite.com/portal/products/erp/financial-management/finance-accounting/account-reconciliation-software.shtml

#7) Onestream

Best for mid to large-sized businesses that want a unified CPM software.

Onestream is a unified CPM software platform that offers tools for account reconciliation as well as financial reporting. It claims to reduce risks involved with the financial statements, improve internal controls by giving you full visibility into the audit trail of all reconciliations, and accelerate the financial close process.

Features offered:

- Automated reconciliations: Onestream automates the reconciliations, sends alerts immediately after the reconciliation status checks.

- Risk-based reporting: The software provides its users with a complete statistical picture of the financial reports.

- Internal controls: The software allows you to assign tasks and keeps all records that show when each reconciliation was completed and by whom

Pros:

- Ensures accuracy and completeness of financial statements.

- Eliminates the risks of financial restatements and reduces external audit costs.

Why we like Onestream: Onestream currently delivers its services to customers from many industries, ranging from Agriculture, Construction to Hospitality, and Manufacturing.

The platform has a 100% customer success rate. Nasdaq, Toyota, and UPS are some of the renowned companies that are their clients.

Price: Contact them for pricing information.

Website: https://www.onestream.com/solutions/account-reconciliations/

#8) High Radius

Best for mid to large-sized businesses that want advanced fraud detection tools and real-time insights into the reconciliation process.

High Radius is an award-winning, automated account reconciliation software that delivers several benefits to its customers, including increased efficiency, reduced errors and improved accuracy, scalability, real-time insights, cost savings, and enhanced fraud detection.

The platform integrates seamlessly with several ERP systems, including SAP, Oracle, NetSuite, Dynamics 365, QuickBooks, and more. You can schedule a demo of High Radius from their site.

Features offered:

- Automated reconciliations: High Radius reduces manual efforts and enhances accuracy in account reconciliations by automating the reconciliation process

- Transaction matching: The software offers AI-powered transaction matching tools

- Journal entries: It also provides automation for preparing journal entries with the help of customizable templates

- Audit and compliance: The software automates the workflows and monitors them, thus simplifying the audit process and ensuring compliance.

Pros:

- Ensures compliance and transparency in workflows

- Provides real-time visibility into the reconciliation process through its intuitive dashboard

- Pre-built reports give you an insight into the reconciliation process

Why we like High Radius: Over 1,000 global businesses, including P&G and Staples, trust High Radius to ease their month-end close process. The platform claims to cut the month-end close time by 30%. Read some of their customer success stories on their site. I would highly recommend High Radius to medium to large-sized businesses.

Price: Contact them for pricing and other information.

Website: https://www.highradius.com/product/account-reconciliation-software/

#9) Cadency

Best for large enterprises that want to increase visibility, ensure policy adherence, and manage risks.

Cadency offers tools for increasing visibility and ensuring policy adherence while managing risks. It enables a transformation of the accounting operations and eliminates risks involved with change management.

Cadency by Trintech is an innovative financial close platform that is known for delivering significant ROI. You can even use their ROI calculator to discover the ROI of financial transformation.

Features offered:

- Balance sheet reconciliations: Cadency simplifies the complex reconciliation process and notifies the accountants about items that have some risk factors and need their attention.

- Transaction matching: Automated transaction matching saves a lot of time.

- Journal entry: The software offers tools for automated data entry from bank feeds and import functions into one place, thus increasing visibility and strengthening governance, and easing the audit process.

- Intercompany accounting: Cadency offers tools for intercompany accounting, meeting regulatory requirements with centralized data and reporting.

Pros:

- Several useful integrations

- Good customer service

Why we like Cadency: Trusted by thousands of large enterprises from all over the world for transforming their R2R process, Cadency has been quite beneficial for its customers.

With Cadency, Serco completed 5K balance sheet reconciliations per month, achieved higher compliance while reducing costs, and improved reporting accuracy while reducing risks.

The platform claims to reduce the number of accounts to be reconciled by 90%, time spent on transaction matching by 30%, and time spent on preparing and reviewing journal entries by 75%.

Price: Contact them for a price quote.

