A detailed analysis of Trading Pit Prop Firm with Pros & Cons. Explore this review to find out if this prop firm can truly help to propel in your trading career:

The Trading Pit is a trading game in which investors trade 500+ forex, commodities, indices, crypto, and stocks CFDs with virtual funds to prove their trading skills and earn real money when those strategies are applied in real markets. Traders can earn real money by investing as low as $100 and winning a single trading challenge.

The trading challenge is the start of the proprietary trading program on the platform. The purpose of the challenge is for the traders to prove they are talented enough to be admitted to the partnership program.

Table of Contents:

Trading Pit Review: Everything You Need to Know

Once they are admitted to the partnership program, they can trade and keep a share of the profits. The platform provides relevant support for traders to succeed, including professional prop trading platforms and tools, learning, and self-coaching, a network of traders for networking purposes, and usual customer support.

[image source]

Once a trader signs up, they run a demo account for two weeks (trial period) before purchasing a trading Challenge whose cost depends on the type of challenge chosen.

In this Trading Pit review, we shall discuss all the trading platforms availed, account types and for whom they are best suited, how to trade with the platform, and the likelihood of success when trading with The Trading Pit.

=> Visit The Trading Pit Website

Overview of Trading Pit

The Trading Pit was founded in 2022 by Illimar Mattus and is part of Pinorena Capital, a private equity firm, which was founded by Illimar Mattus and which invests in brokerage firms and asset managers that include Tickmill and Darwinex.

The latter also invests in banks and leading technology providers, such as OpenAI. The Trading Pit facilitates trading of 400+ financial instruments, including CFDs of FX, indices, commodities, metals, bonds, equities, energies, and cryptocurrencies, as well as futures.

Further Reading => BYDFi Review: Best Trading Exchange

The Trading Pit is registered and based in Vaduz, Liechtenstein, and has offices in Limassol, Cyprus, and Madrid in Spain.

The Trading Pit admits traders from 200+ countries except in Canada, the United States, Russia, Burundi, Cuba, Iran, North Korea, South Sudan, Sudan, and the Syrian Arab Republic. Market data providers Rithmic and DxFeed which partner with Trading Pit, may not be available in some countries where Trading Pit is available.

Futures traders get to trade on CME, CBOT, COMEX, NYMEX, and EUREX. The Trading Pit has not been around for long, but the mother company has a two-decade experience in investment banking, brokerage, and venture capital.

Refer to this video:

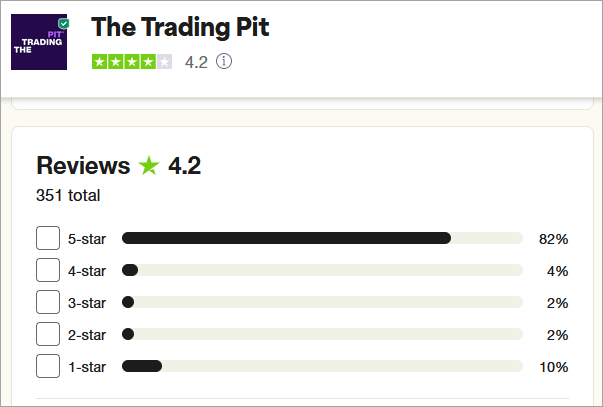

82% of the 351 total reviewers on TrustPilot give it a 5-star rating. Those who give it a positive rating mention that it is a legitimate and genuine company. Customers mention it offers a good mix of trading challenges and trading tools, scaling options with huge account balances and better profits, fast payouts, a good trading community, and good customer support.

Trading Pit Customer Support

The company’s readily available customer support agents can be contacted via email (support@thetradingpit.com) and phone +4232379000 and there is also a chatbot on the default website home page. The website also provides instant chat support via the bot – you are directed to a real agent after insisting you want to contact support and providing some details such as name and location.

The Contact Us page also has a contact form a trader can fill out and submit and expect answers back via email or other methods. The company can also be contacted through social media pages on Facebook, Instagram, Twitter, LinkedIn, YouTube, TikTok, etc.

Clients and unregistered users can use the above methods to contact the company on a 24/7 basis. The company also provides details about its physical office locations in Liechtenstein, Cyprus, and Spain.

In addition to support, the company provides traders with live webinars and individual mentorship, as well as personalized feedback and performance evaluations to traders. Besides, there are many guides on diverse issues, and a platform on which the community of traders learn from each other, share trading strategies, and discuss market trends.

