Read this exclusive CM Index review to explore all about the high maximum leverage offered by the platform. Get to know the legitimate ways to achieve significant trading power:

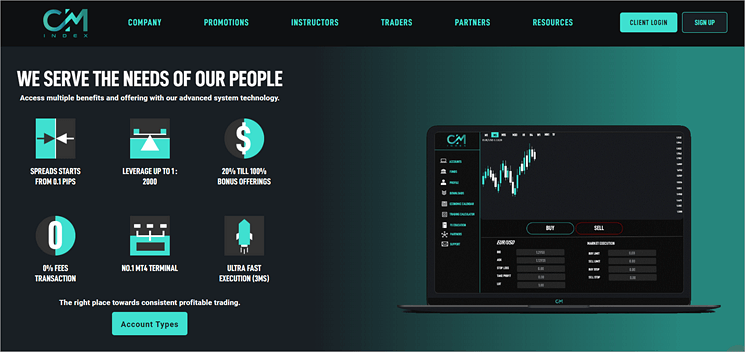

CM Index is a company that provides its customers with forex and CFDs trading brokerage services. They provide direct access to forex and CFDs markets (metals and energies), liquidity, as well as dedicated professional trading platforms, trading tools, and related support services.

The company is regulated to operate in the South East Asia markets. This tutorial reviews the CM Index, including its trading platforms, services and features, fees and charges, regulations, and other details.

Earlier this year, Trust Reviews wrote negative reviews on the CM Index complaining that it is unregulated and claiming that, for that reason, people could experience problems with withdrawals.

CM Index: A Must-Read Review

However, the CM Index is regulated by the Financial Services Authority in Saint Vincent & Grenadines as an International Business Company. It is also licensed as an International Brokerage and Clearing House by the Mwali International Services of Authority in Mwali.

[image source]

The company is also applying for a Money Broking license with Labuan Financial Services Authority. It currently accepts clients from the Asia and Pacific Confederation and does not accept clients from the Americas, Arab states, CIS countries, and European nations. That does not make it a scam.

Warning: Most FX and CFD traders lose money in trading, hence the need to first understand how to trade and practice extensively before trading with live accounts.

There is a need for inexperienced traders to start small and progress incrementally to avoid blowing the account, a need for all traders to understand and implement risk minimization order types and strategies, and a need for all traders to be careful about leveraged trading.

The CM Index review is for forex and CFD traders who are looking legit for ways and methods to trade these assets better. It is for traders looking for a broker to trade these assets at low spreads and fees with ECN and STP brokers, benefits from advanced trading tools such as MT4 and cTrader, benefit from bonuses, and earn trading rebates.

Range of Markets Tradable at CM Index

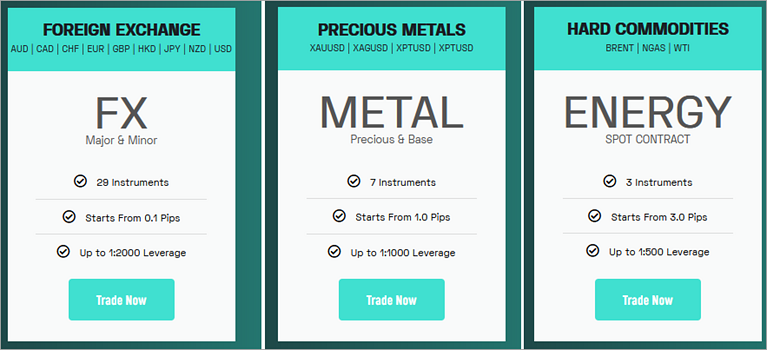

CM Index provides a total of 29 FX instruments, 7 precious and base metal CFD instruments, and 3 energies CFDs for trading.

#1) Foreign Exchange Trading: Customers of CM Index can trade 29 FX instruments, both major and minor pairs, with up to 1:2000 leverage and spreads starting at 0.1 pips.

#2) Precious and Base Metals CFDs: Customers can trade 7 instruments with a leverage of up to 1:1000 (1:20 on Platinum, Palladium, Copper, and Aluminum; 1:100 on Silver), with spreads starting at 1.0 pips.

