Discover the various highlights offered by Exness trading broker. Read this comprehensive Exness review to explore its trading features, account types, fees, and commissions:

Exness provides an online marketplace for trading CFDs of 100+ FX currency pairs, about 100 stocks CFDs, 10 indices CFDs, 3 energies CFDs, 15 metals CFDs, and 10 Crypto CFDs, where customers can trade using professional trading tools and platforms such as MT4, MT5, and Exness’ proprietary web terminal and iOS and Android app.

This Exness review looks closely at the company, the nature and legality of services provided, trading platforms and tools offered to clients, nature of trading support afforded by the company to the client, types of trading accounts and brokerage services provided by the company, client experience, and pricing of the services.

Table of Contents:

Exness Review: Must Read Before You Trade

We considered information obtained from the actual usage and experience of the trading platform, information provided by the company, and inputs provided by the client through reviews.

[image source]

Who is this Exness review for?

This Exness review is for people wanting to trade stocks, forex, indices, energies, metals, and cryptocurrencies and looking for a platform. Most online traders are doing raw and CFDs of forex and stocks, but Exness has diversification options in indices of CFDs, commodities CFDs, and crypto CFDs.

This review provides such persons with the offers the company has on each of these asset classes and categories. We furnish them with firsthand the benefits and challenges of trading these financial instruments with Exness.

This Exness review highlights the trading tools provided by the company for trading these asset classes. We will show you the main features you will find on the trading platforms provided by Exness for trading the aforementioned asset classes.

This review provides the necessary information for traders wanting to know about the professional trading tools they can use to trade these assets, either on Exness or other platforms. The review is also useful for customers of Exness who are already customers or yet-to-be customers and want to identify the best type of trading account they can open and run with the company.

This review also highlights Exness as a company and how it fares as a trading broker among clients when compared to other companies – whether you are talking about popularity, client experience, or pricing of its services.

Quick Expert Tips for Trading with Exness:

- Since the increase in trading leverage can increase the amount of loss, it is advisable to first test your leverage trading skills using a Standard demo account with Exness, though this is unnecessary for Pro traders.

- The lowest spread accounts to choose from are the Zero and Raw Spread types of accounts. They charge a commission that is industry-standard on the Raw Spreads account and lower on the Zero account type. They require a $500 deposit minimum. These accounts are most favorable for pro traders. These can achieve lower trading fees for huge volumes and regular traders. The Pro account, which has slightly higher spreads, does not charge commissions. It is also best for day traders and scalpers due to the instant execution of orders.

- Regular and huge volume traders can also explore rebate and discount opportunities in the Exness Premier program, which depending on level, may carry other benefits such as account managers and event experiences. Beginners and occasional traders are best with Standard and Standard Cent accounts, which do not charge commissions.

Check out this video for a quick introduction to Exness:

Exness was founded in 2008 and is registered as a securities dealer by the Financial Services Authority in Seychelles, where it is also based.

The company is also registered and authorized to trade in Curacao by the country’s Central Bank, in South Africa by the Financial Sector Conduct Authority or FSCA; in BVI by the country’s Financial Services Commission FSC; and in Kenya by Capital Markets Authority.

According to the company’s website, it has 700,000+ traders and 64,000+ partners from many countries around the world. It does not provide services to residents of the USA, Canada, Iran, North Korea, Europe, the United Kingdom, and some other countries. Exness’ core values are honesty, transparency, systematic improvements, quality development, and fairness.

Who regulates Exness?

Exness is regulated by top asset trading regulator authorities from the Seychelles (by the Financial Services Authority or FSA), in BVI by the Financial Services Commission, in South Africa by the Financial Sector Conduct Authority or FSCA, in the United Kingdom by the Financial Conduct Authority or FCA.

The company is also regulated by the Central Bank of Curaçao and Sint Maarten, the Financial Services Commission (FSC) in Mauritius, the Cyprus Securities and Exchange Commission or CySEC, and the Capital Markets Authority or CMA.