Trading Pit Platform Security:

The company employs encryption techniques to secure client data and information. Account KYC is required once one passes a trading challenge. Besides utilizing 2FA authentication for account logins, the company utilizes a secure server.

As we have seen with most prop trading platforms, not much is disclosed about account security measures and most of them do not employ much beyond the 2FA and encryption.

The Trading Pit review: Who is it for?

[image source]

The Trading Pit ores highly with regard to charging low fees, but the commissions are higher for forex and CFD trading. The profit split can be as low as 60% and as high as 80% depending on the Challenge bought and the level of the account, and hence it is not the highest in the prop trading market.

The fact that it allows the holding of positions means Trading Pit is a favorite for swing traders. It also allows the use of EAs (expert advisors) – besides the expertise tools supported, e.g. MT5 and MT4, which allow the use of trading VPS and advanced strategies, which means it is excellent for high-frequency traders.

The platform also allows the use of hedging, risk management, and level II data, which are the right tools for advanced traders.

The scaling plans are very generous. For instance, customers can manage up to $1 million and earn up to $59,200 cumulative profit. Traders are required to place the trade for a minimum of 10 days.

Forex challenge accounts: The Executive Account customers can manage up to $1 million and earn up to $297,3000. Traders are required to place trades for a minimum of 7 days per each of the two phases. It is an excellent choice for skilled forex traders who want higher profitability and fast funding.

The VIP account has a profit cap of $296, 700, accepts a minimum of 7 trades per each of the two phases, and offers a higher daily and max trailing drawdown. It is most preferable for those wanting the highest initial account balance.

Forex challenge accounts: The Lite account earns up to $9,275 in cumulative profits and requires traders to place trades for a minimum of 10 days, and this is excellent for starters who are learning futures trading.

The Standard account offers a max profit of up to $102,900 but has higher profit targets in Phases 1 and 2. The Executive account offers the same maximum cumulative profit as the Standard one, but the profit targets are lower. It is the most preferred by professional futures traders. VIP account, which can earn a maximum profit of up to $120,050, is best for futures traders seeking maximum profits.

Further Reading => Most Popular Day Trading Platforms of the Year

How Does The Trading Pit Fair? (Trading Pit Vs. Competitors)

The Trading Pit performs better than most prop trading firms in terms of instant payouts, which it supports. It also ranks among the favorites, given that the price is a one-time payment compared to firms that require recurring monthly payments.

In comparison, Apex Trader offers lower max funding capital, but the profit split is one of the highest at between 90-100%. While you keep the first $10,000 at The Trading Pit, this is $25,000 at Apex Trader. Apex traders can receive funding every two weeks.

While The Trading Pit won’t allow traders to trade with multiple accounts simultaneously, Apex does, and without a limit on the number of accounts that you can run. Consider that multiple accounts minimize trading risks and expand the profit-making opportunities.

However, Trading Pit offers better and more account size options for the same pricing (hence cheaper) especially when you consider scaling options on the Trading Pit.

Topstep offers limited funding options – 50K, 100K, and 150K, is more expensive compared to Trading Pit, allows trading of only futures, and does not permit overnight positions, although there is an option for live trading straight away once you open a Premium Account.

Topstep provides a better profit share of 90% than a Trading Pit. You keep the first $5,000 earned. Payouts are daily, and you can earn gifts such as the First Payout Bonus on achieving certain targets.

When compared to FTMO, Trading Pit offers more and better trading platforms and more funding account size options, but lower maximum size when compared to FTMO scaling options (offers up to $2 million max). FTMO offers higher profit splits of 80% – 90%. Trading Pit is a more affordable option with the lowest price going at around $188.

How Does The Trading Pit Work

Here is a video for your reference:

Step #1: Sign up on the Trading Pit website. Sign in.

Step #2: Choose a trading challenge based on the account size. You require a subscription to demo trade. Start trading. It is that simple.

The following shows CFD trading challenges and their specifications.

