This article compares and reviews the popular Stock Trading Apps with the top features to guide you in selecting the best stock app for trading:

A stock is basically a share in the ownership of a company. If you buy stocks, you buy a share in the ownership of that particular company.

Traders usually buy stocks in order to increase their wealth. As the value of a company increases, so does the value of its stocks. Investors can earn profits through this.

You can also get shareholder dividends if you own a company’s stocks. Companies usually distribute dividends quarterly. These dividends can be as cash or more shares.

Table of Contents:

Stock Trading Apps Review

If you want to trade in stocks, keep the following points in mind:

- Do a thorough study of the market trends.

- Take help from a friend who is a frequent investor, or talk to a market expert.

- You should know about the tax laws.

- Choose a trading app that suits your requirements.

If you want to invest a small amount of money, look for a trading app that has the following features:

- Lets you trade with little or no minimum balance.

- Do not charge any maintenance fee.

- Offers to trade in fractional shares.

And if you want to invest a large amount of money, you should either look for the one with a dedicated advisor. Or if you want to manage your account yourself, then the app should have the proper tools for market analysis.

In this article, we will look into the top features, pros & cons, ratings, and the other details of the best stock trading apps so that you can make your mind on which one to choose.

Expert Advice: The main three features that you should look for in a Stock trading app are:

- Minimum required balance

- Maintenance fee

- Market analysis reports

*And an advisor if you are a beginner or have little time to look after the market.

Frequently Asked Questions

Q #1) What is stock? Explain with an example.

Answer: A stock is a (partial) ownership of a company. Companies divide their ownership into numerous shares/equities/stocks so that investors can buy them and become co-owners. As the value of the company increases, so does the value of its stocks, and the investors get benefits from it.

For example, let’s suppose, a company divides its ownership into 1,00,000 shares or stocks. So if you buy 1000 stocks of that company, then you will have 1% ownership of that company.

Q #2) How do you make money from stocks?

Answer: When the value of the stock you bought goes up, you can sell those stocks at increased prices and thus earn profit.

You can also get shareholder dividends (a part of the company’s earnings). Companies usually distribute dividends quarterly. These dividends can be as cash or more shares.

Q #3) Is it worth buying 1 share of stock?

Answer: Yes, if you feel like the value of a stock will go up in the near future, then it is better to buy even a share of the stock than to keep the money idle.

Some stock trading apps even offer the feature of buying fractional shares, which enables you to trade with as little as $1.

Q #4) What is a good portfolio?

Answer: A good portfolio has a diversified range of assets to minimize the risk involved. Taking into consideration the global climatic problems, a good portfolio can have assets or stocks of companies that carry our environment-friendly practices.

Q #5) How can I invest 500 dollars for a quick return?

Answer: If you want quick returns, you should be ready to take the risk and invest in a volatile stock. But be careful before investing and do the proper research beforehand, to maximize the chances of earning profits.

Q #6) Can you get rich off Robinhood?

Answer: Yes, absolutely. If you do proper research about the stock you are going to buy, then there are high chances of getting rich with Robinhood, as it brings up for you a large section of stocks, fractional shares, and cryptocurrencies to trade-in.

Q #7) What is the best stock trading app for beginners?

Answer: Acorns, SoFi, Vanguard, Charles Schwab, Ally Invest, TD Ameritrade, Robinhood, and Fidelity are the best stock trading apps for beginners.

Recommended Reading => Best Books for Stock Trading

List of the Top Stock Trading Apps

Here is the list of some popular stock investing apps:

- Uphold

- Robinhood

- TD Ameritrade

- E*Trade

- Fidelity

- Ally Invest

- Charles Schwab

- Vanguard

- Webull

- SoFi

- Acorns

- Interactive Brokers

Comparing the Best Stock Apps

| Tool Name | Best for | Price | Account Minimum | Rating |

|---|---|---|---|---|

| Robinhood | Plenty of trading options and an easy to use app | Free | $0 | 5/5 stars |

| TD Ameritrade | Beginners who want their portfolio managed by experts | Free ($25 for broker assisted trading) | $0 | 5/5 stars |

| E*Trade | Beginners as well as frequent investors. | Free | $0 | 4.7/5 stars |

| Fidelity | Long term planning tools | Free | $0 | 4.8/5 stars |

| Ally Invest | Beginners | Free | $0 | 4.7/5 stars |

Stock Trading Apps reviews:

#1) Uphold

Best for stock conversion to other assets.

Uphold supports the trading of stocks except that it is available in select US states. It allows buying and selling equities using bank accounts, credit cards, debit cards, crypto, precious metals, Google Pay, and Apple Pay. The platform lists about 50 U.S. stocks, including Amazon, Apple, Disney, and Facebook. This is in addition to 210+ cryptos, 27 national currencies, environmental assets such as carbon tokens, and 4 precious metals.