Further Reading => A Comprehensive Review of Trading Pit Platform

Overview of Exness Products and Services

Refer to this video:

Stocks and Stocks CFDs:

- Traders can sell and buy about 100 CFDs of stocks from popular companies in the United States and worldwide, including Boeing, Alphabet, McDonalds, Nike, and more.

- The tradable stocks span multiple industries, including agriculture, technology, telecommunications, real estate, manufacturing, and telecommunications.

- Traders trade most stocks there from Monday to Friday from 13:40 to 19:45, with the pre-market trading starting from 10:00 to 19:45.

- Stocks are traded at low raw spreads starting at 0 pips on Zero account type and at zero commissions. Average spreads on Standard accounts range from 0.3 pips to 23.8 pips, with the majority being under 1 pip and only a few countable CFDs at above 2 pips. These spreads are lower on Pro accounts mainly remaining under a pip and even lower on Zero accounts where more than a quarter are at zero pips and the majority of the rest remain under 0.5 pips. The Raw Spreads are mainly under 1 pip.

- Fast execution.

Forex CFDs:

- Trade 8 major currency pairs, 25 minor currency pairs, and over 60 exotic pairs.

- The average floating spreads for trading major currencies are 1.1 to 2.2 (major pairs) and between 0.9 to 6.6 (for most minors) depending on the currency pairs you are trading. Spreads widen during rollover and low liquidity market conditions.

- Spreads are as low as 0 pips for 95% of the time on the Zero account.

- Trade forex CFDs between Sunday, 21:05 to Friday, 20:59 hours (GMT+0).

- Leverage between 1:200 to 1:1000. Maximum available leverage decreases as the balance increases. Unlimited Leverage is available for those whose balances are equal to or below $1,000. If possible/needful, one can open a new account and reduce such a balance by depositing some into the new account to then access max leverage.

- Dynamic margin requirements (dependent on your leverage) for Majors and Minors and fixed margin requirements for exotic currencies.

- Max leverage for forex pairs limited: It is 1:200 for 15 minutes before up to 5 minutes after major releases, e.g. American Job Report (NFP).

- Stop out protection (positions are protected against market volatility and delays). Stop level is not available for those using Expert Advisors and certain high-frequency trading strategies.

- Fast execution.

Commodities CFDs:

- Trade 15 metals CFDs (except on Standard Cent accounts) and 3 Energies CFDs.

- These are metals and energies CFDs. The metals CFDs are those of popular metals like gold, palladium, aluminum, zinc, lead, silver, platinum, copper, and nickel. Energy CFDs are oil and natural gas CFDs.

- Raw spreads on Raw Spreads account rage from 0 pips to 6 pips for metals and 0.5 pips to 17 pips for energies CFDs. Spreads are higher on Pro, Standard, Standard Cent accounts.

- Spreads are lowest on Zero accounts ranging from 0 pips to 2.1 pips for the majority of commodities CFDs.

- Stop out protection. Stop levels are not available for Expert Advisors’ trading strategies.

- Triple swaps are charged on Wednesdays to cover weekends when no swaps are charged.

- Margins are dynamic for XAU (gold) and XAG (silver) based on the leverage of the trader. Margins are fixed on other commodities CFDs.

- For XNGUSD (natural gas), leverage is set at 1:20, and for XAL (Aluminum), XCU (Copper), XNI (Nickel), XPB (lead), XPT (Platinum), XPD (Palladium), and XZN (Zinc) the leverage is 1: 100. These have fixed margin requirements. Margin requirements for USOIL and UKOIL are 5% and the max leverage is 1:20.

- Trading hours are mainly between Sunday, 22:05, and Friday, 20:58 except for XALUSD, XCUUSD, XPBUSD, XZNUSD, and XNIUSD which trade daily.

- Fast execution.

- Negative balance protection.