Phase 1 of the evaluation offers fast progress and limited drawdowns, while the second phase offers steady progress and extended drawdowns.

| $10,000 acc. balance | $20,000 acc. balance | $50,000 acc. balance | $100,000 acc. balance | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 Phase | 2 Phase | 1 Phase | 2 Phase | 1 Phase | 2 Phase | 1 Phase | 2 Phase | ||

| Price | $99 | $99 | $199 | $199 | $349 | $349 | $569 | $569 | |

| Daily drawdown (balance based) | 4% ($4000 | 5% ($500) | 4% ($800) | 5% ($1,000) | 4% (2,000) | 5% ($2,500) | 4% ($4,000) | 5% ($5,000) | |

| Maximum drawdown (static) | 7% ($700) | 10% ($1000) | 7% ($1,400) | 10% ($2,000) | 7% ($3,500) | 10% (5,000) | 7% ($7,000) | 10% ($10,000) | |

| Profit target | 10% ($1,000) | 8% ($800) or 5% (%$500) | 10% ($2,000) | 8% ($1,600) or 5% ($1,000) | 10% ($5,000) | 8% ($4,000) or 5% ($2,500) | 10% ($10,000) | 8% ($8,000) or 5% ($5,000) | |

| Minimum trading days | 5 | 5 | 5 | 5 | |||||

| Profit share | 80% | 80% | 80% | 80% | |||||

Further Reading => Most Popular CFD Brokers to Look For

Futures Trading Challenges and Specifications:

| Lite Phase 1 | Lite Phase 2 | Standard Phase 1 | Standard Phase 2 | Executive Phase 1 | Executive Phase 2 | VIP Phase 1 | VIP Phase 2 | |

|---|---|---|---|---|---|---|---|---|

| Subscription | $99 for 30 days. | $169 for 30 days. | $349 for 30 days. | $599 for 30 days. ) | ||||

| Extension of subscription | Pay $70 or $120 to increase duration to 60 or 90 days respectively | Pay $120 or $205 to increase duration to 60 or 90 days respectively | Pay $250 or $420 to increase duration to 60 or 90 days respectively | Pay $420 to increase duration to 90 days. | ||||

| Virtual funds | $20,000 | $150,000 | $150,000 | $250,000 | ||||

| Challenge duration | 30 days | 30 days | 30 days | 60 days | ||||

| Minimum trading days | 3 | 3 | 3 | 3 | ||||

| Real Time L1 Data fees | Free | Free | Free | Free | ||||

| Contracts | 10 micros | - | 50 micros/5 Standard | - | 50 micros/5 Standard | 100 micros/10 Standard | ||

| Daily drawdown | $250 | - | $1,500 | - | $2,500 | $1,000 | $2,500 | $1,500 |

| Max drawdown (Trailing on highest account balance) | $500 | - | $3,000 | - | $3,500 | $3,500 | $5,000 | $5,000 |

| Profit share | 60% up to 70% | 60% up to 70% | 60% up to 80% | 70% up to 80% | ||||

| Total payout | $12,080 | $111,900 | $131,850 | $133,300 | ||||

| Quantower license worth $100 | Free | Free | Free | Free | ||||

| Atas License $69 | Free | Free | Free | Free | ||||

| Rithmic license worth $35 | Free | Free | Free | Free | ||||

| Reset cost | $49 | $85 | $179 | $299 | ||||

Scaling plans differ depending on the account type and each level from 1 to 10 offers a different contract size, profit target, drawdown, and profit split.

The following shows the contract sizes and profit split for each level in the four account categories.

| Lite | Standard | Executive | VIP | |||||

|---|---|---|---|---|---|---|---|---|

| Contract size (micros) | Profit share | Contract size (micros) | Profit share | Contract size (micros) | Profit share | Contract size (micros) | Profit share | |

| Level 1 | 10 | 60% | 50/5 | 60% | 50/5 | 60% | 50/5 | 70% |

| Level 2 | 10 | 60% | 50/5 | 60% | 50/5 | 60% | 50/5 | 70% |

| Level 3 | 10 | 60% | 50/5 | 60% | 50/5 | 60% | 50/5 | 70% |

| Level 4 | 15 | 60% | 70/7 | 60% | 70/7 | 70% | 70/7 | 70% |

| Level 5 | 20 | 60% | 100/10 | 60% | 100/10 | 70% | 100/10 | 75% |

| Level 6 | 25 | 60% | 100/15 | 60% | 100/15 | 75% | 100/15 | 75% |

| Level 7 | 30 | 65% | 100/20 | 65% | 100/20 | 75% | 100/20 | 75% |

| Level 8 | 35 | 65% | 100/25 | 65% | 100/25 | 80% | 100/25 | 80% |

| Level 9 | 40 | 65% | 100/35 | 65% | 100/35 | 80% | 100/35 | 80% |

| Level 10 | 50 | 70% | 100/50 | 70% | 100/50 | 80% | 100/50 | 80% |

Step #3: Read the rules and have a trading plan:

The trading rules on Trading Pit require the following: traders should hit the profit target set on each category (as per the account type and levels), and if you make a daily loss, it should be lower in amount than the set Daily Drawdown (daily drawdowns are updated daily and are based on the user account balance).