#3) Energies CFDs.

Types of Brokerage Services Provided by CM Index

#1) STP and ECN Trading Brokerage Services: STP brokers utilize Straight Processing technology and no dealing desks to provide retail traders (retailers trading forex and CFD) with direct access to the market.

All orders coming from retail traders utilizing the CM Index are routed to liquidity providers. The execution prices of the orders are the bid/ask rates (and best possible prices) from the liquidity providers. Having no dealing desks means the orders are not re-processed or re-quoted, which would mean that they would have different prices.

ECN brokerage allows for a minimum lot size of 0.1. Unlike STP, where a broker can choose to deal with different liquidity providers from a liquidity pool, ECN liquidity is sourced from a hub comprising interconnected banks, hedge funds, and other market players. CM Index works with over 10 market depths and 20+ liquidity providers.

CM Index uses the hybrid STP and ECN model, which automates the order entry, and deals with spread pricing and trade execution, while the company can concentrate on providing customer service, education, and market analysis.

Suggested Read =>> Top Forex Brokers of the Biggest Financial Markets

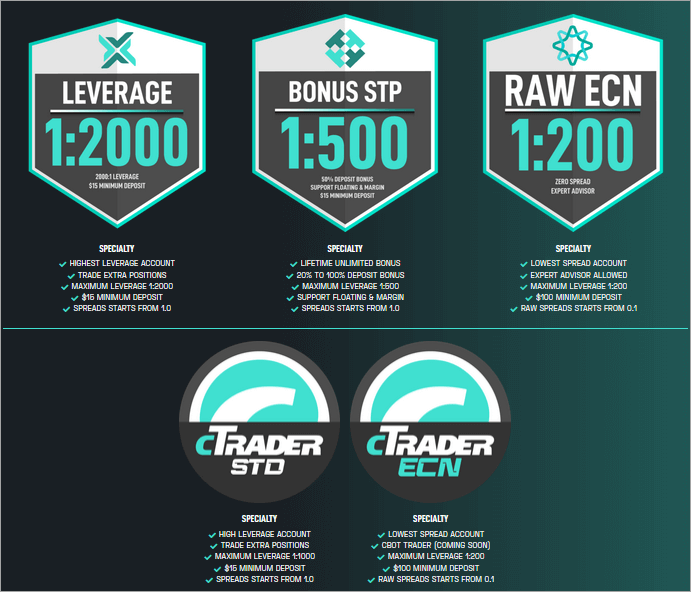

Types of Accounts

CM Index provides three types of MetaTrader 4 (MT4) accounts Bonus STP, Leverage STP, and Raw ECN, each of which features a minimum trade size of 0.01, 100 maximum orders, and a maximum total trade size of 100. The Bonus STP and Leverage STP do not have any commissions, while the Raw ECN account has a commission of $7/lot. All accounts have a spread of 0.1 pips.

The Bonus STP account, whose minimum deposit is $15, offers a maximum leverage of 1:500; the Leverage STP account, which has a minimum deposit of $15, offers a maximum leverage of 1:2000; while the Raw ECN, whose minimum deposit is $100, offers a leverage of 1:200.

CM Index provides two types of cTrader accounts on which traders can use cTrader software to trade forex and CFDs. The Standard and ECN accounts each have a minimum trade size of 0.01, trade size increment of 0.01, maximum trade size of 100, and maximum orders of 100.

The Standard account offers a maximum leverage of 1:1000 while the ECN cTrader account offers a maximum leverage of up to 1:200.

The Standard has a minimum deposit of $15, while ECN has a minimum deposit of $100. A commission of $7/lot is imposed on the ECN, while the Standard does not have any commissions.

How to Trade With the CM Index

How to open a CM Index account?

A real or demo trading account with the CM Index is needed to trade with the broker.

Step #1: To sign up for an account with the CM Index, open the website and click/tap on the Sign-Up button. Fill in all the required details, accept all terms and conditions, and click/tap Continue.

Insert the confirmation PIN sent to your email address and continue. Click/tap accept on Continue On This Device, accept the agreement, and click/tap Next button shown on the next screen.

