Deeply explore the concept and evolution of Due Diligence from this expert guide. Get to understand what is Due Diligence in business along with its process, types, checklist, and service providers:

People in business are likely aware of due diligence. You’ve probably heard it thrown around a lot, especially when a big deal is about to go down. Broadly speaking, I think most people have a basic idea or gist of what this term means.

That said, it would also be fair on my part to assume that most people’s knowledge of due diligence is surface-level at best.

Table of Contents:

- Due Diligence Meaning: Ultimate Guide For Investors

- What is Due Diligence?

- Types of Due Diligence

- Purpose Specific Types of Due Diligence

- Due Diligence Checklist

- Due Diligence Process

- Levels of Due Diligence

- Common Red Flags to Avoid with Due Diligence

- Tips for Solid Due Diligence

- Top Due Diligence Service Providers

- Cost of Due Diligence

- Due Diligence as it Pertains to M&A

- Frequently Asked Questions

- Conclusion

Due Diligence Meaning: Ultimate Guide For Investors

At its core, due diligence is a vetting process wherein a company or investment’s information is verified. This process has evolved considerably over the years.

Check the video below to understand what due diligence is:

We now have virtual data room platforms like iDeals streamlining and automating this process, thus helping businesses save a lot of time and money. So, although people know what due diligence is, they need to be thorough in their knowledge of it.

As such, I was convinced to write a detailed article, as in-depth as I could, trying to unravel all key aspects related to this very crucial business practice.

Consider this article your only guide to the due diligence process as it has been carried out over the years.

What is Due Diligence?

Due diligence is a process undertaken by one company to verify the information of another company, especially one with whom they hope to engage in a business arrangement. When I think of due diligence, checklists come to mind.

[Via Pexels]

It is essentially a company making a checklist, trying to carefully validate and verify the reputation of a client, vendor, or third-party. For instance, a firm entering into any formal deal with another firm would first assess various aspects of its potential partner’s business, like its financial standing and any other scandals in its past.

Only after this information is verified will the firm feel comfortable in moving forward with a business arrangement. Simply put, it is a vetting process undertaken by a firm for its own peace of mind. Proper due diligence ensures that a company isn’t entering into a deal or deciding they’ll end up regretting later.

The Origin or History of Due Diligence

You would be amazed to know that Due Diligence isn’t a modern business practice. You can trace its origins all the way back to the early 30s with the introduction of the USA Securities Act. Once this act came into effect, dealers and brokers were obligated to be as transparent as possible in disclosing information related to the instruments they were dealing in.

Failure to comply with this act would result in severe criminal prosecution. Of course, the laws surrounding due diligence have evolved over the years and are no longer as harsh as they were when the Securities Act was first launched. This same act today includes a legal defense that protects dealers and brokers.

[Via Investopedia]

In the past, due diligence would involve assessing compliance, reviewing checklists, and evaluating financial performance over the years. The company undergoing this process had to prove, on paper, that its information is accurate and that its organization’s financial standing is strong. That said, modern times demand a more evolved process.

I think due diligence today must extend beyond verification of basic facts and financial records. It should also pertain to the assessment of a company’s long-standing culture and risks. Modern due diligence processes have taken a far more strategic approach. The goal now with such vetting processes is to unravel both opportunities and risks.

Time is also of the essence, with just how fast and tech-driven the modern corporate world has become. This time-sensitive nature of modern business dealings is something companies can address by leveraging virtual data room platforms like iDeals or Intralinks.

Recommended Reading => iDeals Virtual Data Room

The primary goal of Due Diligence

It is easy to find yourself in a conundrum when you are trying to understand a term that’s as broad and profound as due diligence. I think due diligence is best understood when its purpose is clear.

It is, at its core, a vetting process that’s undertaken by an entity to verify and validate certain information connected to a business partner before a deal can be closed.

The goal of due diligence will vary depending on the form it ultimately takes, given the circumstances. The goal of due diligence will shift based on the role it needs to serve.