The fractional equities you buy on Uphold also offer proportional ownership and are entitled to declared dividends in cash. You can keep them to earn the latter or sell them away when prices increase.

To buy a stock, simply sign up, verify an account, and visit the dashboard. On the Transact tab, click or tap the ‘From’ drop-down menu and select the source of funds. Enter details of the source and amount. Go to the ‘To’ drop-down menu and select the equity you want to buy and proceed.

Top Features:

- Crypto staking. Earn up to 25% staking crypto.

- Educational content

- Uphold MasterCard. Earn up to 2% cashback on crypto purchases.

- Withdraw to bank.

- iOS and Android app.

Pros:

- Insurance. Also maintains a FINCEN license.

- Cross-asset trading.

- Lower-than-industry spreads. No trading fees.

- Low deposit minimum – $10. You can buy equities for as little as $1.

Cons:

- Poor customer support.

- Variable spreads that are higher for low-liquid coins.

Why you want this app: Uphold allows for a diversified portfolio of stocks, crypto, precious metals, and fiat. It allows for cross-asset conversions.

Android ratings: 4.6/5 stars

iOS rating: 4.5/5 stars

Android downloads: 5 million+

Price:

- Free to use the app and website.

- Transaction fee – in form of spreads: stocks 1.0%, fiat 0.2%, precious metals 2%, cryptos 0.8% to 1.2% for

- Bitcoin and Ethereum (up to 1.95% for other cryptos). Between 2.49% to 3.99% for Google Pay, Apple Pay, and credit/debit card transactions. Bank transactions are free ($20 for US wire of up to $5,000).

#2) Robinhood

Best for plenty of trading options.

Robinhood is a trading app that lets you build a portfolio of your choice with the wide range of tradable options available on the platform. You can start investing with as little as $1.

Top Features:

- Invest with as little as $1 with fractional shares.

- Trade-in crypto exchanges.

- 0.30% interest in the uninvested cash.

- Commission-free investing in stocks and funds.

Pros:

- No minimum balance is required.

- No commission on the trade of stocks.

- Fractional shares.

- Crypto exchanges.

- Easy to use the app.

Cons:

- No trading of mutual funds.

Why you want this app: Robinhood is the most downloaded non-gaming app in the U.S. The reason being the bundle of features that it offers, like crypto exchanges, fractional shares, etc.

Android rating: 3.9/5 stars

Android downloads: 10 million +

iOS rating: 4.1/5 stars

Price:

- $0 per trade.

- Robinhood Gold starts at $5 per month.

Website: https://robinhood.com/us/en/

#3) TD Ameritrade

Best for beginners who want their portfolio managed by experts.

TD Ameritrade can be called the best stock app, because of the analysis reports it provides to its users. And the portfolio management by experts can be very helpful for beginners.

Top Features:

- No commission on online stock, ETF, and options trades.

- Manages your portfolio based on your goals.

- Retirement planning.

- Get real-time quotes, charts, and analysis reports to build your portfolio.

Pros:

- Commission-free trading.

- Educational resources.

- Market analysis reports.

Cons:

- The cost of broker-assisted stock trading is a bit high.

Why you want this app: This app gives you real-time market analysis reports, educational resources, and a bundle of stocks to trade in, that too at zero commission fee.

Android rating: 3.2/5 stars

Android downloads: 1 million +

iOS rating: 4.5/5 stars

Price: $0 fee on online trade of stocks.

Website: https://www.tdameritrade.com/home.page

#4) E*Trade

Best for beginners as well as frequent investors.

E*Trade is one of the best stock trading apps, which can be an appropriate choice for a beginner as well as a frequent investor. Because it has an automated investing feature, gives market insights, and lets you choose from a list of pre-built portfolios.

Top Features:

- Automated investing.

- Lets you trade in stocks, bonds, ETFs, mutual funds, options, and more.

- Choose from pre-built portfolios.

- Tools to educate and guide you before investing.

Recommended Reading => Top Crypto ETFs to buy in 2022

Pros:

- No commission on trade.

- No minimum balance is required.

- Plenty of options to invest in.

- Market analysis reports.

Cons:

- No trade-in cryptocurrencies.

- $500 minimum investment is required for broker-assisted investing.

Why you want this app: E*Trade is one of the best stock apps. It gives you plenty of choices to invest in, market analysis tools, and automated investing features.

Android rating: 4.6/5 stars

Android downloads: 1 million +

iOS rating: 4.6/5 stars

Price: There is no commission on the online trade of stocks.

Website: https://us.etrade.com/home

#5) Fidelity

Best for long-term planning tools.

Fidelity is one of the top best trading apps, which is loaded with plenty of features for financial planning. You can trade, save, plan and research with the help of this application.