You will then need to verify your email address. Insert your email address to be sent a verification code and enter the code. Click the Next button.

The next process is to verify the phone number. Enter the phone number on the next screen, to which you will be sent a verification code, enter that verification code to the website, and enter Next. Proceed to verify your ID or passport by uploading it. Also, verify your photo by uploading a selfie.

Complete the verification process and wait for the account to be approved.

Step #2: To open a trading account, click or tap on Login to Client’s Cabinet. Next, Click/tap Open Live Account.

Step #3: Select the type of account preferred and click/tap Continue. Select your account leverage and currency, and optionally enter your IB ID before clicking/tapping Continue. The screen displays the details of your account. Proceed by clicking/taping on Continue.

Note your account details such as the login, password, and investor password, then can download the trading terminal and proceed to trade.

Refer to this video to understand how to fund your account:

Step #4: Click/tap on Deposit to deposit: Click/tap Client Cabinet, select Funds, and click/tap Deposit Funds, select your trading account, choose a deposit payment method e.g. credit card or bank transfer, enter the deposit amount, complete the deposit and where necessary e.g. in a bank deposit upload your proof of payment. Wait for the deposit to be completed. Sometimes, it is instant.

Step #5: To become a partner: Log into your Client Cabinet, select the IB Menu click/tap Request IB, select the target country for business, and insert your social media website e.g. Facebook and the IB request will be reviewed and managers contact you. You also get assigned a manager who you can also contact on the IB application (Click/tap Contact Your Account Manager).

Step #6: To withdraw funds from your account: Log into the Client Cabinet with your details, select the Funds tab from the menu, and choose Withdraw Funds. Choose the withdrawal method and proceed.

Insert your account details (e.g. bank account number, account holder name, and bank name when using the Local Depositor method), enter the amount to withdraw, and submit the request. Some withdrawals are instant others are not depending on the withdrawal method.

Further Reading => In-depth Review of Funded Trading Plus

CM Index Trading Platforms and Tools

MetaTrader 4 Trading Platform

CM Index provides robust trading tools via the MetaTrader 4 third-party trading platform designed and coded by a company known as MetaQuotes. By default, the platform has the capability for trading using trading robots or so-called Expert Advisors. Traders using MT4 can also share trading strategies and copy trade.

- MT4 can be used on Windows and MacOS desktops over the web browser without having to download any software, as well as Android and iPhone-based mobile devices. CM Index has installation guides for each of these operating systems.

- MT4 can also simulate trades when you have not deposited any funds into your broker account.

- You must add CM Index Ltd as the broker on MT4 to trade your CM Index account with MT4. This is done from the “Add new broker” button and clicking or tapping on the + button and typing CM Index Ltd. Otherwise, you can add much more brokers with which you have an account, and trade your funds from whatever supported broker account.

How to Use MT4 with CM Index

Step #1: Visit the CM Index website, download, and install for your platform or operating system.

Step #2: Open the application. Click or tap on the File menu from the menu bar, select Open an Account from the list of File menu items, and select Add a new broker option to add CM Index Ltd if not there. Choose a Demo or Real CM Index Account and proceed with login where needed.

The former means you will trade with dummy funds, while the latter implies trading with real money you deposited in a live account.

On the mobile MT4 app, tap the + button on the top right edge of the app, and choose to open a demo account or log into an existing account. If you select the latter option, search for “cmindex” choose demo or real account, and log in with the password.

To use the web app, open the website and click or tap on Client Login.

Features of MT4

The features are listed below:

- Monitor and close your positions and pending orders.

- Modify stops and limits on open positions.

- Set up price alerts.

- View trade history.

- Download trade reports.

- One-click trading: Trade right from the charts as you continue to analyze your trades without leaving the charts.

- Multiple chart timeframes.

- MQL4 language for developing indicators and trading robots.

- Strategy tester for testing algorithmic trading strategies before launching them to live markets. You can test multi-asset strategies (including arbitrage and pair trading strategies) that trade on multiple symbols simultaneously.

- Copy trading: You can buy or get free signals from the Signals marketplace or sell your own. Use the Signals button.

- Six pending orders buy stop limit and sell stop limit.