Types of Due Diligence

One can categorize due diligence into two groups. There is a “hard” approach to due diligence and a “soft” approach to it. I will now explain.

| Hard Due Diligence Examples | Soft Due Diligence Examples |

|---|---|

| ● Legal Due Diligence ● Financial Due Diligence ● Operational Due Diligence ● Commercial Due Diligence ● Tax Due Diligence ● IP Due Diligence | ● HR Due Diligence ● ESG Due Diligence ● Commercial Due Diligence ● Administrative Due Diligence. |

#1) Hard Due Diligence

Hard due diligence refers to the assessment of hard facts, and by hard facts, I mean numbers and data. This involves the detailed and careful examination of a business’s financial records, like its profit and loss statements. Hard due diligence can help you identify red flags, inconsistencies in financial records, and future revenue projections.

As you can tell, there is a lot of mathematics and analytics involved with due diligence. Some businesses could use the results to paint a rosier picture of their company. However, judging by the various PR and media disasters we’ve seen in the past, relying on hard numbers alone to vet a company’s reputation isn’t a good idea.

Further Reading => Top Due Diligence Software

You need a more balanced approach, which is achieved when hard due diligence is done hand-in-hand with soft due diligence.

#2) Soft Due Diligence

Unlike hard due diligence, which takes a more quantitative approach to vetting, soft due diligence entails a more qualitative approach. Instead of numbers, it is other equally crucial aspects like internal management, staff, and customer loyalty that are put under the microscope.

With soft due diligence, you essentially have a better idea of how the company functions day-to-day. It is estimated that most merger and acquisition deals fall apart because the human element was ignored during the vetting process.

While assessing a company’s data is important, it is also equally important to verify its standing when it comes to corporate culture, client and employee relationships, etc.

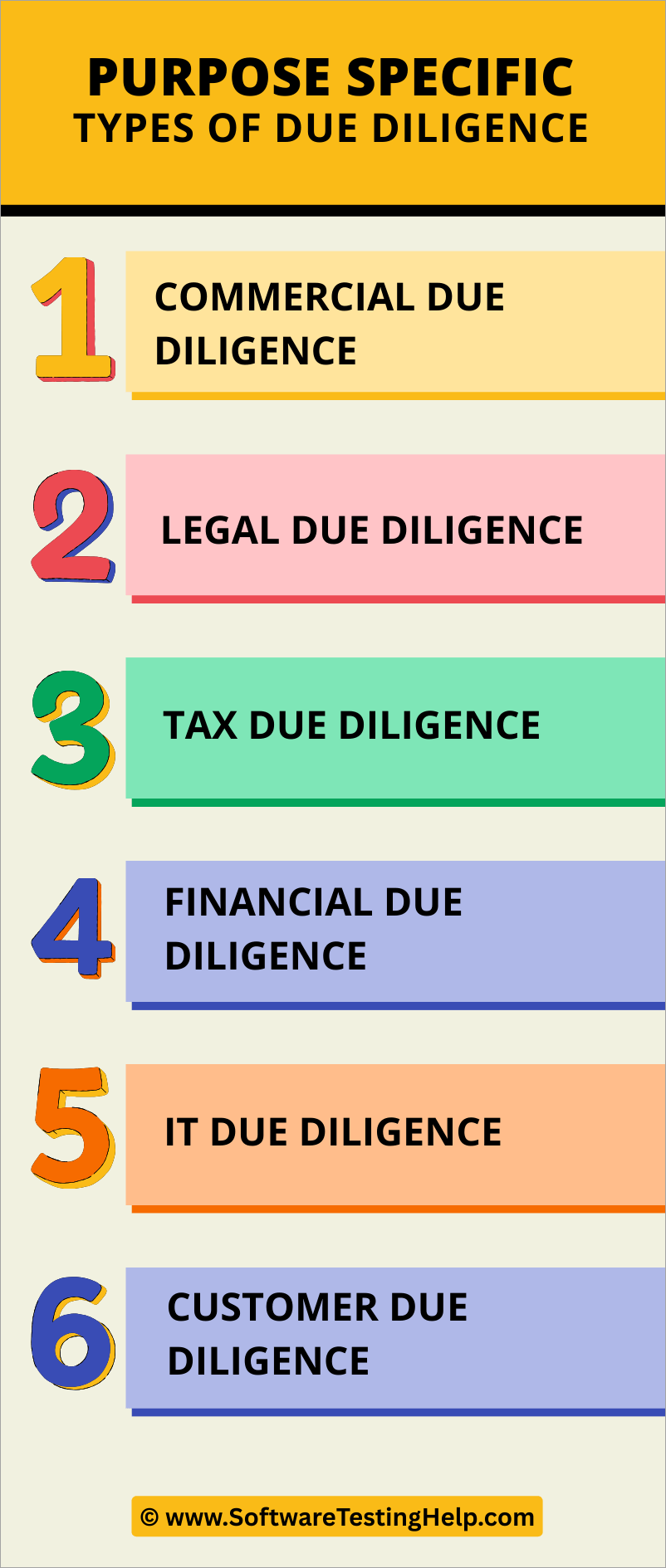

Purpose Specific Types of Due Diligence

Delving even deeper into the types of due diligence, you could categorize the process even further based on its specific goal:

#1) Commercial Due Diligence

A typical commercial due diligence process will involve vetting a company’s financial standing in the market. You would normally assess its market share, positioning with respect to competitors, growth prospects, and future potential.

#2) Legal Due Diligence

This type of due diligence involves vetting the company on legal grounds, thus making sure they’re complying with the necessary regulatory requirements. Under this process, you’ll identify any pending litigation against the company or check whether it was properly incorporated.

#3) Tax Due Diligence

This involves assessing the company’s status when it comes to taxes. Tax due diligence would involve finding out whether the company owes any taxes and whether or not its tax burden can be mitigated in the future.

#4) Financial Due Diligence

This includes investigating a company’s financial statements. For instance, going through their balance sheets, P&L statements, cash flow, etc. Due diligence here will involve a lot of mathematical analysis to rule out any inconsistencies and irregularities in the records maintained by the business.

#5) IT Due Diligence

This will involve the vetting of various software solutions, data management practices, and the IT infrastructure being employed by the company. This assessment is done to investigate a company’s cybersecurity, scalability, and integration risks.

Further Reading => Top Cybersecurity Software Tools to Look For

#6) Customer Due Diligence

This includes a thorough and lengthy process wherein the identity of each client the company has worked with is verified. This could help unearth any potential fraud and make sure the vetted company is compliant with the applicable anti-money laundering regulations.

Due Diligence Checklist

Below is a checklist of all critical areas that must be scrutinized, depending on the type of due diligence being undertaken.

#1) Financial Due Diligence

- Financial statements like balance sheets, profit and loss and cash flow statements.

- Assessing the trend of revenue and expenditure over a specific period.

#2) Commercial Due Diligence

- Target market assessment

- Competitor analysis

- Customer satisfaction and retention assessment

- Sales and marketing strategy evaluation.

- Branding evaluation.

Also Read =>> Top Marketing Analytics Tools

#3) Legal Due Diligence

- Verifies the legal structure of a company.

- Examining company bylaws and related corporate documents.

- Reviewing client, customer, supplier, employee, and partnership agreements.

- Examining contract-related liabilities.

- Reviewing a company’s litigation history.

- Going through past lawsuits.

#4) IT Due Diligence

- Assessing a company’s IT infrastructure.

- Reviewing the company’s cybersecurity protocols.

- Assessing patents, copyrights, and other IP assets.

- Study the company’s tech roadmap.

- Verifies the scalability of the existing IT infrastructure.

#5) HR Due Diligence

- Reviewing employee contracts.

- Evaluating employee performance.

- Making sure the company complies with established employment regulations.

- Reviewing the existing organizational hierarchy.

- Examining employee benefit programs.

- Making sure the company complies with existing pension laws.