Top Features:

- Financial planning for your future needs.

- Market insights by a specialists’ team.

- Helps you save tax.

- Robo advisor.

Pros:

- A dedicated advisor.

- 24/7 customer service.

- No commission on the trade of U.S. stocks and ETFs.

Cons:

- Advisor’s fee is high.

Why you want this app: Fidelity is one of the top 10 most downloaded non-gaming apps in the U.S., which is proof of its usefulness. Fidelity can help you invest while saving taxes at the same time, which is a great plus point.

Android rating: 4.4/5 stars

Android downloads: 1 million +

iOS rating: 4.8/5 stars

Price: Free (for trading in U.S. stocks and ETFs).

Website: https://www.fidelity.com/

Further Reading => Explore the Top Proprietary Trading Firms

#6) Ally Invest

Best for beginners.

Ally Invest lets you invest the way you want. You can either do the investing yourself, by doing the market research, or you can opt for a managed portfolio.

You can choose a portfolio with companies that are environment friendly or choose a portfolio that can save taxes, and much more.

Top Features:

- Self-directed investment.

- Managed portfolio.

- Invest in stocks, mutual funds, bonds, ETFs, options, and margin account.

- Choose a portfolio based on your perspectives, for example, a portfolio to optimize tax, or a portfolio with environment-friendly companies, etc.

Suggested reading =>> Best Crypto Tax Software

Pros:

- No commission fee on U.S. stocks and ETFs.

- No minimum account balance is required.

Cons:

- No trade-in any international assets.

Why you want this app: Ally Invest is a great platform for investing. You can trade in a large variety of commission-free stocks or get a managed portfolio if you do not have time to monitor the market trends.

Android rating: 3.7/5 stars

Android downloads: 1 million +

iOS rating: 4.7/5 stars

Price: $0 ( On-trade of U.S. stocks and ETFs)

Website: https://www.ally.com/invest/

#7) Charles Schwab

Best for beginners as well as advanced traders.

Charles Schwab is one of the leading stock trading apps, which is loaded with financial products for you to trade in. You can also get educational resources and market analysis tools, to get proper knowledge before investing.

Top Features:

- Trade-in stocks, options, bonds, mutual funds, ETFs, and other financial products.

- Market insights so that you can do proper research before investing.

- A dedicated specialist.

- Planning tools.

Pros:

- $0 account minimum.

- $0 maintenance fee.

- 24/7 customer service and 300+ branches.

- Educational resources.

Cons:

- Charges high fees for some mutual funds.

Why you want this app: With Charles Schwab, a beginner and an advanced trader, both can benefit. The research tools and a dedicated specialist are its plus points.

Android Ratings: 3.2/5 stars

iOS Ratings: 4.8/5 stars

Android Downloads: 1 million +

Price:

- $0 (On-trade of U.S. stocks and ETFs)

- $25 service charge for broker-assisted trades

Website: https://www.schwab.com/brokerage

#8) Vanguard

Best for planning tools and long-term investments.

Vanguard can be termed as one of the best stock investing apps, which was established in 1975. Over 30 million investors trust Vanguard. It gives you a personal advisor or you can do self-directed investing if you prefer.

Top Features:

- A personal advisor and a Robo advisor.

- Lets you meet your retirement goals or other savings goals.

- Self-directed investing.

- Market summary to help you choose the best investment.

Pros:

- Commission-free online stock and ETFs trading.

- No minimum balance is required.

- 3100+ no-transaction-fee mutual funds.

Cons:

- Market research data is reported to be limited

Why you want this app: Vanguard can be a good option for beginners or those who want to do financial planning for their future needs. The planning tools are worth appreciating.

Android Ratings: 1.7/5 stars

iOS Ratings: 4.7/5 stars

Android Downloads: 1 million +

Price:

- Free (For online trading in stocks).

- $25 for broker-assisted trading.

- The annual fee for a digital advisor is 0.15% of the assets under management.

- The annual fee for a personal advisor is 0.30% of the assets under management.

Website: https://investor.vanguard.com/home

#9) Webull

Best for active traders who want to trade in stocks as well as cryptocurrencies.

Webull is a stock trading app with other features, including trade in cryptocurrencies, options, ADRs, options, and ETFs. They charge you a $0 commission on trading and give you market analysis reports so that you can invest wisely.

Top Features:

- Analytics tools to help you in investing.

- Lets you invest in stocks, options, ADRs, and ETFs.

- Tradition, Roth, or Rollover IRA accounts.

- Trade-in cryptocurrencies.

Pros:

- $0 commission on trading.

- No minimum balance is required.

- Availability of crypto exchanges.

Cons:

- No mutual funds.

Why you want this app: Webull is one of the most popular stock trading apps in the U.S., which lets you trade in several stocks, ETFs, ADRs, options, and cryptocurrencies.