- Thousands (2,000+) of technical indicators, multiple timeframes, and several analytical objects. Also, leverage free trading robots and paid robots from the marketplace. Also, benefits from free indicators from the in-house CM Index Smart signal center.

- Trade with VPS. You can subscribe to monthly trading VPS to solve Internet issues.

cTrader Platform

cTrader is a (Windows, MacOS, Android, iOS, web) trading platform (can also be installed on a server) that offers several trading capabilities, including the following:

- 50+ pre-installed technical indicators. 6 chart types and 28 timeframes. Charts are customizable. Add custom cBots and indicators.

- Trading from the charts (so-called 1-click trading).

- Charts can be organized into detachable standalone multiple screens within the app. Each screen has a full-screen and resizable option.

- Level II market depth pricing.

- Advanced order types. Including stop loss, trailing stop, and other pending order types.

- Trigger methods: Pending and stop loss can be triggered by the opposite side, second consecutive price, and second consecutive opposite price, which can protect against erroneous prices. There are no restrictions on stop/limit levels.

- Newsfeed: Market sentiments are also available.

- cTrader also supports manual trading, copy trading, algo trading, and Analyze. cTrader Copy (accessed through the Copy tab when logged in) allows traders to copy strategies of other traders and have theirs copied by other traders.

- Social traders can also share signals (via signals links), price alerts (via links), strategies, etc. across various social media platforms. Educators can also share technical analyses and knowledge with other traders. They can do so from YouTube, Discord, Telegram, forums, own landing pages, etc. through Chart Streams on which streams can be watched on cTrader Web, sharing snapshots of their charts using the ChartShot button of the app (e.g. from the Instruments bar), and other tools.

- cTraders also provide vast tools for money managers. These include Investor Access, Shared Access (traders grant access to their accounts to money managers, e.g. for remote trading and control and transparency), Algo, and cTrader Copy.

- cTrader also has tools for networkers and affiliates, for instance, who need to direct traffic to their web pages and resources or those owned by their brokers. These include the cTrader Invite Link, access to cTrader via Guest Mode, Embeddable cTrader, and cTrade Deeplinks, which direct users to certain screens in cTrader Web or Mobile.

- Algorithmic trading is supported via the tools provided on the cTrader Algo. They can use custom indicators, cBots, and plugins.

- cTrader ID, which allows clients to access all accounts and switch between them with one click instead of having to log in each time with a password and username.

Watch this video to grasp the concept of Chart Trading:

General Features of CM Index Trading Platforms

- The margin call level is 50% when you get a warning that your equity may decrease below your margin.

- Stop out level is 30%. The open leverage position closes out automatically when the equity decreases to 30% of the margin.

- Negative balance protection to ensure the overall potential risk does not surpass the account equity. CM Index Ltd covers the negative amount in case an account goes negative.

- Trading hours:

- Customers can keep up to 100 positions open simultaneously per client, including pending orders. The total lot-sizing restriction per ticket is 100 lots.

- No requotes and no re-executions. Order execution is guaranteed to be 100%.

- Orders are executed at the best available market price.

- If there are emerging market gaps from a Friday near a Sunday opening, all pending limits or stop orders for corresponding place sizes are executed at the first market price available.

- Trading breaks during the day depending on the instruments being traded. Clients can see prices streaming during this break, but no new orders can be placed or preexisting orders executed during the break.

- Spreads can be wider when liquidity providers are resetting and when liquidity is low. This can happen during the online switch (late Sunday, early Monday session start) and during the offline switch (Friday session end).

- 5+1 daily candle week provided for all clients. One extra candle for Sunday Bar at GMT+0.

- Most active hours for day traders are between the London markets’ opening and closing of the US markets. The peak is when the two converge. Key sessions are markets in London, the U.S., and Asia. Market opening and closing can change between summer and winter months when many countries are transitioning to/from daylight savings time.

Trading hours are:

- Swap-free accounts for Islamic customers. These have no swap or rollover interest on overnight positions. Swap-free accounts are also available for other clients.

Pros & Cons

Pros:

#1) High-speed Execution: The speed is 50,000 transactions per second.