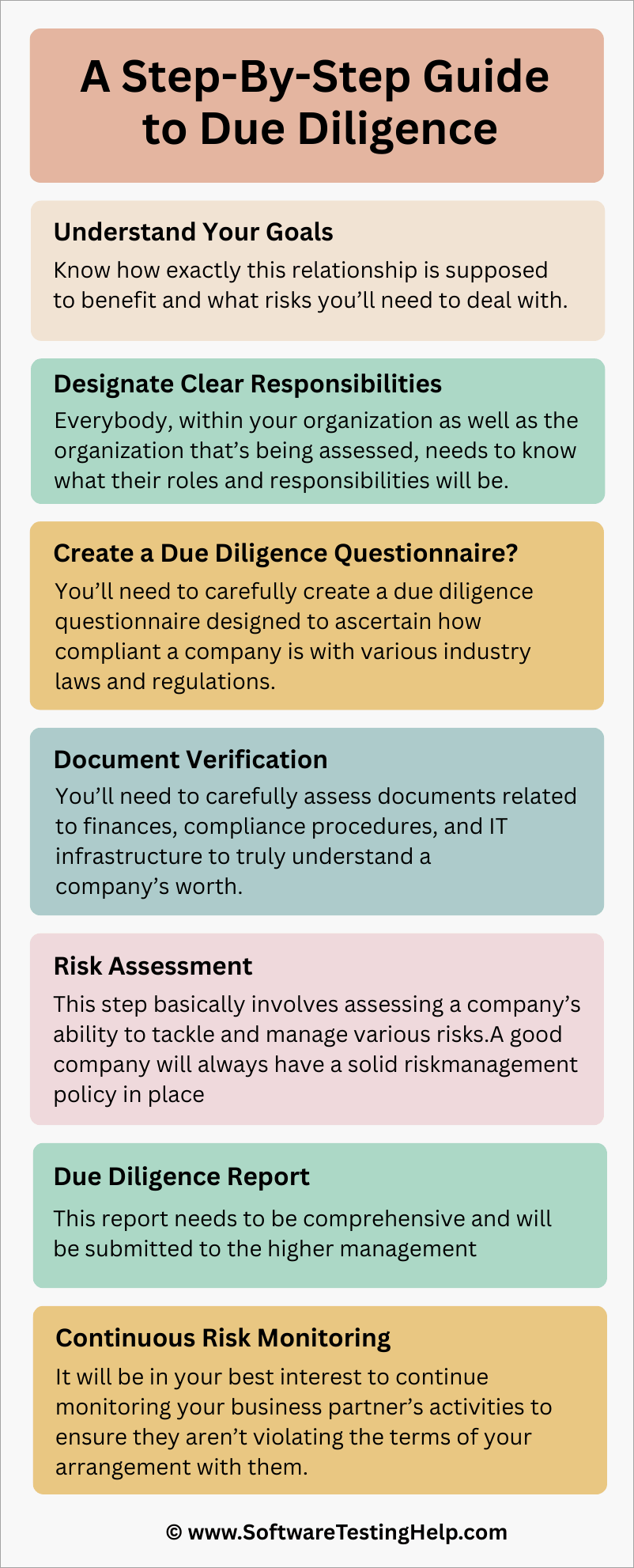

Due Diligence Process

Regardless of what purpose you want the due diligence to serve, the process will largely remain universal.

#1) Understand Your Goals

Before you kick-start the process, certain things need to be clear. For instance, you need to be clear on why you are trying to engage with another party. Know exactly how this relationship is supposed to benefit and what risks you’ll need to deal with.

#2) Designate Clear Responsibilities

With a clear goal in mind, it is now time to designate roles and responsibilities. Remember, this process is long and tedious. You must assign the right person to the right job. Everybody within your organization and the organization that’s being assessed needs to know what their roles and responsibilities will be.

#3) Create a Due Diligence Questionnaire?

This is a very important step in the process. You’ll need to carefully create a due diligence questionnaire designed to ascertain how compliant a company is with various industry laws and regulations. A well-laid-out questionnaire will make you privy to that company’s risk exposure and help you gather data important to combating it.

#4) Document Verification

The type of arrangement or deal you are engaging in will determine the type of documents you’ll need to audit. Typically, you’ll need to carefully assess documents related to finances, compliance procedures, and IT infrastructure to truly understand a company’s worth.

#5) Risk Assessment

This step basically involves assessing a company’s ability to tackle and manage various risks. A good company will always have a solid risk-management policy in place. You can verify this policy to get an invaluable insight into that third party’s approach to risk management.

You could combine this insight with your own risk-management approach for better results down the line.

#6) Due Diligence Report

With due diligence conducted, it is now time to create a report that includes your findings. This report needs to be comprehensive and will be submitted to the higher management. It will then be up to them on whether or not the deal can move forward.

#7) Continuous Risk Monitoring

Due diligence never ends after a deal is closed. It will be in your best interest to continue monitoring your business partner’s activities to ensure they aren’t violating the terms of your arrangement with them.

Levels of Due Diligence

As you can see from the process depicted above, Due Diligence is a long process with various aspects. If I had to summarize this process to make it even more comprehensive, I would dissect it into three distinct levels, which would be as follows:

Level 1

Think of this level as the preliminary evaluation phase. At this stage, any professional spearheading the due diligence process will focus on gathering basic but critical information.