Indices CFDs:

- Trade 10 CFDs of indices from popular global markets in China, Germany, Japan, the U.K., and the United States.

- Average spreads on the Standard account were 6.4 pips to 64 pips when I checked. These get lower on Pro accounts, and even lower on Zero account types (for instance you can trade 5 out of 10 indices CFDs at 0 pips on a zero account although you get charged a commission). On the Raw Spreads account, these spreads average between 0 and 20 pips and are lower than on a Pro account for any pair.

- Extended swap-free account available.

- Dividend amounts may be updated daily.

- Fixed margin requirements, leverage fixed at 1:400 for US30, US500, and USTEC, while for others, it is fixed at 1:200.

- Stop out protection available. Stop level not available for Expert Advisors.

- Trading hours are mainly Sunday 22:05 through to Friday 20:00 GMT+0, with a daily break implemented at varying times each day.

Crypto CFDs:

- Swap-free trading of 10 crypto CFDs. CFDs of Bitcoin, Ethereum, and Litecoin cryptocurrencies.

- Spreads vary from 10 pips to hundreds of pips on a Standard account.

- Fixed margin requirements.

- Stop out protection available but not to traders using Expert Advisors.

Also Read =>> Best CFD trading platforms to trade with

Platforms Provided for Trading Assets of Exness Platform

#1) MetaTrader 4:

- Trade CFDs using professional analytics tools (analyze markets using 30 built-in technical indicators with the ability to get more, 23 analytical objects, 6 pending order types (buy limit, buy stop, sell limit, sell stop, take profit, stop loss), 2 execution order types, trailing stops type of orders. Over 100 FX pairs. Candle, bar, and line type of charts.

- Algorithmic trading or using Expert Advisors: craft own algos using MQL4 scripting language, import scripts, get free trading robots from the market, or buy. Additionally, automate your market analytics.

- Mobile trading, in addition to desktop and web trading.

- Supports market and instant order execution.

- Get trading signals from experts.

- Copy trades of expert traders.

- MT4 MultiTerminal for Windows OS: open and run up to 128 trading accounts and 10 demo accounts on MT4. Account managers can use it.

#2) MetaTrader 5

- Trade CFDs of more than 200 instruments. This includes 100 FX pairs.

- Use expert tools, which include 38 built-in indicators, 22 analytical objects, and 46 graphical objects, to analyze markets and trades. Candle, bar, and line type of charts.

- Mobile trading (iOS), in addition to desktop (Windows, Linux, and MacOS) and web trading.

- 8 pending order types on MT5: buy limit, buy stop, sell limit, sell stop, take profit, stop loss, buy stop limit, and sell stop limit.

- Copy trading – copy strategies of other traders.

- Algorithmic trading using robots. Craft your own trading robots software on the MetaEditor tool using MQL5 scripting language, import, get free, or buy ones from the MT5 Marketplace.

- Hedging, which means you can open and run a trading position, and its opposite. You can also run multiple hedged positions.

- Multi-window charts.

#3) Exness Trade App

- Trading terminal is designed for MT5 accounts. It supports opening, closing, modifying, and deleting orders. For MT4 accounts, you need to use the MT4 mobile app.

- Mobile trading app offering advanced charting, price alerts, trading notifications about the status of positions, trading calculator (to estimate spreads, margins, and swaps), trading order histories, etc.

- Trading signals from Trading Central. These can be integrated into your analytics.

- Economic calendar to help stay up to date with impactful market news, events, and data releases. Also provides FXStreet market news in real time.

- Live in-app chat.