Android rating: 4.4/5 stars

Android downloads: 10 million +

iOS rating: 4.7/5 stars

Price:

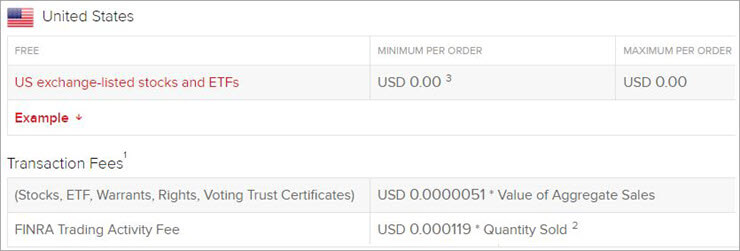

- $0 commission for trade in stocks, ETFs, and options listed on U.S. exchanges.

- Fees Charged By Regulatory Agencies & Exchanges:

Website: https://www.webull.com/

#10) SoFi

Best for beginners or people who face a lack of time problems to keep up with the market conditions.

SoFi is a family of 2 million + members and is a great platform for beginners in the line of investing. The automated investing feature, fractional shares, and trading in cryptocurrencies are all the features that a new investor needs.

Top Features:

- Lets you invest in stocks, ETFs, or cryptocurrencies.

- Grants loans on low interest rates.

- Automated investing.

- Fractional shares, crypto exchanges, and retirement accounts.

Pros:

- Automated investing can be beneficial for beginners, and people have less time to analyze the market.

- No management fee.

- No minimum balance is required.

- Fractional shares.

Cons:

- $10 minimum balance required for trading in cryptocurrencies

Why you want this app: SoFi is one of the best stock apps for beginners. It offers an automated investing feature and lets you buy fractional shares, which can be quite helpful for beginners.

Android rating: 4.4/5 stars

Android downloads: 1 million +

iOS rating: 4.8/5 stars

Price: $0 commission for trade in stocks, ETFs, and options listed on U.S. exchanges

Website: https://www.sofi.com/

#11) Acorns

Best for building environment-friendly portfolios.

Acorns is a leading investment services provider having about 9 million investors connected with it. Acorns lets you invest, save, plan and learn, all at the same time.

Top Features:

- Educational resources.

- Portfolios built and rebalanced by experts.

- Environment-friendly portfolio.

- Retirement planning.

Pros:

- Automated investing.

- No minimum balance is required.

- Educational resources.

Cons:

- $1 – $5 monthly fees.

Why you want this app: The biggest plus point of Acorns is the feature of letting you build a portfolio with stocks of environment-friendly companies. The educational resources and other features are also up to the mark.

Android rating: 4.4/5 stars

Android Downloads: 5 million +

iOS rating: 4.7/5 stars

Price: There is a free trial for 30 days. Price plans are as follows:

- Lite: $1 per month

- Personal: $3 per month

- Family: $5 per month

Website: https://www.acorns.com/

#12) Interactive Brokers

Best for advanced investors.

Interactive Brokers is an investment platform for advanced investors, which gives its services to around 1.33 million clients. The app lets you invest in international stocks, bonds, and much more.

Top Features:

- Lets you invest in international stocks, bonds, currencies, options, futures, and funds.

- Market analysis reports.

- Fractional shares.

- Robo advisor.

- Helps you choose stocks of companies that practice environment-friendly processes.

Pros:

- Fractional shares.

- $0 commission on the trade of U.S. stocks.

- No minimum balance is required.

Cons:

- The web version is reported to be complicated to work with.

Why you want this app: The market analysis feature, availability of a large number of investment options, checking whether the companies who are offering their stocks, practice environment-friendly norms or not, are some of the plus points of the application.

Android Ratings: 3.3/5 stars

iOS Ratings: 3/5 stars

Android Downloads: 1 million +

Price:

Check our Detailed Review of Interactive Brokers

Conclusion

This article was written to give you a brief knowledge about stocks and the best stock trading apps in the industry.

In the end, we have come to the following conclusions:

- Robinhood, Interactive Brokers, Webull, TD Ameritrade, and Charles Schwab can be excellent choices for advanced traders.

- Acorns, SoFi, Vanguard, Charles Schwab, Ally Invest, TD Ameritrade, Robinhood, and Fidelity are the best stock trading apps for beginners.

- Some apps like Acorns and Interactive Brokers assist you in figuring out which stocks are environmentally friendly, which is a great plus point.

- The apps that let you invest in fractional shares can be a great option for those who want to invest with little savings.

Also read =>> Best Stock Trading Apps in India

Research Process:

- Time taken to research this article: We spent 8 hours researching and writing this article so you can get a useful summarized list of tools with the comparison of each for your quick review.

- Total tools researched online: 20

- Top tools shortlisted for review: 11