The total lifetime loss made in an account should be lower than the Maximum Drawdown (the account is closed automatically if the account equity goes below this set amount), trade for at least 5 days for you to achieve a passed status, keep the account active by ensuring they place a trade within 21 consecutive days, and each trader can run only one Earning account at a time.

Watch this video on how to successfully complete the challenge.

Step #4: Start trading.

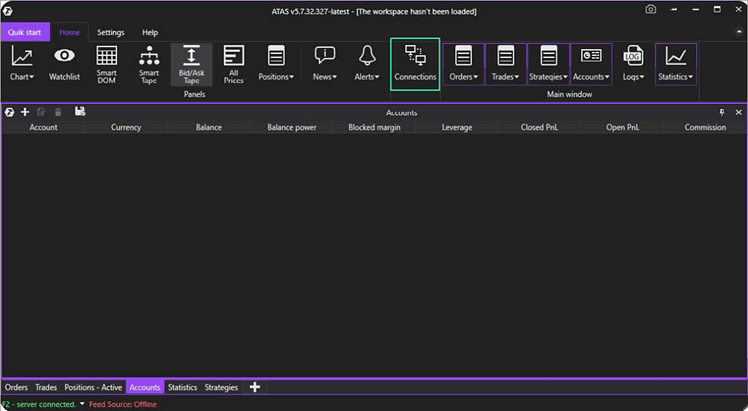

Trading Platforms and Tools

Let us see how to trade with different platforms on The Trading Pit.

#1) R Trader

[image source]

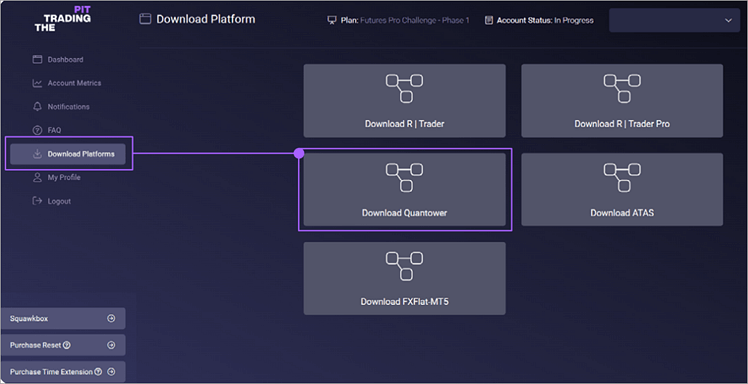

The R Trader Pro works on Windows. To download, visit your Client Area->Dashboard->Download Platforms on Trading Pit.

Once you download and install, you can log in with the username, password, and system to which you will connect (these are issued by your broker. This platform is used for risk management.

To set up risk parameters to auto close your positions, head over to Trader Dashboard->View choose the account for which you want to set the risk parameters, right-click on it, and choose View Risk Parameters. The Auto Liquidate Threshold is used to avoid breaching the Drawdown limits by setting a threshold that is lower than the drawdown value.

#2) Quantower

The Trading Pit is also offering a free user Quantower platform license for those who sign up for a Trading Pit license. It works on a desktop. To install, log into your Trading Pit account, head over to Client Area->Dashboard and click on the Download Platforms tab. Choose the Quantower platform. Install the downloaded file and run the program from your desktop.

Further Reading => Detailed Review of HyroTrader Crypto Prop Firm

Connect your TTP account to the Quantower.