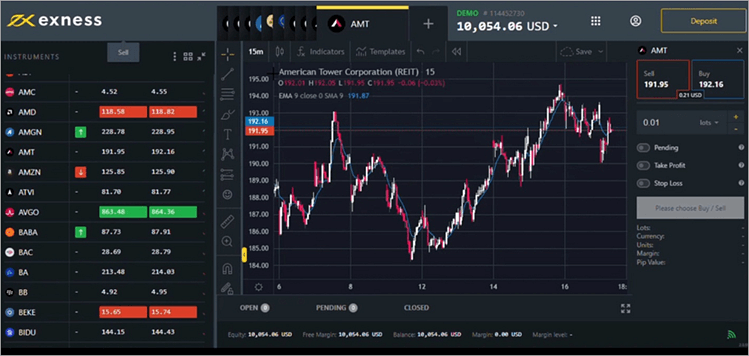

#4) Exness Terminal

- Trade 100+ CFDs via the web without having to install any apps.

- Only the MT5 account type is supported.

- 1-click trading. Ultra-fast order execution is supported.

- TradingView charts integration.

- Manage your account, view order details, including history, deposit and withdraw funds, etc.

- Stop out protection.

#5) Exness WebTerminal: MT4 WebTerminal and MT5 WebTerminal

- Use Exness on ordinary web browsers without installing any software.

- Analyze markets with professional tools – including 40 built-in customizable indicators.

- 6 order types on MT4 and 8 on MT5.

Suggested Read =>> Top Forex Brokers of the Biggest Financial Markets

How to Use Exness

How to Trade with an Exness Account?

Use the following procedure to open an account and trade:

Step #1: Register an account: Visit, go to create an account, and fill in the required details. Can also register with an email account. You are directed to the Personal Area.

Step #2: Create a Trading Account: Visit the My Accounts section and click/tap Open New Account.

A demo trading account and a real MT5 trading account are created by default and are available for use when you visit the My Accounts section. Click/tap mT5 to change to other types of account.

From the Personal Area, you can create and manage your trading accounts, deposit, withdraw, see order history, etc.

Next, choose an account type or click/tap Continue for the demo account. Enter max leverage, starting balance for demo account, default currency, account nickname, and trading password, after which you can click/tap Create an account.

Step #3: Verify your account, which is required to deposit and trade unless you are using a demo account. From the profile section, you can submit relevant identification documents for prompt verification.

Step #4: Deposit money: Visit the Personal Area->Deposit and choose the method through which you will deposit the money. Proceed per the prompts to deposit funds. The platform allows minimal deposits as low as $1 to $10 depending on the method of payment, and there are multiple instant payment methods.

Step #5: Trade: Once the money has been reflected on the account, it is time to trade.

The Trade tab located in the Exness’s Personal Area against your account is where to start. Select Trade, and choose whether to use Exness Terminal or MT. Download and install the MT platforms to use on your computer where need be.

If you are using the web terminals, click or tap on the option. Choose the instrument (stocks, forex, indices, crypto, etc.) to trade from the top left Instruments drop-down menu.

Select what to trade from the list of instruments that appear. Continue to place buy and sell trades with the relevant order types of your choice. Market analysis tools are richly available on the platform before you proceed to place orders.

If using MT5 or MT4, install, log in with credentials given after opening an MT5 or MT4 account on the web or mobile Exness website or app.

Suggested Read =>> How to place trades on MT4/5

See this video on how to copy trades and strategies from traders on Exness (with a monthly subscription), a feature available only on the Exness social trading app (downloadable from the company’s website or app stores)

Here you find traders from around the world regardless of the platform on which they provide signals (including on MQL4 and MQL5).

Further Reading => List of the BEST Forex Brokers in UK

Types of Exness Accounts

Standard Account Types:

#1) Standard: Suitable for beginner and advanced trader types. The most popular type of account at Exness. Market execution is slow for day trading and scalpers using Exness.

- Trade forex, metals, cryptocurrencies, energies, stocks, and indices for spreads starting at 0.2 pips.

- No commission on these accounts. 100+ FX pairs and other instruments to trade.

- Minimum lot size is 0.01 lots. The maximum lot size is 200 lots (from 7:00 – 20:59 GMT+0) and 60 lots (from 21:00 – 6:59 GMT+0).

- No deposit minimum – only dependent on the deposit payment method.