This information is typically readily available. Through initial financial analysis and evaluation of risk, the goal is to find out whether a business arrangement is worth the time, money, and effort.

Level 2

The second phase is far more comprehensive and involves a more in-depth examination of the information obtained. The goal at this stage is to identify risks that may not be apparent right off the bat.

This stage involves extensive risk assessment, in-depth investigation, and detailed operational, legal, and financial examination.

Level 3

At this stage, the investigation evolves even further, with specialized professionals being tasked with examining all details related to a company’s technical, regulatory, and industry-specific aspects. Level 3 due diligence is complex and usually becomes necessary when a high-stakes deal is involved.

In summary, Level 1 due diligence pertains to basic information assessment. Level 2 due diligence involves a more comprehensive investigation, whereas Level 3 due diligence demands exhaustive scrutiny into all crucial aspects of a business.

Common Red Flags to Avoid with Due Diligence

No matter how thorough or sincere you are when undertaking a due diligence process, even a small mistake can derail your progress. As such, it would be in your best interest to be vigilant and aware of the following red flags.

#1) Missing Documentation

During the vetting process, you may come across a problem where critical documents and paperwork are either missing or incomplete. If that happens, know that something’s fishy and you should dig deeper.

#2) Confusing Legal Structure

Some businesses have a structure that’s complex to follow. If you encounter such a structure, chances are that it is hiding conflicts, interests, or liabilities that could harm your bottom line down the line.

#3) Unresolved Legal Issues

It is always wise to steer clear of companies with a troubled legal past. You should stay away from companies that have active litigation or are subject to ongoing investigations.

#4) High Employee Turnover

High employee turnover is a sign of poor morale and a toxic work culture. Stay away from companies that have an abnormally high attrition rate and a long list of negative reviews on online sites like Glassdoor.

#5) Cybersecurity Pitfalls

An absence of proper security protocols or an unwillingness to comply with HIPAA and GDPR data protection laws is a huge red flag. Ignoring this during the due diligence process will make your company susceptible to the risk of a data breach.

#6) Counting on Surface-Level Information

Relying solely on a company’s executive summary is a recipe for disaster. This summary might paint a rosy picture that is far from the actual reality. You need to dig deep and get your hands on data that’s more reliable.

#7) Ignoring Due Diligence After a Deal is Closed

Due diligence is a continuous process that should not end at the first screening. You’ll need to keep an eye out for your new partner long after the deal is closed to make sure they aren’t violating any terms of the agreement and are staying compliant.

#8) Relying on Traditional Processes

The world has evolved considerably, and the processes involved with due diligence have evolved as well. Not adapting to this reality and ignoring AI-powered, automated solutions like iDeals or Datasite to spearhead your due diligence process can put you at a significant disadvantage.

Tips for Solid Due Diligence

At first glance, all the above information can seem overwhelming. However, know that you only need to follow the below tricks to perform due diligence exceptionally well and avoid the above-mentioned pitfalls.

- Have a clear objective and goal in mind.

- Designate responsibilities to people across departments like HR, legal, IT, compliance, etc.

- Ensure consistency throughout the process with structured frameworks and checklists.

- Use modern AI-powered and automation-based technology to streamline the process. Virtual data rooms like iDeals, Datasite, and SecureDocs are all great tools that’ll simplify various key aspects of the due diligence process.

- Categorize your findings by the level of risk associated with each.

- Summarize your findings in a comprehensive report. Maintain a clear audit trail.

- Do not stop after the deal is closed. Monitor your new partner to ensure continued compliance.

Top Due Diligence Service Providers

I believe one thing is crystal clear so far in this article. Due Diligence is a complex, multifaceted process. The process demands time and commitment that many organizations simply can’t afford.

This is where third-party due diligence service providers come to the rescue. There is no shortage of good due diligence service providers in the USA. The table below does a good job of mentioning some due diligence providers that I can personally vouch for.

| Company Name | Strenghts | Suitable For |

|---|---|---|

| iDeals | Virtual Data Room with AI capabilities for due diligence and document management | Small to large-scale organizations engaging in high-stakes deals. |

| EY (Ernst and Young) | Comprehensive consulting on strategy, corporate, and tax due diligence | International deals and Large-scale organizations |

| Deloitte | Financial, Tax, Technology, and Operational Review | Global Deals and Software-related transactions. |

| Boston Consulting Group | Internal operation optimization, market dynamics examination | Corporate and Private equity clients |

| BDO | Operational and HR assessment. | Mid-market clients |

| Due Diligence Consulting LLC | Private investigations and investment research. | International deals |

Cost of Due Diligence

Due Diligence costs will vary from one case to another and depend on a variety of factors. Everything from the deal to how complex the deal is will determine how much it will cost you. The type of due diligence you undertake will also influence the expense.