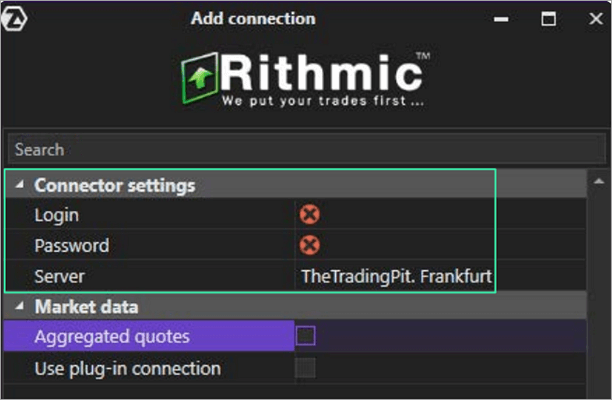

Click the Trading Pit Rithmic from the upper right corner, select the demo option, and log in with your details sent by Quantower once a pop-up appears. Navigate to the Connections settings. After purchasing a Challenge on TTP, set the Demo server to Frankfurt. Enable MBO and Rithmic logs and close the pop-up. The TTP account is connected and you are ready to trade on Quantower.

#3) ATAS Platform

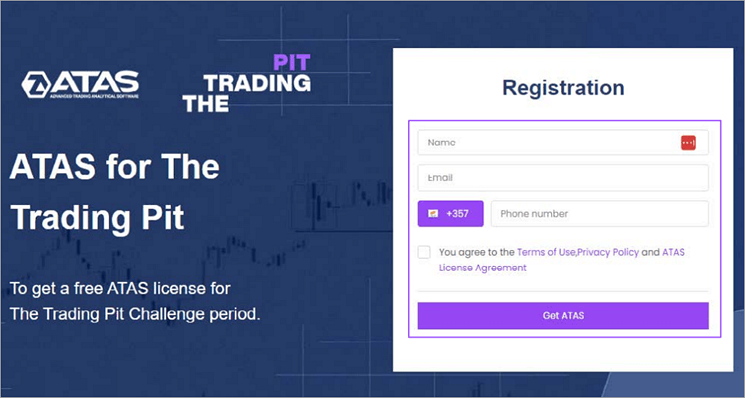

Download and install the ATAS platform.

The Trading Pit is offering a free ATAS platform use license to anyone who buys a Trading Pit Challenge. To benefit, sign up on the Trading Pit platform, and go to Client Area->Dashboard->Download Platforms-> Download ATAS.

You will receive an email from ATAS with login credentials valid for 90 days but which can be renewed using the same procedure from the TTP website. ATAS works on a desktop.

To connect The Trading Pit to the ATAS platform, open the latter, left-click on Connections or Feed Source, and click/tap the ‘Add’ button on the new pop-up window. Choose the Trading Pit Rithmic as the data provider or Rithmic if you have your subscription with the latter.

From the pop-up that appears, log in to your The Trading Pit account with the user account and password sent to you by email by The Trading Pit. Set the server to The Trading Pit Rithmic – Chicago/Frankfurt and click/tap Finish and you are ready to trade.

4. Other trading platforms supported on The Trading Pit include MetaTrader 4 and MetaTrader

Trading Pit Features

- Live news and market analysis broadcast known as LiveSquawk by The Trading Pit team: Experts in the program will analyze news sourced from major news headlines, social media, newswires, blogs, TV, and websites. It is accessible (with free signup) for free to all traders with a subscription. it also features an economic calendar that provides traders with a schedule of important industry events and earnings that usually influence prices. Also included are audio feeds for immediate market news.

- Level 1 market data is available through a tab for anyone who signs up for a challenge. Users can upgrade to Level 2 data (from CME, CBOT, COMEX, and NYMEX). Users can also upgrade to Eurex market data.

- Leaderboards: Top-performing traders are listed based on their achieved profits, number of payouts, and country of residence/activity.

- Payouts are processed every Friday for as little as $100.

- Network with other traders – share knowledge, learn more about trading, and earn more money.

- Educational tools: podcasts, e-books on Trading Pit Academy, webinars, success stories, and guides.

- Community of traders through a dedicated Discord channel.

Pros and Cons

Pros:

- Get a 25% increase on the account balance, for instance, if you meet certain targets such as keeping the account active for 2 months, receiving 2 payouts, doing a 4th scale-up of the account, or accumulating a total profit of at least 10% on the initial balance.

- The Trading Pit supports scalping, hedging, and the use of advisors.