- Unlimited leverage. 0% hedged margin.

- 60% margin call and 0% stop out.

- Market order execution.

- Swap-free accounts are available.

#2) Standard Cent: This account offers micro lots and is best suited for new traders. Market execution is slow for day trading and scalpers using Exness.

- Trade only Forex and metals. Up to about 36 instruments are available, which may limit traders.

- Spreads from 0.3 pips. No commission.

- Leverage is unlimited.

- Minimum lot size 0.01 lots. The maximum lot size is 200 lots. Maximum number of positions is 1000.

- No deposit minimum – depends on the deposit payment method.

- 0% hedged margin, 60% margin call, stop out is 0%.

- Market order execution.

- Swap-free accounts are available.

Professional Accounts:

#3) Pro: This account offers instant execution for trading orders and zero commission. It is one of the most favorite for scalpers and day traders due to instant execution.

- Trade forex, metals, cryptocurrencies, energies, stocks, and indices.

- Low spreads starting at 0.1 pips.

- No commission.

- $500 minimum deposit.

- Unlimited leverage.

- Minimum lot size of 0.01. The maximum lot size is 200 (from 7:00 – 20:59 GMT+0), 60 lots between 21:00 to 6:59 GMT+0.

- 0% hedged margin, 30% margin call, 0% stop out.

- Instant order execution for forex, metals, energies, stocks, and indices; market order execution for cryptocurrencies.

- Swap-free accounts are available.

#4) Zero: The advantage of the account is zero spreads for the top 30 instruments. Market execution is slow for day trading and scalpers using Exness.

- Trade forex, metals, crypto, energies, stocks, and indices CFDs.

- Spreads start at 0 pips.

- Low commission from $0.05 per lot per side.

- $500 minimum deposit.

- The minimum lot size is 0.01 lots. The maximum is 200 lots from 7:00 to 20:59 GMT+0 and 60 lots between 21:00 and 6:59 GMT+0.

- Unlimited leverage.

- An unlimited number of trading positions.

- 0% hedge margin, 30% margin call, 0% stop out.

- Market order execution.

- Swap-free accounts are available.

#5) Raw Spread: It offers low spreads and a fixed commission per lot.

- Trade forex, metals, crypto, energies, stocks, and indices CFDs.

- Spreads start at 0 pips.

- Commission up to $3.50 per lot per side.

- $500 minimum deposit.

- Unlimited leverage.

- Minimum lot size is 0.01 lots. Maximum size is 7:00 to 20:59 GMT+0 and 60 lots between 21:00 and 6:59 GMT+0.

- 0% hedged margin, 30% margin call, 0% stop out.

- Market order execution.

- Swap free account available.

#6) Demo Accounts: Used either for testing your trading skills, gaining trading experience, or testing out the features offered by the Exness platform.

General Features

#1) Trading signals (available from MT’s Personal Area or on the Exness App) from Trading Central which help traders to develop trading strategies and plan trades, and market news delivered by FXStreet.

Also, obtain access to trading guides for both beginners and expert traders. You also get access to Trading Central’s WebTV. The latter provides the latest news from the NYSE, videos with market commentaries, and trading ideas from Trading Central experts.

#2) Copy trading on the mobile version of the Exness social trading app: Traders can follow strategies and even copy trades from other traders using the social trading features from their accounts. You can copy traders based on risk level, and profitability such as their monthly returns, amount of trading, trading period, etc.

#3) Compensation fund or trading insurance: As a member of the Financial Commission, Exness avails that each member is covered with insurance Financial Commission of up to €20,000 per client.

#4) Negative balance protection. Other account and fund protection measures include keeping client funds in segregated accounts with tier-1 banks, Bug Bounty program, stop-out protections, user and device and card authentication mechanisms, and insurance. Stop levels are unavailable for those using certain high-frequency trading strategies or Expert Advisors.