#2) Low Latency: 3 milliseconds of execution latency.

#3) Low Spreads: ECN spreads start at 0.1.

#4) Leverage of up to 1:2000. MT4 Bonus STP accounts leverage ranges from 1:100 for balances of 5,001 USD and above, 1:200 for balances of between 2,000 USD and 5,000 USD, and 1:500 for balances of between 1 USD and 2,000 USD.

For Leverage STP accounts, a maximum leverage of 1:2000 is applied for balances of between 0 USD and 500 USD; 1:1000 is applied for account balances of between 501 to 1,000USD; 1:500 is applied for balances of between 1,001 USD to 2,000 USD; 1:200 for account balances of between 2,001 USD and 5,000 USD; and 1:100 for balances of 5,001 and above.

For ECN Raw accounts, a maximum leverage of 1:200 is applied for account balances of between 0 USD to 5,000 USD; and a leverage of 1:100 is applied for balances of between 5,001 USD and above.

For cTrader STD accounts, the leverage maximum is 1:1000 for a contract size of 10,000 USD and decreases by 100 for every 10,000 USD increase in contract size down to 1:300 for 80,000 USD contract size and 1:200 for 100,000 USD contract size and 1:100 for any amount larger than that. cTrader ECN accounts have leverages of 1:100 for contract sizes of 100,000 USD and above.

#5) 0% transaction fees

#6) Multiple bonus offerings. 20% lifetime deposit bonus of up to 2,000 USD which is a trading bonus that cannot be withdrawn except its profits. Additionally, there is a special bonus of 100% up to 100 USD. The latter is given on client deposits. There is also a $30 no Deposit bonus that can be used to experience live trading.

#7) Trading games and contests where participants can win prizes while learning and gaining experience in trading. Gifts on CM Points which are awarded on deposits and trading.

#8) Provides expert advisors e.g. MetaTrader Expert Advisors, unique trading tools, e.g. PZ Trading, trade simulation tools and data, extra charting tools, and (free and paid) extra trading indicators for platforms such as MT4.

Simulators and trade replay tools such as the free MetaTrader 4 FX Simulator and paid MetaTrader 4 FX Simulator. Also provides trading education, courses, e-books, videos, and materials, e.g. through the TYT Team.

#9) Revenue sharing through referral, affiliation, sales commission, and partnership programs. Partners are provided with expert tools to track their traffic and sales, track transactions (history, commissions, payouts, refunds) on a dashboard, do client trading trend analyses, do account reporting, and an auto commission payment system.

Revenue share for partners is up to $12 per lot of net revenue generated by the trader their refer generates. Partners also get up to $10,000 bonus on top of the standard partner commission.

#10) Partners also receive online video and written tutorials, access to educational seminars, customer introducer links, banners, flyers, merchandise, landing pages, and other marketing materials for educating their clients.

#11) Hedging and scalping are allowed on FX and CFDs.

#12) Cash back rebates paid to users of Bonus STP Cashback and Leverage STP Cashback accounts. These are paid to partners holding IB or MIB accounts, or given by such partners to their clients. They vary depending on the traded lot size and instruments traded. The minimum lot size to trade to start earning is 0.01. Cashback earned can be as low as $15 and can be withdrawn from the Cashback wallet.

Cons:

#1) Limited geographical coverage: provides services in South East Asia and none to the Americas, Arab states, CIS countries, and European nations.

#2) Very limited number of tradable assets and asset classes.

#3) Price slippage can happen due to a delay between an action and its execution or due to a lack of liquidity depth resulting in volume-weighted average price slippage. However, the company works with top-tier banks as multiple liquidity providers to prevent slippage. The company does not use the last look when the LPs support it.

Deposits and Withdrawals

- Banks process deposits and withdrawals from and to all countries.

- Instant deposits and withdrawal processing take 1-7 days when using credit and debit cards for transactions (with a minimum amount of $15 and a maximum of $500). Bank deposits and withdrawals are processed within 1 to 7 days. Deposit is instant with an online bank transfer method and withdrawal is up to 24 hours. The local Depositor method is up to 1 hour. Depositing and withdrawal are processed within up to 24 hours.