Website: https://www.trintech.com/cadency/

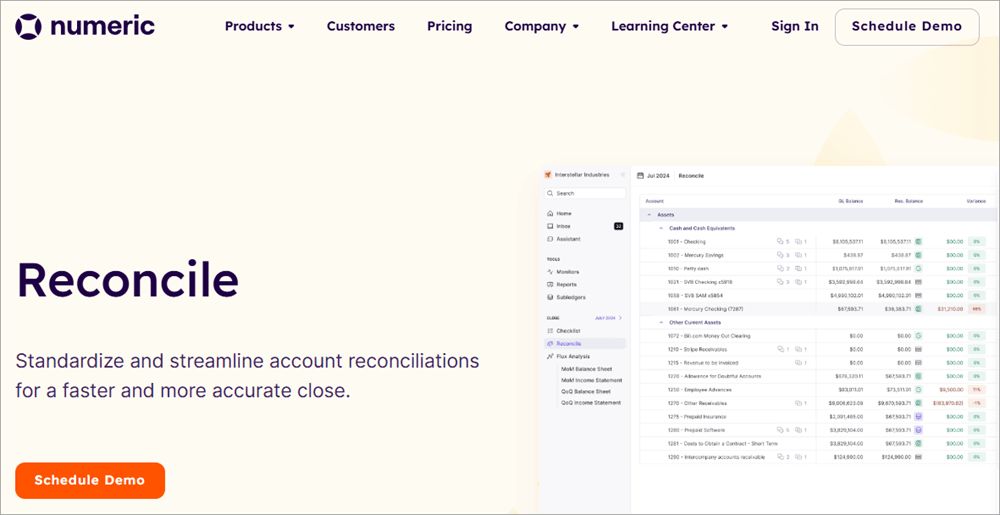

#10) Numeric

Best for businesses of all sizes that want templates for starting the reconciliation process.

Numeric is an AI-assisted, award-winning platform that is AICPA SOC certified and loaded with features for streamlining account reconciliations, accelerating the close process, audit trails, and much more.

Numeric is known for quick, efficient, and audit-ready account reconciliations. You can schedule a personalised demo of Numeric from their site.

Features offered:

- Account Reconciliation: The software offers tools for managing and tracking dependencies, looks after the account reconciliations, and lets you track their progress

- Alerts and triggers: Sends automated alerts when an unexpected change occurs in the reconciliations.

- Internal controls: Provides a complete audit trail of each task performed, lets you build standard processes for reconciliations

- Analytics: The software has integrated analytics that ensure data integrity. It also provides beneficial insights into the financials.

Pros:

- Real-time team collaboration

- Offers templates for kick-starting the process

- Offers end-to-end encryption of data

- Offers a free plan.

Why we like Numeric: Numeric has Airbyte, Medley, Metropolis, and many more customers. Their users have given some positive reviews about the platform, for example, the software saves a lot of their time, identifies bottlenecks in the month-end close process, keeps a record of the workflows, maintains accuracy in the close process, delivers good value, and much more.

Price: Numeric offers a free plan. It has the following paid plans-

- Starter: $30 per month per user

- Growth: Custom pricing

- Enterprise: Custom pricing

Contact the sales team for more pricing information.

Website: https://www.numeric.io/product/reconcile

FAQs on Balance Sheet Reconciliation

1. What is R2R process automation?

Record-to-Report process automation refers to automating the whole process from recording transactions to report creation. R2R process automation has several benefits, including increased accuracy, minimal errors, time saving, and more.

2. Can reconciliation be automated?

Yes, reconciliation can be automated with the help of software. But it is only possible when your accounts and financial data are in electronic form.

3. Which example is considered an error when reconciling the bank account?

If an error has occurred while reconciling the bank account, you will notice mismatched transactions. Transactions don’t match when you have entered a value more than once or omitted some entries.

So if you see mismatched transactions, re-check the entries to find out the error and then correct the error with a journal entry.

4. Does a bank error require a journal entry?

Yes. If an error has occurred while making entries, the accountant will have to make a new journal entry to balance accounts. For example, if an entry of $200 (increase in accounts) is entered as $20, then the accountant will have to make another entry of $180 for making adjustments.

5. Which software is used for data reconciliation?

Record to Report Automation by Redwood, Trintech, FloQast, Blackline, and Oracle Cloud EPM are the best software for automated account reconciliation tools.

6. What are the tools for reconciliation?

The software used for streamlining the reconciliation process is often referred to as a tool for reconciliation. They offer features like automated reconciliations, journal entries, transactions matching, and more.

7. How do you perform account reconciliation?

The account reconciliation process involves the following steps:

1. Collecting information about all of the organisation’s internal as well as external financial records

2. Matching the internal records with the external receipts

3. If any entry mismatched, then it is investigated, and adjustments are made

4. The whole process is being documented for future audits

5. The process can be reviewed and approved by an authority to check its accuracy.

The whole process must be repeated at regular intervals.

Conclusion

Account Reconciliation can be a tiresome, error-prone, and time-consuming process if done manually. Thanks to the software that makes the whole process quick, accurate, and cost-effective, all at the same time.

So it would be a good idea to invest in an account reconciliation software. Our study suggests that Record to Report Automation by Redwood, Trintech, FloQast, Blackline, Oracle Cloud EPM, Oracle NetSuite, Onestream, High Radius, Cadency, and Numeric are the top 10 BEST automated account reconciliation software today.

These platforms have the best set of features, have a good number of customers with amazing reviews, offer good features for keeping your company data secure, and are known for delivering quick and accurate results.

- Time taken to research this article: We spent 18 hours researching and writing this article, so you can get a useful, summarized list of tools with a comparison of the top 5 of them for your quick review.

- Total tools researched online: 23

- Top Account Reconciliation Software shortlisted for review: 10