#5) Swap-free status on all account types for Muslims (automatic for those from such countries) and for those on Extended swap-free status.

#6) Triple swaps are charged on Wednesdays to cover weekends when no swaps are charged.

#7) Get a free Virtual Private Server for trading with Expert Advisors (only for those meeting eligibility criteria shown on the Personal Area or Profile tab on the app, relating to 30-day total trading volume in lots excluding social trading/portfolio management).

Can use mobile apps to access your VPS trading accounts. To use VPS, apply from the Dashboard’s Personal Area. Use up to 5 trading platforms to trade on one VPS.

#8) Exness Premier offers trading rebates and discounts for active and loyal clients. The Preferred premium category (requires one to have $20,000 total accrued in deposits and $50 million in quarterly trading volume) offers priority customer support, exclusive educational content, enhanced trading analytics, as well as special promotions and rewards.

The Elite premium category (which requires $50,000 in total accrued deposits and $100 million in total quarterly trading volume) adds in Personal Manager and lifestyle benefits on top of the Preferred category benefits.

The highest level attainable is the Signature (for $100,000 in total accrued deposits and $200 million in total trading volume per quarter) adds in events on top of the Elite category benefits.

#9) Instant deposits and withdrawals are available 24/7. Free deposits on a majority of methods, and free withdrawals. Exness supports many deposit and withdrawal methods, including bank transfer, Webmoney, Wire Transfer, Credit/Debit Cards, Perfect Money, Skrill, and Neteller.

#10) Base currencies from which customers can choose include ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, INR, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PKR, PHP, SAR, QAR, RHB, SGD, UAH, USD, UGX, UZS, XOF, VND, and ZAR.

Deposits and Withdrawals

Refer to this video:

#1) To deposit and/or withdraw funds from Exness, log in and visit the Personal Area. Select Deposit or Withdrawal depending on what you want to do.

Select the desired deposit/withdrawal method from the provided options, input necessary details like account number (for deposits), currency, and amount, and then proceed with the action. Verify the details, including by entering the code received on the phone, and proceed by providing the necessary account credentials to complete the transaction.

#2) Withdrawals are made using the methods through which you deposited.

#3) Most deposits and withdrawals made via e-wallets, credit and debit cards are instant (or up to 24 hours). Bank transfers can take between 1-7 days, and crypto up to 24 hours.

#4) No withdrawal minimums – only dependent on the payment method utilized (which is between $1 and $50 for direct bank transfers).

Pros & Cons

Pros:

- Multiple account types provide a greater choice for different types of clients. Multiple account levels with those that can suit in-platform brokers and expert clients, providing trading rebates and account manager benefits.

- Mostly free deposits (sometimes charged on some payment methods by third-party providers e.g. the bank issuing the credit card) and withdrawals. Low minimum deposit requirements (as low as $1 to $10) on Cent and Standard accounts depending on the deposit method.

- It provides swap-free advantage for most tradable instruments (e.g. gold, crypto, and on major FX pairs) and on all Islamic accounts, which lowers the cost of reducing positions overnight (starting 21:00 GMT+0).

- No management fee or account dormancy fee.

- Partner program where a customer can earn up to $1850 per client for introducing new traders.

Cons:

- Limited geographical coverage: it does not provide services or sell to residents of the United States, European Union, Iran, and North Korea.

- Complaints regarding delays in crypto and other deposits, rejection of some third-party payment methods, and verification required on payment methods.

Trading Fees, Commissions, and Other Charges

- Exness charges fees in the form of spreads onto which a markup fee is added, as well as commissions on some account types.

- If you want to get the lowest possible spreads afforded on ECN accounts, then the types of accounts to go for are the Zero and Raw Spread accounts where spreads can be as low as 0 pips. However, both of these professional trader accounts charge a commission. The Raw Spread account charges a commission of up to $3.50 per lot per side. Commissions on Zero are as low as $0.05 per lot per side.