Cons:

- Best of trading practices for pro traders are prohibited including manual or automated copy trading unless you are copying trades from an external account that is yours, high-frequency trading, news trading (with orders only allowed 2 minutes before and after high-impact news releases), gap trading (account may even be closed if a trade is made less than 2 hours of a closure of a financial market with a target to exploit a price gap when the market reopens).

- The company also forbids traders targeting to make a profit through exploiting system errors, gambling, and inconsistency trading, for instance, where a trader completes their 5 trading days by placing large lot trades in the first days and low-volume lots during the remaining days. Since the system adheres to standard risk management approaches, also a trader cannot achieve the profit target in a single trade.

Further Reading => Explore the Top Proprietary Trading Firms

Frequently Asked Questions

1. What is a pit in trading?

Also called the trading floor, this is the area of a securities exchange that is set aside for traders who buy and sell shares in real-time for their clients and brokerages. While major exchanges still have pits, electronic trading has mainly replaced the process.

2. Who is the owner of The Trading Pit?

The Trading Pit prop trading firm was founded by Mattus Illimar, who is the CEO of the Pinorena Capital that owns Trading Pit. Mattus is experienced in venture capital, global brokerage, and venture capital. Mattus has a history of trading on the financial markets. The Trading Pit CEO is currently Daniela Egli.

3. What broker does The Trading Pit uses?

The Trading Pit proprietary trading firm partners with brokers FXFlat and GBE Brokers to facilitate CFDs and futures trading by its clients. CFDs brokerage is provided by CySEC-regulated firm GBE for liquidity.

The partnership brings about immense trading options for traders in terms of types and the number of assets they can trade.

4. Where is the Trading Pit based?

The Trading Pit is headquartered in Liechtenstein. The company, however, has other offices in Spain and Cyprus and teams in Brazil, Portugal, Italy, Germany, Vietnam, Malaysia, Russia, Poland, China and the MENA region.

5. Do prop firms pay you?

Proprietary trading firms do pay out, but the amount of payment depends on the trader’s performance. A trader is provided with trading capital and they trade with the money to make a profit, which they then split with the company.

Customers on most prop trading firms get between 50% and 90% of the profit they make while the rest go to the company. However, most require you to subscribe to an account before starting to make a profit trading on their platforms.

Trading Fees: Spreads

- Spreads are dependent on the third-party futures provider, which is GBE. The spreads are as low as 0 pips, especially for FX Majors, but the majority of the FX pairs range between 2 and 3 pips for all FX pairs. Unfortunately, the commission for all FX and futures is $5 per lot/side, which is higher than the industry standard.

- Spreads for CFD futures mainly are between 2 and 4 pips. Spreads are between 2 and 5 pips for Metals, between 2 and 150 pips for Energies Futures, between 0.8 and 2.2 pips for CFD Cash Indices, and between 1 to 100 pips for Crypto CFDs.

* CFD Futures and Energies Futures trades are swap-free but for FX and Metals 3-day swaps are applied on Wednesdays, and Crypto and Equities CFDs where 3-day swaps are charged on Fridays.

* Commissions for Equities range from 0% to 20% depending on the instrument traded. Commission for Crypto CFDs trading is 0.2%.

* For futures, the trading cost per side varies from 0.52 to 3.2 on CME, 0.82 to 2.17 on COMEX, between 0.92 and 2.67 on CBOT, between 0.82 and 2.12 on NYMEX exchange, and between 0.4 and 1.57 on Eurex.

Conclusion

Trading Pit prop trading broker can be used to trade stocks, Forex, futures, crypto, and commodities using professional trading tools. The profit split is between 50% and 100% depending on what trading level and account.

It turns out to be more affordable than most prop trading platforms and you can get a 25% increase in account balance on meeting certain trading targets. However, you cannot auto-trade and there are limits on several other trading strategies that are liked by traders, e.g. news trading.

Recommended Reading => Best Books for Stock Trading

Our Rating

The Ultimate Trading Pit Review: Read Before You Trade

Thinking of joining Trading Pit Prop Firm? Read this comprehensive review to analyse its features, pros & cons to explore the truth behind the hype.

Price: 5

Price Currency: $

Operating System: Windows, iOS, Android

Application Category: FinanceApplication

5

Pros

- Get a 25% increase on the account balance.

- It supports scalping, hedging, and the use of advisors.

Cons

- Traders cannot achieve the profit target in a single trade.

Research Process:

- Time taken for review: 30 hours