- The bank’s minimum per transaction (Deposit and Withdrawal) is USD 1,000. The maximum deposit and withdrawal are USD 10,000 each. The minimum deposit/withdrawal per transaction is 15 USD with online bank transfer and the maximum is 2,000 USD. With the Local Depositor method, each transaction requires a minimum of $10.

- Other deposit/withdrawal methods: Neteller and Skrill – $15 to $2,000 with instant depositing and up to 24-hour withdrawal processing. Cryptocurrency – $100-$10,000, with up to 1 hour deposit processing and up to 24 hours withdrawal processing.

Fees

- 0% transaction fees. No additional withdrawal and deposit fees above the third-party fees.

- Spreads are as low as 0.1 pips, especially for ECN and STP accounts that offer direct pricing from liquidity providers. Average spreads for STP accounts range from 1.3 pips to 1.9 pips for the major currency pairs except for the USD/HKD, where it is 8.8 pips. For minors, it ranges from 1.5 pips to 4.8 pips. For ECN accounts, the average pips range from 0.1 pips to 0.3 pips for majors, which is considerably low, and 0.4 pips to 0.8 pips for most of the minors FX pairs.

- A markup fee is added on spreads and commission is charged on STP account types. ECN accounts do not have this added. A flat commission rate is applied for ECN accounts.

Frequently Asked Questions

1. What is the CM Index?

CM Index is a forex and CFDs trading provider or broker. The company provides a platform on which customers can trade CFDs and forex pairs using advanced trading tools such as MT4 and cTrader.

The greatest advantage is that it provides a direct market (direct from liquidity providers) using a combination of ECN and STP models, which lowers trading fees by reducing spreads (the difference between the sell and buy price for any asset). Besides the small markup fee added, it charges no extra trading fees.

2. What time is the CM Index withdrawal?

CM Index processes withdrawals from Monday to Friday and from 14:00 to 16:00 server time (GMT+0 or GMT+1) over the weekends. There are several withdrawal methods as there are deposit methods. The team is available to process deposits 24 hours a day, 7 days a week.

3. Is CM Index legit?

CM Index is legit to trade with. It is regulated mainly in South East Asia by the Financial Services Authority in the Saint Vincent & Grenadines, Mwali International Services of Authority in Mwali, and Labuan Financial Services Authority (in the process of). It is not regulated in the Americas, Europe, or Arab states and therefore does not accept clients in those regions.

4. How to claim just a market welcome bonus?

A $30 No Deposit Bonus is given as a welcome bonus at the CM Index once a person registers an NDB account. CM Index also gives a 100% Deposit Bonus applied for deposits of $15. There also are cashback rebates based on the traded lot amount.

5. How does CM Index trading work?

With a CM Index account, you can utilize advanced trading platforms to trade CFDs (metals and energies) and forex pairs at low spreads and without extra fees.

You can utilize platforms such as MT4 and cTrader to trade these asset classes. These platforms support algorithmic trading, signal provision, and sourcing, as well as copy trading.

Further Reading => Most Popular Paper Trading Platforms to Look For

Conclusion

This CM Index review discusses the company, products, and services in detail.

CM Index boasts very low ECM spreads, multiple bonus offerings to clients, trading games, and contests where traders can earn real cash and cash rebates. It provides a very high leverage of 1:2000, which can help expert traders multiply their profits, though very risky.

There aren’t as many financial instruments to trade on the platform compared to several other STP and ECN brokers, but the platform is excellent for scalping and hedging even by day traders and high-frequency traders.

- Time taken to review CM Index: 35 hours

Our Rating

CM Index - The People's Broker: A Must-Read Review Before Trading

An intensive must-read CM Index review. Discover its pros and cons to explore the legitimate ways of trading like an expert to enjoy more returns.

Price: 5

Price Currency: $

Operating System: Android 4.0 or higher, iOS 7.0 or higher

Application Category: FinanceApplication

5

Pros

- High-speed Execution

- Low Latency

- Low Spreads

- Multiple bonus offerings

- Provides expert advisors

Cons

- Limited geographical coverage

- Limited number of tradable assets