- Pro accounts provide spreads that are slightly higher than Zero accounts on all financial instruments but there is no commission per trade, making it one of the most favorable for pro traders. Remember this account type requires a $500 deposit minimum just like the Zero and Raw Spread, unlike Standard and Standard Cent which do not have minimum deposit requirements, and their spreads are considerably higher than all other accounts.

- Other charges include a swap fee. However, most of the assets can be traded swap-free, plus there are swap-free Islamic accounts and accounts at the Extended swap-free status. Clients might incur charges for deposits when using some deposit payment methods but most deposits are free same as withdrawals. There are no charges for inactive accounts or reactivating accounts.

Frequently Asked Questions

1. Is Exness legal in the United States?

Exness does not have a license (either from FINRA, North American Securities Administration Association (NASAA), SEC, Commodities Futures Trading Commission (CFTC) or other regulator) to operate as a trading broker (for any asset class) in the United States.

As such, it does not provide services to residents of the United States.

2. Is Exness a legitimate company?

Exness is a legit trading company depending on which country you are a resident of. The company is an authorized trading broker by the Financial Services Authority in Seychelles, where it is also based.

Exness is also registered and authorized to trade in Curacao by the country’s Central Bank; in South Africa by the Financial Sector Conduct Authority or FSCA; in BVI by the country’s Financial Services Commission FSC; and in Kenya by Capital Markets Authority.

Residents of the USA, Canada, Iran, North Korea, Europe, the United Kingdom, and some other countries legally cannot trade on the platform.

3. Which country owns Exness?

Exness was founded in 2008 and is based in Cyprus where it is regulated as a securities trading company. It is also regulated as a trading platform in South Africa, Nigeria, Kenya, and other African countries, Curacao, and Seychelles.

4. Can I trade with $1 on Exness?

Exness accepts deposit minimums as low as $1 to $10 (for the Standard account types) depending on the method you use to deposit. For instance, some crypto and e-wallet payment methods may allow you to send $1 to the account.

This means anyone can try out asset trading at very low risks. Spreads are also tight even on the Standard account types which also do not charge commissions.

5. Is it safe to invest in Exness?

Based on customer reviews, Exness appears safe and secure to trade with. The trading broker and platform are reviewed by 11,000+ clients and former clients who give it an average of 4.8/5-star rating. That means it is more popular than most securities and asset trading apps online.

Besides, 86% of these reviewers gave it a 5-star rating. Those who gave it a 5-star rating are positive about the app’s web experience, leverage, low minimum deposit requirements, fast deposits, and withdrawals, as well as its simplicity and ease of use.

Clients also rate it positively in terms of providing helpful trading signals, the fact that it provides low and raw spreads and the availability of multiple market and trade analytics.

Negative reviews are recorded in single instances regarding high commission charged regardless of whether a person makes a profit or not, market price slippage/depreciating almost always following market news, stop loss failing to work, delayed UPI deposits and bank withdrawals (multiple complaints on delayed deposits and withdrawals which may be dependent on the method used), etc.

Conclusion

Exness is an ECN and STP type of trading broker. According to our Exness review, the company wins about charging low spreads on the Zero professional account whose commission starts very low at $0.05 per lot per side, although there is a $500 minimum deposit requirement.

The standard accounts have no minimum deposit requirement and impose spreads that are lower than the industry’s standard, in addition to not charging a per-trade commission. The main drawback is its service unavailability for residents of many parts of the world, and a limited number of assets (including per class) to trade.

Review Process:

Time taken for the review: 20 hours

Our Rating

Exness Review: Best Trading Broker to Rely in 2024

This Exness review aims to provide all information about the platform. Explore its features along with Pros & Cons to become a perfect trader in today's competitive market.

Price: Contact them for lowest rates

Price Currency: $

Operating System: Windows, iOS, Android

Application Category: FinanceApplication

5

Pros

- No management fee

- Multiple account types

- Low minimum deposit requirements

Cons

- Limited geographical coverage