Typically, smaller deals can cost between $25000-$50000, whereas larger deals can set you back by $150,000 to $500,000. Of course, this is just an estimate. The service providers or professionals you approach will have their own quotes.

For clarity, I would advise against pinning your hopes on estimates. Instead, get a clear estimate based on your requirements and goals from the professionals themselves.

Due Diligence as it Pertains to M&A

[Via DealRoom]

Due diligence is a critical stepping-stone for any high-stakes M&A deal. In this context, a company considering a deal will perform this process on the company it wishes to acquire. The process here will involve the acquirers asking certain questions integral to the M&A deal.

These questions could revolve around the company’s current financial standing or its current policies. Besides data and numbers, the acquirer will also assess the target company’s work culture, management, and other humanistic elements. The process itself will vary, depending on the industry and purpose being served.

For instance, a larger legal company acquiring its smaller competitor would want to review its target’s financial reports and employment agreements. They would also like to find out how well their target company complies with various laws and regulations.

Further Reading => Best Investment App for Beginners

Similarly, a US-based investment firm trying to acquire a stake in a Singapore-based manufacturing company will first assess the latter’s ESG profile. This ESG assessment could involve verification of the manufacturing company’s carbon emissions, environmental footprint, water usage, etc.

Other Examples of Due Diligence

Besides serving your M&A deals, due diligence can be a process that proves immensely useful in several other scenarios as well.

For instance, a company seeking a partnership with an IT solutions provider will have to undertake due diligence to ferret out any security risks or compliance issues.

Similarly, shareholders performing an in-depth background check on all potential board members is another good example of due diligence being put to good use. Due diligence in these scenarios will help shareholders pick the best members possible to form their board.

Background checks being performed by company heads to fill executive roles is yet another good example of due diligence.

Frequently Asked Questions

1. What is Due Diligence?

Due diligence can be best described as a vetting process that one entity undertakes to verify and validate information before making a decision. It is a process that a company will take to assess the risk of entering into a business arrangement with another company, client, or third-party.

2. How long does Due Diligence take?

Due diligence is a long and tedious process that has to be done with the utmost vigilance and care. You cannot rush it. Normally, this process can take anywhere from 30-90 days.

This timeframe will vary depending on the situation and complexity of the arrangement taking place.

For example, a high-stakes merger and acquisition deal demands a longer due diligence process that could go on for months. Some straightforward deals could only take a few weeks.

3. Who conducts due diligence?

Fund managers, brokers, dealers, investors, research analysts, and companies typically perform due diligence when trying to engage in a deal or arrangement with another party.

Although voluntary for investors and companies, brokers and dealers are legally obligated to conduct a due diligence process.

4. How much does due diligence cost?

I cannot say for certain how much due diligence will cost, as it depends on various factors. You could expect to pay thousands or even hundreds of dollars for this process.

The cost will largely depend on factors like:

• Size and nature of business

• Complexity of transaction

• Type of due diligence being performed

• Number of subsidiaries, etc.

5. What is a due diligence period?

The due diligence period encompasses the entire timeframe before a deal comes to a close. It entails a period during which a company undertakes its investigation into a target company.

During this phase, the company initiating the due diligence process will verify information, assess risks, and finally decide whether to go with the deal or abandon it.

Conclusion

My goal with this article was to go far beyond unraveling Due Diligence’s meaning. I believe I have accomplished that with this little guide. Due diligence is an important process, one that has to be done with care and patience for the best results. Improper due diligence could result in you entering into a very problematic business relationship.

Due diligence done right could help you explore lucrative partnerships and avert financial or compliance disaster. This process can be long and tedious, but thanks to modern technologies like iDeals, it can be conducted with considerable efficiency today.

When undertaking the process, be aware of the red flags and be clear about your objectives. With the right tools and insight, your due diligence process will be exceptionally simple and successful.